For the entirety of cryptocurrency’s short history, Venezuela has been seen to be among the most striking example of the need for the utility. The South American country has hosted escalating political tension for years, as skyrocketing hyperinflation, electricity blackouts and shortages of vital food and medicine intensified popular discontent.

Venezuelan trade volume dominates P2P markets

Venezuelan peer-to-peer (P2P) markets have long been a leader in terms of volume, in part owing to widespread geo-blocking that targets Venezuelan citizens on the part of cryptocurrency exchanges. Recently, Binance announced that as of July 1, 2019, the residents of Venezuela and 28 other countries will be restricted from accessing Binance’s decentralized exchange platform.

Venezuelan trade has consistently comprised the second-largest market on P2P Bitcoin marketplace Localbitcoins, trailing only behind Russia. During the week of July 13, 2019, approximately 5,012 BTC changed hands — equating to 49,248,298,468 Venezuelan bolivar (approximately $5 million).

Origins of Venezuela’s economic crisis

Following former President Hugo Chavez’s death in March 2013, Venezuela’s current president, Nicolas Maduro, was elected to power in April 2013. The Democratic Unity Roundtable, an electoral coalition of Venezuelan political parties opposed to the policies of the United Socialist Party of Venezuela, claimed that the election was fraudulent. However, the Supreme Court of Venezuela ruled Maduro to be the country’s legitimate president. During 2013, Venezuela’s annual inflation reached a 16-year-high of 56.2%. Since Maduro’s election, hundreds of thousands of Venezuelans have taken to the streets to protest corruption, hyperinflation, a scarcity of basic goods and violent coercion.

Oil prices slump during 2014

From the start of 2014, the price of oil dropped roughly 60% from more than $100 per barrel. With crude oil equating to approximately 80% of Venezuelan exports, the plummeting price of oil drove the Venezuelan economy to enter a recession. 2015 saw Maduro’s United Socialist Party of Venezuela suffer defeat during parliamentary elections. However, Maduro vowed to “stop by hook or by crook the opposition coming to power, whatever the costs, in any way,” and replaced the country’s entire Supreme Court the following day. The following month, President Maduro consolidated executive control over all three branches of government amid decreeing a national “economic emergency,” effectively preventing the National Assembly from legislating.

During 2015, Venezuela experienced the highest rate of inflation in the world, with inflation exceeding 100% for the first time in the country’s history. The following year saw annual inflation reach 274%, while the price of consumer goods in Venezuela rose by 800%. A study published by Diario Las Americas approximated that more than 15% of Venezuelans were then regularly consuming food waste that had been discarded by commercial establishments.

During 2017, Venezuelan inflation was estimated to have skyrocketed to 2,000% annually. Victor Torres, a chauffeur living in the Venezuelan city of Maracaibo, articulated the ordeal of attempting to make basic purchases under conditions of extreme hyperinflation to The Telegraph, stating: “The other day I went to buy a banana. In the morning it cost 1,900 bolivares and in the afternoon, 3,000. You can’t live this way. I am disappointed with politicians.”

Venezuelan inflation climbs to 130,000% in 2019

Following Venezuela’s May 2018 election, Maduro claimed to have won 67.8% of the ballot. However, the result was challenged by the governments of Argentina, Chile, Colombia, Brazil, Canada, Germany, France and the United States — which described the election as failing to guarantee a free, fair and transparent democratic process, and subsequently moved to recognize Juan Guaido of the Popular Will party as the legitimate president of Venezuela. During October 2018, Venezuelan annual inflation was estimated to have reached 130,060%.

Since 2015, the United Nations estimates that 4 million Venezuelans have fled the country — roughly 12.5% of Venezuela’s current population.

Since the establishment of the Corruption Perceptions Index in 1995, Venezuela has been ranked among the world’s most corrupt regimes. In 2010, the index ranked Venezuela as the 164th-least transparent government of 178 nations, with Venezuela ranking 166th of 178 countries in 2016, and 168th of 180 nations in 2018. The World Justice Project also ranked Venezuela 99th out of 99 nations according to its 2014 Rule of Law Index, with the index currently ranking Venezuela 126th of 126 nations.

