On May 30, Tezos implemented the amendment Athens A, as the result of a voting process that involved its baker nodes (the Tezos equivalent of “miners”) from Feb. 28 to May 30.

Although the actual relevance of the upgrade was quite small (see below), the Tezos community underlines that the test was a milestone. The smooth shift to Athens A indeed demonstrated the capability of Tezos to evolve without forking, thanks to the features of proposal/selection/voting/test/implementation this blockchain itself encompasses.

On the very same day, another fast-growing young company backed by a cryptocurrency, Iota, announced an important step toward total decentralization, substituting its Coordinator mechanism with the new Coordicide tool.

Coordicide will perform the same functions of its predecessor, ensuring transaction security and preventing double spending. However, the new protocol will allow the peculiar Iota block creation process to work in a fully decentralized and permissionless manner.

The debate over what constitutes the most suitable approach to the exchange business and the declarations of some big companies about decentralized exchanges (DEX) — both for or against it — only add to the fact that the topic of decentralization is still a paramount concern as crypto involves more people and use cases.

The evolution of cryptocurrencies as a business increases the amount of interest it generates. As in any business, this involves issues relating to power distribution. But such questions are difficult to answer in a simplistic way.

Benevolent dictators

Bitcoin (BTC) defines itself as a peer-to-peer (p2p) network, as per the title of its white paper; the new electronic cash would work in a trustless manner — the 2008’s foundation document states — thanks to the consensus of the honest nodes that “control a majority of CPU power.”

The dream of money created by the people and for the people, freely circulating across the national borders, and untouchable by the rapacious economic monopolies was very appealing during the years following a dramatic financial crisis, which some may argue left the world suspicious toward governments and traditional financial actors.

However, while Bitcoin evolved from being a “cypherpunk” plaything to a relevant business entity, many concerns about its actual decentralization and “internal democracy” arose. In autumn 2016, for instance, two researchers — De Filippi from Harvard University and Loveluck from Université Paris-Saclay — published a paper that criticized the “highly centralized and undemocratic” technocratic approach to governance that, in their opinion, characterizes Bitcoin core developers.

Defining the small number of individuals in charge to decide which changes shall be incorporated into Bitcoin as a sort of “benevolent dictator,” the two researchers noticed:

“There exists, therefore, an obvious discrepancy between the libertarian vision of Bitcoin as a decentralised infrastructure that cannot be regulated by any third party institution, and the actual governance structure that dictates the technological development. […] While the (a)political dimension of the former has been praised or at least acknowledged by many, the latter has remained, for a long time, invisible to the public: the technical decisions to be taken by the Bitcoin developers were not presented as political decisions, and were therefore never debated as such.”

Additionally, Vitalik Buterin and Ethereum’s core team were labeled with the same title of “dictator” as a consequence of the decision to alter the mainchain to refund the victims of the DAO hack on June 2016.

The hack itself and the following debate between the supporters of Vitalik’s choice and the defenders of the inviolability of the blockchain stressed, as an article on Wired noticed then, how much human weaknesses were still influencing processes that, theoretically, are managed only by the impersonal rules of mathematics.

A similar dispute emerged once again in 2018 about the vote on the Ethereum Improvement Proposal (EIP-999), which aimed to unfreeze 587 multisig wallets attacked during the July 2017 Parity hack.

It is worth noting that the internal debates inside both the Bitcoin and Ethereum communities brought the first relevant cases of a direct democracy instrument being applied, which is allowed by the blockchain architecture itself.

Even if the process of development and amendment of the core software remains the privilege of a qualified technical elite, all the nodes taking part in the network can veto a piece of code, refusing to upgrade and forking the blockchain. Therefore, every miner has voting rights that are equal to the hashing power and, if a new alternative blockchain is born, the free and democratic rules of the market would determine which is the more successful coin.

