By CCN Markets: The bitcoin price might have slipped below $8,000 for now, but it could be headed much higher in the near future. Fundstrat Global Advisors Co-Founder Thomas Lee is willing to put it on the line for bitcoin once again, making an aggressive short-term prediction on where the cryptocurrency could be trading if it can capture enough momentum.

In an interview with Binance CFO Wei Zhou, Lee laid out his bullish case. Lee and Zhou agree that once bitcoin regains the $10,000 level, it will be “fast and furious” to $20,000. From there, it’s seemingly to the moon. Once the key FOMO threshold kicks in, historically the price will surge 200% to 400%. Lee stated:

“If bitcoin somehow manages to get to [$10,000], it’s very likely going to make a run to $40,000 within five months.”

Few People Lose Money at Current Bitcoin Levels

When bitcoin finally recaptures $10,000 is anyone’s guess. But in the meantime, BTC $8,000 or thereabouts is not too shabby. Lee points to a bunch of historical stats, saying “it’s at a level that very few people have lost money owning bitcoin here.” The next key threshold could open the floodgates to big investors:

“Every institution is going to realize, look at $10,000 it’s likely to go back to its all-time high, which is double. There are very few things that can double. So I think FOMO truly gets triggered once bitcoin hits $10,000.”

Institutional investors thought bitcoin was headed to zero during the crypto winter. | Source: CoinMarketCap

Last year, when the bitcoin price shed more than 80% of its value, it scared many institutional investors away from crypto. Lee suggests it’s understandable considering that if a stock falls roughly that much, its chances of recovering are slim to none. But what they were missing is that bitcoin is in a league of its own.

“At the end of the day, Wall Street – if there’s a known asset class and they believe they can have an edge, they’re going to be quite interested in investing in it…At the right tipping point, and it’s either going to be because of the size of the blockchain or the size of the crypto market itself, Wall Street’s going to suddenly say, ‘Hey look, I don’t care if I understand exactly what’s happening but if I can make a lot of money let’s go ahead and do it.’”

Lee points to the example of credit default swaps as a historical precedent, which started as an Excel spreadsheet and now exceeds cash bond trading.

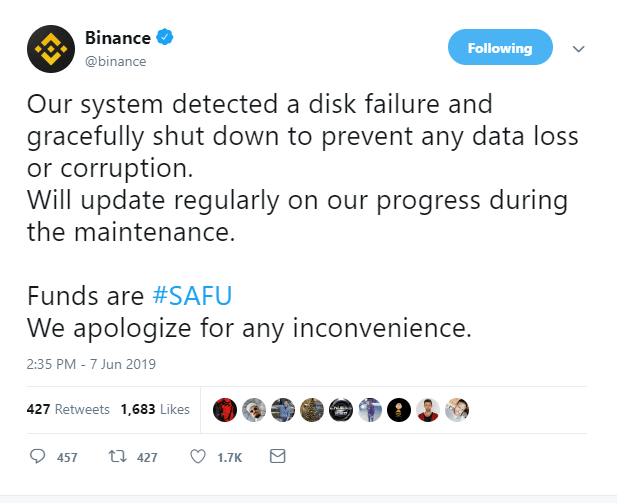

Binance Maintenance in Response to Disk Failure

Incidentally, at about the time the Binance/Fundstrat interview was posted, Binance users were experiencing issues on the exchange due to what was later described as a “disk failure.”

It’s all systems go on Binance. The bitcoin price, however, remains stuck below $8,000 for the time being though it is most recently paring its losses.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN Markets.