Since June 26, within the past three weeks, the bitcoin price has declined from $13,868 to around $11,200 by 20 percent against the U.S. dollar.

After recording a 250 percent increase in value year-to-date at its yearly peak, a pullback for bitcoin was generally anticipated by traders.

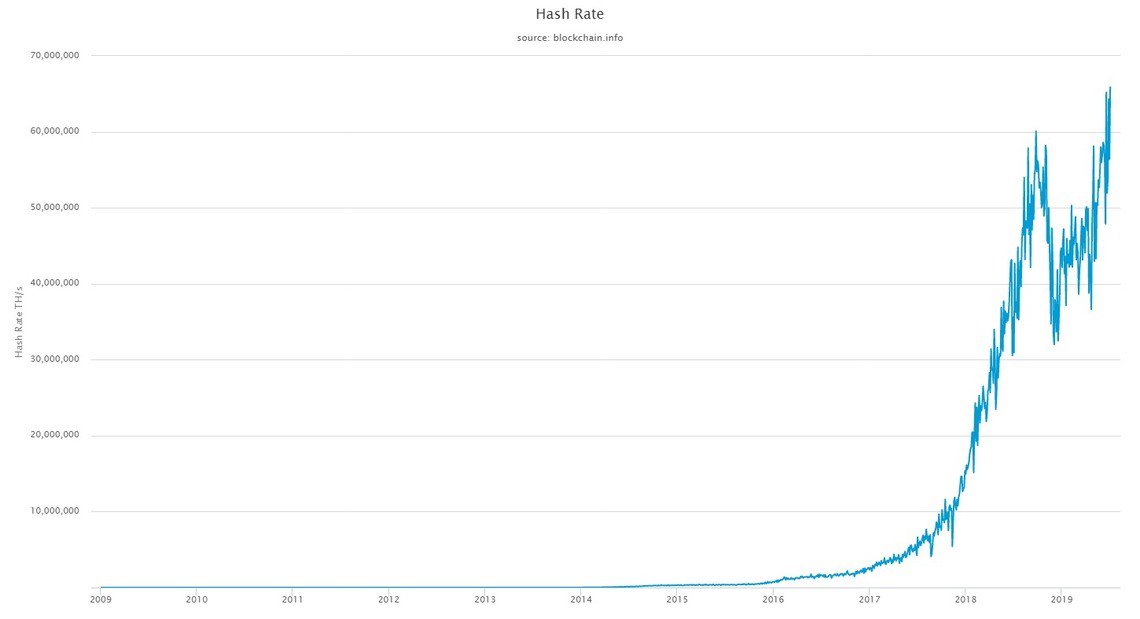

Following its 20 percent decline, fundamentals for the dominant crypto asset remain strong as seen in its hash rate achieving an all-time high.

What does all-time high bitcoin hash rate indicate?

Since January 2019, the hash rate of the Bitcoin blockchain network has increased from around 35 exahash to nearly 75 exahash, achieving an all-time high in about ten months.

Up until December 2018, bitcoin mining was not profitable for most miners, even for large institutions running large-scale centers with long term commitments for cheap electricity.

As the bitcoin price began to spike in April and eventually achieved a yearly high at around $14,000, the hash rate of the Bitcoin blockchain network surged, doubling in merely three months.

The spike in the hash rate of a blockchain network is often considered an important indicator of strength because hash rate represents the amount of computing power that protects the network.

A consistent increase in the hash rate also indicates that a growing number of miners are committing more resources in mining the asset, suggesting that miners anticipate the bitcoin price to increase over the medium to long term.

Speaking to CNBC’s Fast Money, BKCM CEO Brian Kelly stated that miners he spoke to said they have acquired enough capital to fund their operations throughout the upcoming year without selling bitcoin, expecting the network to undergo a block reward halving in May 2020.

“I’ve talked to a lot of miners around the world, a lot of them have said they have sold enough bitcoin to get us through the next year or so and we are going to hoard bitcoin at this point in time and we are not going to sell it and the supply of bitcoin will get cut in half. Just real simple economics: lots of demand hitting little supply, price goes higher,” Kelly said.

When a proof-of-work (PoW) blockchain protocol undergoes a block reward halving, the rate in which its native crypto asset, which is BTC in the case of the Bitcoin network, is reduced by half.

As such, upon the occurrence of halving, the circulating supply of bitcoin at conventional exchanges and over-the-counter (OTC) exchanges drops, which historically has acted as a catalyst for bitcoin and the rest of the crypto market.

Halving is the next big narrative

There are several solid fundamental factors in the likes of rising hash rate, a growing number of trading venues, and increasing inflow of institutional capital that are considered as potential catalysts of bitcoin.

But, as the market nears the end of 2019, the narrative of the block reward halving is likely to strengthen, which studies done by investment firms such as Grayscale have found that many investors are not aware of.

“The halving is close enough that it’s time to start talking about it more seriously, but far enough out in the future that it’s unclear whether it’s priced into the market efficiently. In fact, based on anecdotal conversations with market participants, we were surprised to learn that many of them were not even aware of this event,” a Graysacle report read.

Click here for a real-time bitcoin price chart.