This happened, for instance, in July 2016, when the integrity supporters divorced from the amended Ethereum mainchain, giving birth to Ethereum Classic (as well as a new coin, ETC). Similarly, in August and October 2017, when people became unsatisfied with the introduction of SegWit on the Bitcoin network, they tried to find a solution to the block’s dimensions issue, creating, respectively, Bitcoin Cash (BCH) and Bitcoin Gold (BTG).

Voting, pickaxe in hand

This dream made of equal rights and free competition, however, is troubled by severe concerns over the actual distribution of mining power that sustains the different blockchains based on proof-of-work (PoW).

When considering Bitcoin, for instance, it’s easy to understand the distance from its pioneer days and the present: On May 22, 2010, on the legendary first Pizza Day, the hash rate required to feed the whole network was about 109 MegaHash/s (MH/s), while eleven years after, on BTC Pizza Day 2019, the required computing power reached almost 52 ExaHash/s (51,934,800,000,000 MH/s).

While mining shifted from an amateurish activity to a capital-intensive business, the community has lost its role as a validator, which became much more of an exclusive prerogative of the giant mining pools that formed an oligopoly.

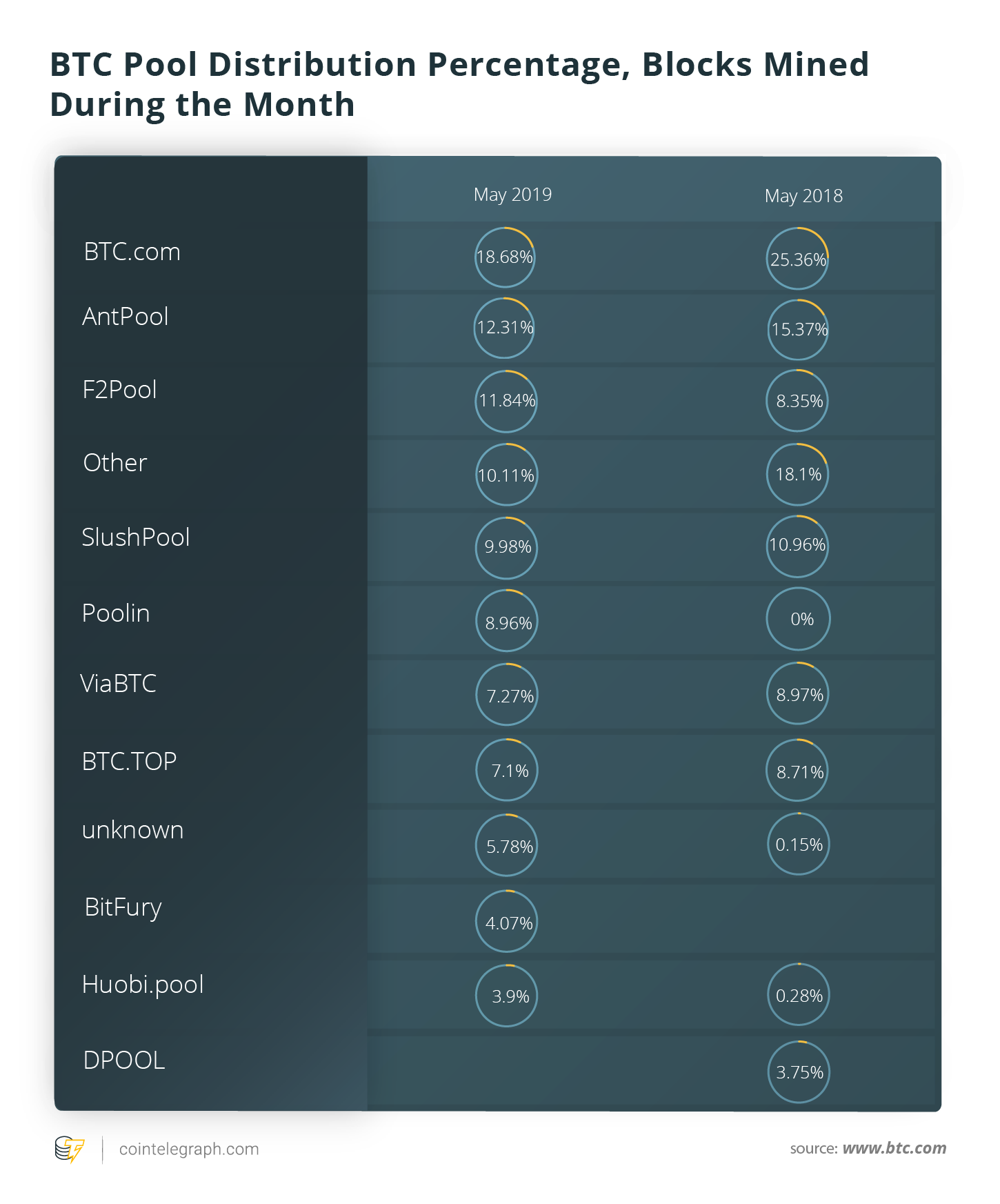

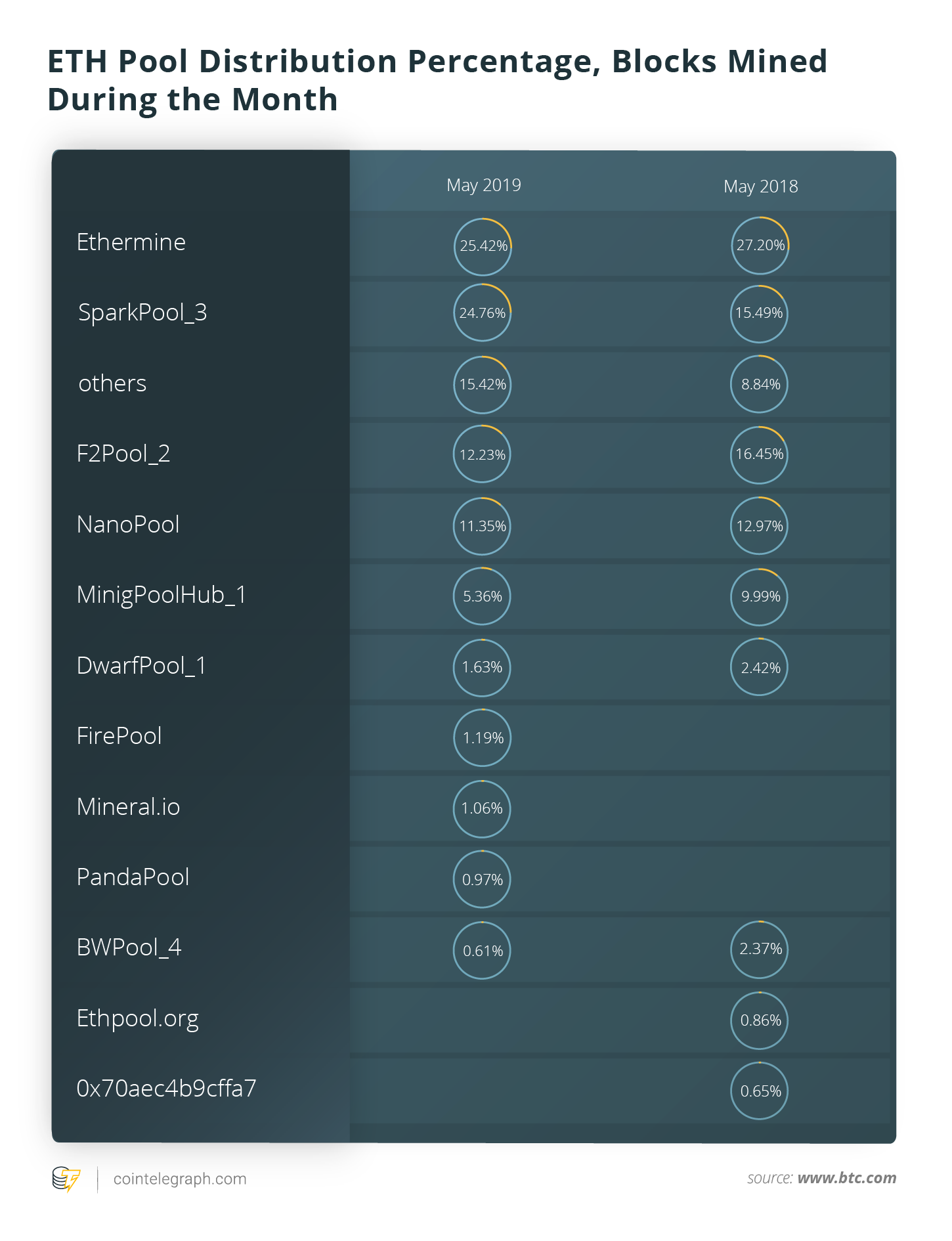