Economic sanctions

In addition to struggling to persevere the degrading economy and rampant political corruption, Venezuelan citizens also bear the brunt of sanctions imposed on the Latin American nation by the U.S. and other countries.

At the start of 2019, Alfred de Zayas, the first U.N. rapporteur to visit Venezuela for 21 years, described U.S.-imposed sanctions as comprising “economic warfare.” The special rapporteur recommended that the International Criminal Court investigate the sanctions maintained by the U.S. as potential crimes against humanity under Article 7 of the Rome Statute, arguing that the sanctions are illegal due to their lack of endorsement from the U.N. Security Council. He stated:

“Modern-day economic sanctions and blockades are comparable with medieval sieges of towns. Twenty-first-century sanctions attempt to bring not just a town, but sovereign countries to their knees.”

Zayas’ findings were based on his late-2017 mission to the country that saw the rapporteur interview government ministers, members of the country’s opposing parties, nongovernmental organizations (NGOs) operating in Venezuela, and local academics, activists and church officials. The criticisms of the economic sanctions have been echoed by numerous NGOs, with the president of Fundalatin, Eugenia Russian, stating:

“We consider that one of the fundamental causes of the economic crisis in the country is the effect that the unilateral coercive sanctions that are applied in the economy, especially by the government of the United States.”

President Donald Trump has recently threatened to intensify the sanctions currently imposed on Venezuela, stating that he will “continue to use the full weight of United States economic and diplomatic power to press for the restoration of Venezuelan democracy” while announcing support for the recognition of Guaido as the country’s legitimate leader in January.

