The Cambridge Centre for Alternative Finance launched a new real-time index tracking the total electricity consumption of the Bitcoin network. The index, called Cambridge Bitcoin Electricity Consumption Index (CBECI), provides a real-time estimate of the total annual electricity usage of the Bitcoin network and enables live comparisons with alternative electricity uses in order to put numbers into perspective.

Semi-Accurate Energy Tracking Index

Researchers at the University of Cambridge have published a new index, called Cambridge Bitcoin Electricity Consumption Index (CBECI), in order to estimate the energy consumption of Bitcoin Network.

Bitcoin uses the Proof of Work (PoW) consensus algorithm, a method originally invented in 1993 by Cynthia Dwork and Moni Naor to avoid spam and Denial-of-Service attacks by requiring a math challenge to be solved for requesting a service. This challenge entails a certain use of resources, in this case computing power, while the verification of completed work is easy and immediate.

Due to its development and spread, the Bitcoin Network has come to consume a quantity of energy comparable to that of some countries and this is one of the first critical arguments used to discredit bitcoin.

According to the index, the consumption of the Bitcoin Network is equal to 7.32 GW which is equivalent to an annual consumption of about 61.76 TWh. One of the metrics provided allows us to classify the energy consumption of Bitcoin by comparing it to that of some countries. At the current level, bitcoin consumes more power than Switzerland does over the same time period, but less than the Czech Republic.

[Source: CBECI]

Considering global consumption, Bitcoin accounts for roughly 0.25 percent of the world’s entire electricity consumption.

However, as specified in a post published for the launch of the index, these figures are to be taken lightly as they are only estimates and in most cases, they only provide a one-time snapshot, and the numbers often show substantial discrepancies from one model to another.

In fact, another model used to present bitcoin energy consumption is the one presented by Digiconomist. In this case, the annual consumption of bitcoin amounts to almost 75 TWh, almost 14 TWh more than the Cambridge index.

Energy Consumption is not a Weakness for Bitcoin

Bitcoin’s real revolution is in its architecture. Bitcoin is decentralized and can’t be controlled by a central authority or a small group of people. But, in order to have a consensus about which blockchain contains the common version of truth, a measure must be applied. In the PoW mechanism, the chain which has the most accumulated energy is considered the one chain everyone can rely on as the truth.

Thus, energy consumption is an essential feature for securing the Bitcoin blockchain. Bitcoin miners secure the network and the amount of energy consumed is directly related to the security of the network. Bitcoin is computationally expensive by design which is expressed in the wording “proof of work.” This implies resistance to forgery, inflation, and theft.

So far, this consensus mechanism is the best solution for creating a secure and decentralized digital currency. The proof of stake (PoS) consensus mechanism is not a safe alternative. Thanks to PoW, carrying out an attack on the bitcoin network is practically impossible and it allows it to minimize trust in third parties as the verification of the transaction history, the blockchain, can be proven easily by everyone.

In Perspective

Considering the energy level consumed by Bitcoin alone cannot provide an accurate metric. All new technologies such as data centers, computers and before them trains, planes, and automobiles were and still are energy-intensive. Over time, all of these have become more efficient, a natural progression of any technology; saving energy equates to saving costs.

So it is true that bitcoin consumes an increasing amount of power worldwide but we should also consider where this power comes from. Initially, the mining activity was concentrated in China where most of the energy comes from fuel sources. However, a study published by Coinshares, a cryptocurrency asset management, and analysis firm, found that as much as 74 percent of the electricity used by bitcoin actually comes from clean sources, like wind, solar, and hydropower. From this point of view, producing bitcoins is one of the most efficient sectors in terms of energy waste.

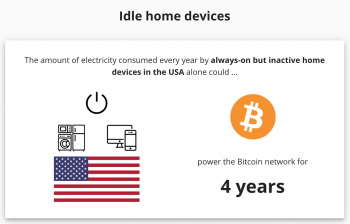

In comparison, according to a Cambridge metric, the amount of electricity consumed every year by always-on but inactive home devices in the USA alone could power the bitcoin network for four years.

[Source: CBECI]

This represents a real waste of energy as it’s not useful for anything, whereas the Bitcoin Network consumes a lot of energy but does not waste it. Bitcoin represents a real alternative to the current financial system; it has the features to be a qualified, stateless, world currency since it is censorship-resistant, permissionless, and trustless all the while providing instant settlement.

Essentially, the energy consumed by Bitcoin is for the common good, not a waste.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4