The data published by one of them show that, since April 2013, the three largest mining companies produced more than 50% of the blocks of the system (BTC Guild with 37.83%, SlushPool 11.54% and BitMinter 7.09%). The situation changed very little during the following years, despite the swirling turnover among the companies leading the industry.

The dynamic only seems to have scaled down in the very last few months; however, the dominance of the first three players (presently BTC.com, F2Pool and Poolin) is still above 40% of the blocks.

Ethereum was born with specific features preventing ASIC-based mining. However, its algorithm could do nothing to limit a concentration of power, which is even more accentuated than in Bitcoin’s blockchain: Since the summer of 2017, two pools alone — Ethermine and SparkPool — produced over 50% of the new blocks almost continuously every month.

Even if vicious behavior that could undermine the whole crypto economy is rather unlikely in the two leading blockchains, recent events involving the smaller ETC demonstrated that the possibility of a 51% attack is far from theoretical. Last January, the exchange Coinbase revealed evidence of an ETC blockchain reorganization, which included double spending worth over $1.1 million.

Give me liberty or give me scalability

Proof-of-stake (PoS) could contribute to answering the concerns surrounding the rise in concentration of power within the mining industry and the risk that a malicious super-miner could hijack a whole blockchain.

The critical feature of PoS is to bond the rights to validate the new blocks — to “vote” in cases of a fork — to facilitating a “lottery” influenced by the dimension of the stakes “frozen” in the nodes, instead of asking the validators to compete through computing power.

This would bring some advantages — considering the fee levels, transaction speed and ecological footprint — as PoS forging is less demanding than PoW mining in terms of fixed capital and energy involved. Besides, the broader adoption of PoS would disrupt the mining business model, undermining the oligopolistic position of the pools that are dominating the market now.

However, even if the shift toward PoS would theoretically bring immediate democratization in the way blockchain is being run, in a long-term perspective, it is somewhat unclear if and how forging business would avoid spiralling toward concentration and bringing it from individual geeks to giant multinational companies.

Delegate proof-of-stake (DPoS), on the other hand, makes even more explicit the issue of the internal governance and the trade-off existing between scalability and decentralization. This consensus algorithm began to work for the first time in Bitshares, the first blockchain project designed between 2014 and 2015 by Daniel Larimer, also the creator of Steemit and EOS.

Since then, the crypto community divided itself between those who equate Larimer to Satoshi Nakamoto and those who see DPoS as an unforgivable sin against the very nature of the blockchain.

