By CCN: Bitcoin will completely disrupt the entire tech industry, Silicon Valley, and Wall Street. That’s the wildly-optimistic outlook of a former executive at crypto unicorn Coinbase.

Crypto Will Disrupt EVERYTHING

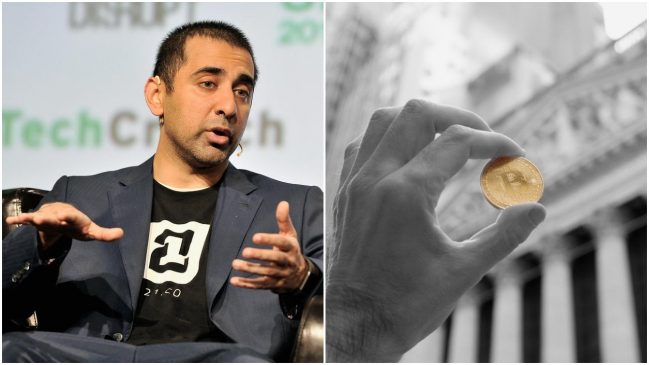

Despite making a surprise exit from the cryptocurrency exchange last month, Balaji Srinivasan says he remains a firm believer in bitcoin’s future. Srinivasan served as Coinbase’s chief technology officer (CTO) for close to a year before announcing his departure in May.

One month later, Srinivasan unleashed a tweetstorm concretizing his reputation as the most rabid of bitcoin bulls. More than just predicting that cryptocurrency could become a store of value, he opined that public blockchains would disrupt virtually every sector of the global economy.

To his point, blockchain has already witnessed steady adoption in the financial industry, with Vanguard recently announcing $1.3 trillion in index funds managed through distributed ledgers. Srinivasan envisions a future in which the global economy runs on the blockchain. A public blockchain.

Wall Street’s in a Mess of Trouble

The bullish prediction is not far off from what other industry enthusiasts have predicted for the potential of crypto and blockchain. While many analysts have called for a reshaping of securities that would see stocks issued through tokens–similar to initial coin offerings–Srinivasan goes a step further.

With the rise of crypto, Srinivasan finds Silicon Valley and Wall Street redundant. Rather than going through traditional channels for funding, raising capital and operating a business, crypto allows entrepreneurs to function with nothing more than an internet connection.

While Srinivasan’s argument centers on crypto disrupting the existing tech industry, his faith in digital currencies speaks to their ability to inspire globalization. As he points out, location becomes irrelevant when citizens can transact with bitcoin. Crypto provides an alternative to the restrictions of government fiat–a powerful tool in places like Venezuela and Argentina where hyperinflation is the norm.

Decentralization, the idea that crypto can operate without a figure of authority, will also lead to upheaval in the tech sector. Silicon Valley’s venture capitalist industry started as a way for lean startups to circumvent traditional funding routes. Crypto will take that process to a new level.

Bitcoin Will Be the New Gold Standard

Bitcoin will be a “universally valued instrument,” Coinbase’s ex-CTO predicts. | Source: Shutterstock

Srinivasan sees bitcoin becoming a “universally valued instrument,” driven through mass adoption by major corporations. Despite precious metal pundits disparaging bitcoin as worthless, Srinivasan anticipates bitcoin quickly cementing its status as the “digital gold standard.”

Bitcoin is more versatile than gold and capable of operating on a digital landscape. It also has the support of millennials, with 90 percent of younger investors preferring bitcoin to gold, according to one investing expert.

While crypto may not be able to solve all of the world’s problems, the possibility of off-chain functions increases its use exponentially and allows for tailoring to individual and community needs.