Pledgecamp is a crowdfunding platform that incorporates blockchain technology for security and accountability. Since decentralization lies at its very core, it was crucial for Pledgecamp to build a robust internal ecosystem, where its members are automatically incentivized to work in the best interests of the entire network. The way they managed to achieve that, was by incorporating some pretty sound tokenomics principles.

Tokenomics 101

Tokenomics consists of two words “Token” and “Economics.” Tokenomics is the quality of a token which will convince users/investors to adopt it and help build the ecosystem around the underlying project of that token. To put it simply, anything that impacts the token’s value is a part of tokenomics. One of the most potent factors that can affect an asset’s value is “supply and demand.”

What is “supply and demand?”

The law of supply and demand is one of the basic principles of microeconomics. The law shows the interaction between the supply and the demand of a particular asset/resource:

- As the supply of an asset increase, its demand will subsequently decrease, which will decrease its value.

- Conversely, as the supply of an asset decreases, its demand will increase, which will drive its price up.

The spot where the supply and demand curves intersect is the equilibrium i.e. the sweet spot where you want to be.

So how does this factor into tokenomics?

To work in conjunction with supply and demand, most crypto projects incorporate a maximum cap to their overall supply. This is why Bitcoin has a total limit of 21 billion coins. Mining becomes progressively harder and the block reward also decreases as the system reaches the overall limit.

There is another technique that a lot of projects use to control their overall supply. The method is called “token burning.” The idea is that when the network reaches a particular level, a certain amount of tokens are burnt and wholly removed from existence. Vitalik Buterin, the creator of Ethereum, calls these levels “sinks.”

“The important thing is that for the token to have a stable value, it is highly beneficial for the token supply to have sinks – places where tokens actually disappear and so the total token quantity decreases over time.” -Vitalik Buterin, On Medium-of-Exchange Token Valuations (2017)

Incorporating sinks via a dual-token system

Most of the projects out there in the crypto-space are single token systems. These tokens take up multiple roles in their native ecosystem, such as:

- Being used as a mode of payment.

- Allows the user to stake them in the ecosystem to take up important roles.

- Gives the holders voting rights within the ecosystem.

- Used as a means of people for their work within the ecosystem.

Unless it is necessary, projects shouldn’t need more than one token. Most projects with dual-token and even triple-token systems are doing nothing more than polluting the cryptospace with useless tokens.

Keeping all this in mind, Pledgecamp still opted for a dual-token system. The two tokens used by Pledgecamp are Pledge Coins (PLG) and Camp Shares (CS). Let’s look at how these two co-exist within PledgeCoin and, more importantly, how it makes sense for both of them to exist in the ecosystem.

PLG and CS co-existing

PLGs are utility tokens which are mainly used for:

- Funding projects.

- Paying for various services.

CS, on the other hand, are non-exchange tokens which cannot be used for paying for anything in the ecosystem. One can only gain CS after staking PLG tokens. Owning CS tokens will give people the right to become a Moderator.

A Moderator is responsible for maintaining the overall health and well-being of the Pledgecamp ecosystem by removing behavior violations. Behavior violations include and are not limited to listing scam projects, exhibiting abusive behavior, and engaging in illegal activity.

Before we proceed, keep these points in mind about the Camp Share tokens:

- CS is produced at a 1:1 ratio to the amount of PLG staked by the user.

- A minimum balance of 10,000,000 CS is required to achieve Moderator status

The value of Camp Share tokens

You are probably thinking right now, if the idea is just to stake the PLG tokens, then why burn then and replace them with the new CS tokens in the first place? Why not just keep the PLG?

Remember that unlike PLG, CS tokens have no exchange value. By burning PLG, Pledgecamp is reducing the overall supply of the tokens that can actually be used as a utility token. Reducing the supply drives the overall demand of PLG up. The Camp Share tokens are nothing but a representation of the amount of stake you have within the ecosystem.

Why will a user keep their CS tokens?

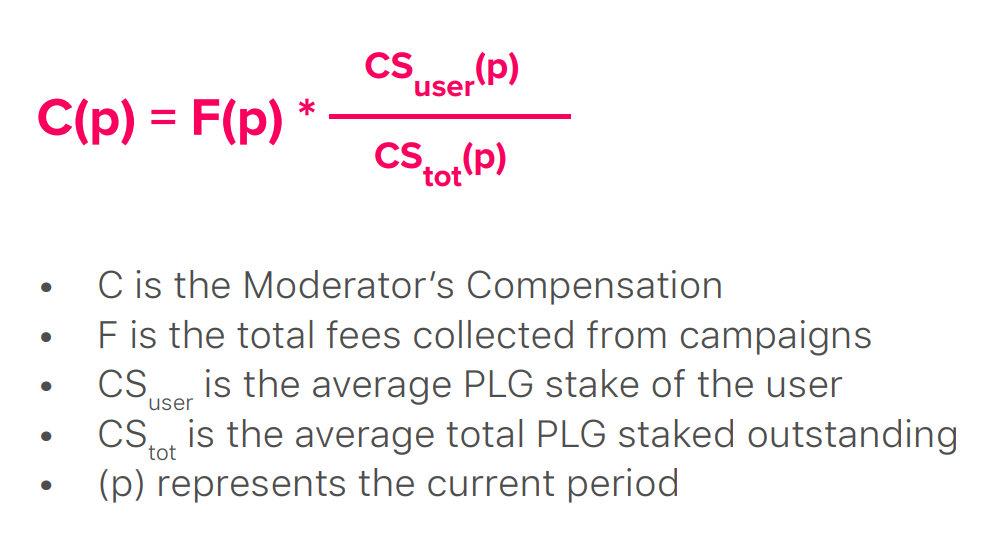

So, why will a Moderator bother keeping their CS tokens, if they can’t spend it? Well, first and foremost, being a Moderator will allow them to earn rewards from the ecosystem. The total campaign listing fees generated within the system is shared among the Moderators as a reward. The reward is distributed as per the following formula:

As you can see, the Moderators get a reward which is directly proportional to the amount of CS tokens that they possess. So, not only are Moderators incentivized to keep their CS tokens, it actually works in their interest to lock up more PLG tokens and maintain a higher number of CS.

NOTE: Pledgecamp is aware that in its nascent stage, the number of campaigns listed will be less, which is why 50 billion PLG ( 5% of the initial token allocation) has been kept aside to reward the Moderators in the early days.

However, if you do want your PLG back, then you can burn your CS, which will return an equivalent number of PLG after a 30-day vesting period, reversing the stake.

Conclusion

PLG and CS work in conjunction with each other to leverage the supply-demand formula and keep the Pledgecamp ecosystem healthy. Pledgecamp’s dual-token system ensures that the overall tokenomics of the network remains strong.