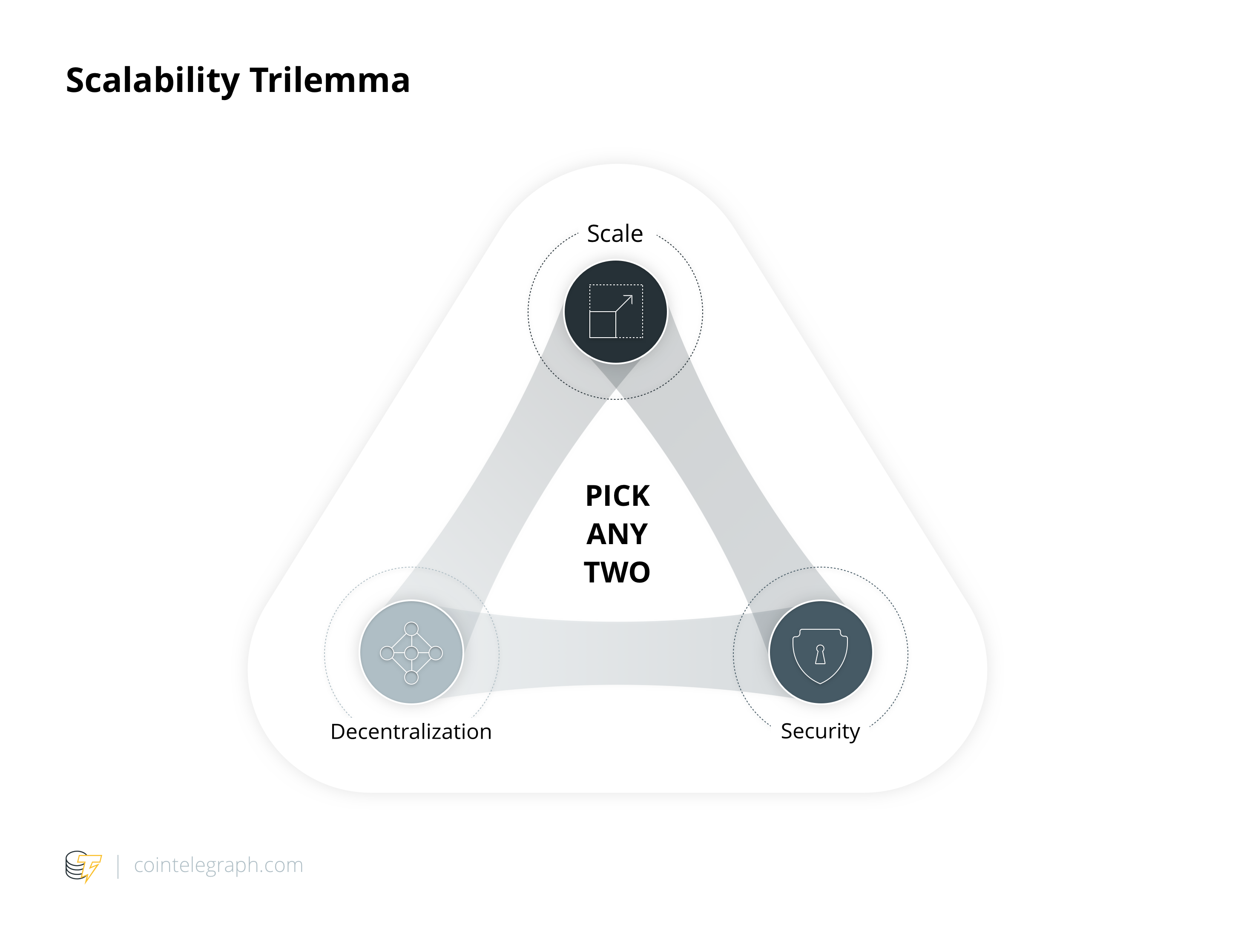

Cryptocurrencies must rely on blockchains that could guarantee that transactions will be unique and irreversible. However, to reach this advisable degree of security, it seems inevitable that a choice has to be made between either a time-consuming solution that implies a broad and distributed consensus or more effective architectures, which achieve efficiency while harming system decentralization.

The so-called “scalability trilemma” was first coined by Buterin and Trent McConaghy to explain how difficult — if not impossible — it would be to attain scalability, decentralization and security, all at the same time.

Since security is a sine qua non for every blockchain and scalability is a goal determining the success of a cryptocurrency, decentralization looks to be the odd one out.

In DPoS, limiting the validation process to an elite group of nodes — empowered also by the stakes delegated by other members — would enhance the performance, guaranteeing both security (as malicious nodes would be sanctioned economically) and preventing unchallengeable power positions (as delegators could revoke their sustain if they disagree with the delegate’s policy).

The effectiveness and the actual match between this ideal model and its application could vary enormously from case to case, as everyone who lives in a country ruled by a representative parliamentary system would know.

Like in politics, criticism and scandals are commonplace in DPoS. Since its launch in June 2018, the largest DPoS/PoS currency existing on the market, EOS, has been plagued by recurrent embarrassments revolving around its governance model.

Decentralization doesn’t seem to be a top priority for many DPoS supporters, indeed. For instance, last May, Neo founder Da Hongfei declared in an interview during Consensus 2019 that the high level of centralization of his blockchain is part of a strategy to compete against Bitcoin and Ethereum, in terms of superior performance. Despite some openings to decentralization during the summer of 2018, the Neo Foundation is still controlling half of the supply of NEO coins and the majority of the nodes running the network. “That’s intentional. We want to keep it more efficient,” the Chinese entrepreneur said.

It’s then easy to understand why Buterin himself bluntly criticized EOS, Neo and other DPoS projects during his keynote at the last Blockchain Connect Conference in San Francisco on Jan. 11, 2019. In the same speech, Ethereum’s co-founder stated his support for options he defined as “good, legitimate ways to make a blockchain fast,” without harming decentralization.

One possible solution to the problem of scalability would be the creation of a “second layer” network, that allows transactions to occur off-chain and then ultimately settle on-chain.

Only, this secondary network would require some forms of centralization or trusted players to keep the mainnet both safe and decentralized, despite a significant growth in the number and speed of the performed transactions.

This is the path by which the Lightning Network is experimenting on Bitcoin’s blockchain and what projects such as Plasma, Raiden, Counterfactual and Truebits aim to introduce into the Ethereum ecosystem.

Considering the “first layer,” Ethereum core developers have been working for a long time toward a more sophisticated solution. It encompasses both a new approach to PoS block validation, known as Casper, and the possibility for the network to operate through segmentation — called sharding — that allows every “island” of Ethereum to act as parallel blockchains, multiplying the performance of the system as a whole. The two development paths are presently joined under the label of Ethereum 2.0, the new spec of the cryptocurrency that is set to begin operating between 2020 and 2021.

Athenian democracy

Proof-of-stake is indeed quite similar to the original form of democracy deployed in Athens during the fifth century B.C. This form of government was based, in fact, not on a free election but on a draw that could appoint randomly selected citizen as magistrate or as delegates of the “people.” Fate was therefore the guarantor of equality (however, the city denied civil rights to women, slaves and foreigners).

Tezos’ blockchain defines its distinctive feature as the ability to self-amend and self-govern its code evolution. However, is it unclear if the choice to label its first amendment as “Athens” was referring more to the random, PoS-ish nature of the historical Greek democracy or to the allure of participating in a free debate, which the ancient republic earned in collective consciousness.

On Feb. 28, Paris-based developer team Nomadic Labs proposed the migration from the original protocol “alpha” to “Athens,” injecting the network with the hashes referring to two alternative code updates.

The reform marked a milestone when considering the process rather than the content: Athens A aimed to reduce the number of Tezos’ native tokens (XTZ) accounted in one “roll” (the unit of account for Tezos’ proof-of-stake) and to increase the gas limit for each block, while the Athens B proposal contained only the gas limit increase amendment.

As every new piece of code aiming to upgrade Tezos protocol, Athens charged a reward for the developers, if approved: The request was a symbolic amount, sufficient to pay for a round of beers for the team (100 XTZ, less than $150).

The Tezos Foundation explicitly chose not to vote or to vote “Pass” during the different phases of the pool, to avoid influencing the results.

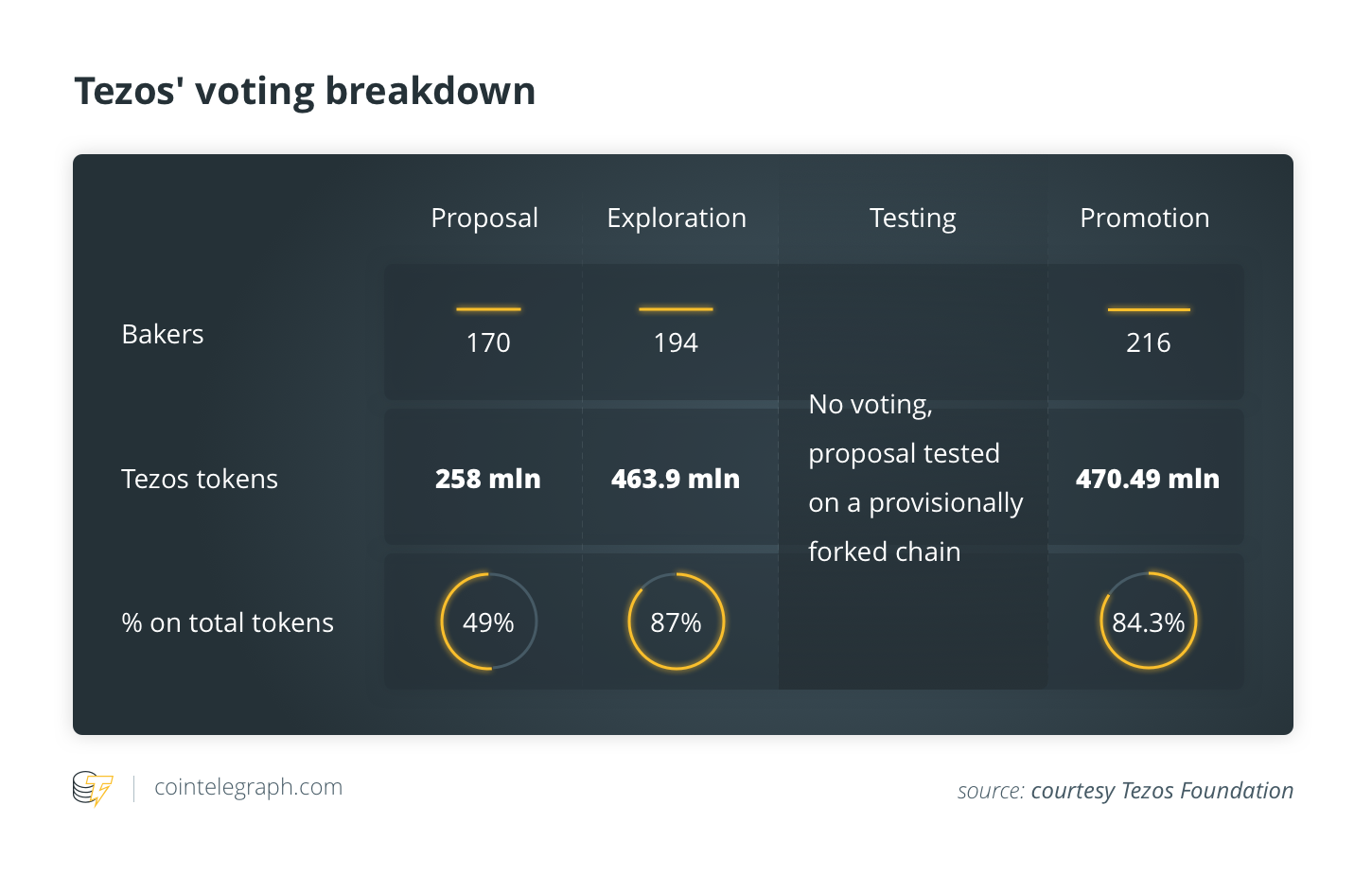

During the first phase of the process, aiming to choose which proposal should undergo the voting, 170 bakers representing almost half of the XTZ on stake, decided to bring Athens A to the “Exploration Period.”

An even more significant number of participants (194 bakers, 87% of the stake) then expressed their opinion on the amendment, approving it and choosing to test Athens A in a sort of a “48-hours fork,” on a temporary parallel mainnet.

A final round of voting was required after the test (involving 216 bakers, representing 84.3% of the stake) to allow for an automatic update to the new code for all the nodes, which activated Athens A after 12:40 a.m. UTC on May 30.

The high level of participation in the vote among the Tezos community is even more remarkable considering the recent failure of another experiment on direct involvement of token holders.

Jacob Arluck from Tocqueville Group explained in a post on Medium the significance of Athens and stressed that the voting was indeed just a part of a more comprehensive process aiming to activate the Tezos community as a whole:

“It’s really exciting because it’s the first step towards this idea of self-upgrading, decentralized, internet-native economic infrastructure.”

Social networks, web-based platforms, on-chain signaling tools and baker-promoted pools are some of the instruments that guaranteed — in a somewhat unplanned and “decentralized” fashion — the debate among bakers and the delegator token holders.

People opposed to the governance architecture seemed to have been the decisive factor and Tezos’ co-founder, Arthur Breitman, confirmed to Cointelegraph that the success of Athens relied on a mix of direct participation and the delegation mechanism:

“The fear of ‘voter apathy’ has permeated most discussions of on chain governance. Tezos guards against that issue by borrowing ideas from Gordon Tullock’s concept of liquid democracy. The massive participation in the Athens vote and high degree of engagement from the community shows that this approach seems to be working.”

With great power comes great responsibility

The case of Tezos’ amendment helps to focalize on the strong similarities between the debate about decentralization in blockchain and some well-established topics in sociology, economics and political science.

The dilemma of performance vs. decentralization, for instance, has strong analogies with the debate regarding the relationship between political freedom and economic development. Considering the diverging paths of different developing countries (recently, India and China), argue that autocracy could achieve higher performance than democracy, because it is not impaired by the need to mediate with the public opinion and different groups of interests.

Others, for instance, such as Nobel Prize winner Amartya Sen, believe that freedom is a part of the development process as its final aim, as an instrument to check its advancement and as a guiding light to define its direction. Professor Sen also recognizes, however, that real freedom means more than regular formal pools, and it is possible to transfer his concern for genuine political participation to the blockchain-related issues presented above.

The effort that the Tezos community demonstrated in its first election is indeed quite similar to that of many opinion groups that try to resist “political laziness,” which affects many large democratic countries nowadays (Breitman reference to Tullock’s article was not accidental).

It is, however, unpredictable if it would be possible to reach such a high degree of involvement in a broader and more mature network. Bitcoin PoW mining too was somehow a democratic activity when nodes were in the hundreds; the real issue arises when the number of users surpasses the number of people directly involved in system development.

Widespread adoption is likely to flood the system with users who are more concerned with issues like transaction cost and speed, user-friendly applications and global acceptance as a means of payment rather than obscure topics like 51% attacks or the scalability trilemma.

It is even possible that the average user could freely choose to renounce a significant amount of the libertarian features that have defined cryptocurrencies since their origin, for the sake of more comfortable handling.

In 1576, the French political philosopher Étienne de La Boétie clandestinely published his “Discourse on Voluntary Servitude.” The text explained that tyrants (La Boétie also put elected governors among them) could retain their overwhelming power over their subjects because the people themselves forfeit their original freedom.

More than violence and intimidation, the French thinker argued that the real causes that brought the majority to accept servitude were the desire for profit and the custom of servitude itself.

Even without calling it real “servitude,” nowadays, we are still undoubtedly living in a centralized world, among centralized institutions and using everyday centralized technologies we don’t completely understand. It is therefore quite hard that a new frame of mind, more suited to handle the power and the responsibility coming with decentralization, could arise overnight.

It is almost impossible to design a perfect voting system that, just using a set of rules, could force people to take responsibility for their freedom, limit media brainwash and prevent bribery. So, it seems quite unlikely that technology alone could assure the cryptocurrencies reach true decentralization under every possible scenario.

It is impossible to know which answer to the issue of blockchain governance will become dominant in the future; however, it is plausible that the fundamentals of human behavior will be part of it, alongside mathematics.