Petro

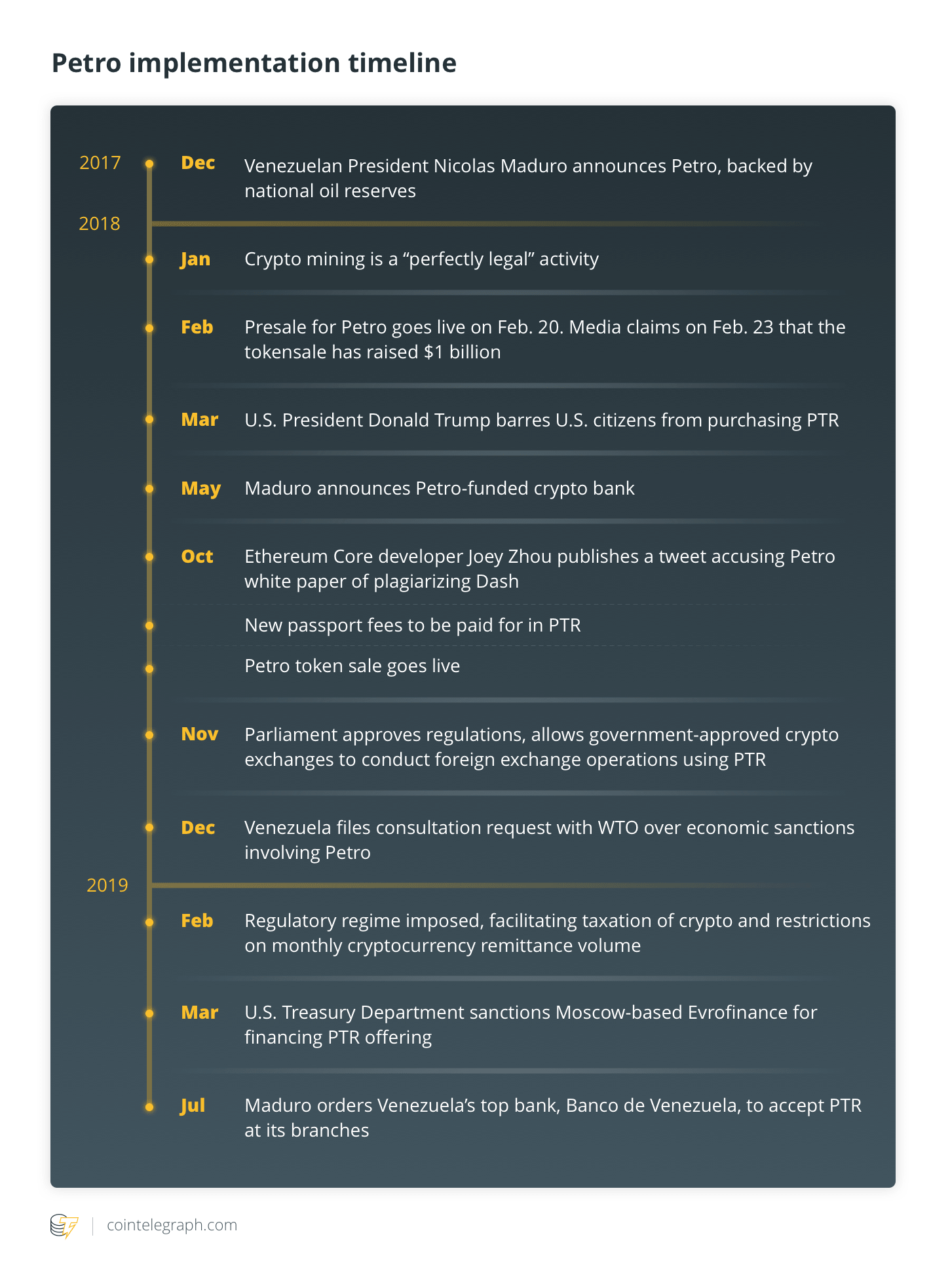

In a bid to circumvent the economic sanctions imposed on Venezuela, Nicolas Maduro announced plans to launch a cryptocurrency backed by the nation’s oil, gasoline, gold and diamond reserves during December 2017. The president claimed that the digital currency, named Petro (PTR), would allow the country to access “new forms of international financing.”

At the start of January 2018, President Maduro ordered the issuance of the first 100 million Petros, announcing that each Petro will be pegged to the value of one barrel of Venezuelan oil — equating the cryptocurrency’s capitalization to roughly $5.9 billion. Several days later, the opposition-run National Assembly criticized Petro, calling the digital currency “null and void.” Parliamentary Deputy Jorge Millan described Petro as fraudulent, stating: “This is not a cryptocurrency, this is a forward sale of Venezuelan oil. It is tailor-made for corruption.” He went on:

“We find ourselves before a new kind of fraud, disguised as a solution the (financial) crisis. This incompetent government wants to compensate for lack of oil production with these virtual barrels.”

At the end of January 2018, Maduro announced that cryptocurrency mining was a “perfectly legal” activity. The president also announced that citizens targeted during the prior year’s police crackdown on mining operations would have any related charges dismissed. On Jan. 30, 2018, Maduro’s administration published the white paper for the cryptocurrency.

On Feb. 8, 2018, Jose Vielma Mora, Venezuela’s minister of foreign trade and international investment, told the state-sponsored news outlet TeleSur that foreign investors would be willing to conduct trade in exchange for Petro, claiming that Poland, Denmark, Honduras, Norway, Canada and Vietnam were among the trading partners preparing to accept the controversial cryptocurrency as a means of payment.

Venezuela launched the presale for Petro on Feb. 20, 2018. 82.4 million Petros were made available in exchange for select fiat currencies and cryptocurrencies. Three days later, Venezuelan media claimed that the presale had raised $1 billion. On Feb. 24, the Venezuelan government launched a free cryptocurrency training course aimed at improving digital currency literacy for ordinary citizens.

Trump administration bans U.S. citizens from purchasing Petro

On March 19, President Trump barred American citizens from purchasing Petro by executive order. At a G-20 meeting in Buenos Aires, U.S. Treasury Secretary Steven Mnuchin, stated:

“President Maduro decimated the Venezuelan economy and spurred a humanitarian crisis. Instead of correcting course to avoid further catastrophe, the Maduro regime is attempting to circumvent sanctions through the Petro digital currency — a ploy that Venezuela’s democratically-elected National Assembly has denounced and Treasury has cautioned U.S. persons to avoid.”

The U.S. Treasury Department described Petro as comprising an “attempt to prop up the Maduro regime, while further looting the resources of the Venezuelan people.” On March 27, Bitfinex announced that it would not support Petro in light of the U.S. sanctions against the cryptocurrency.

Venezuela promotes Petro adoption

During 2018, the Venezuelan government conceived several initiatives designed to bolster the adoption and perceived utility of Petro. In May 2018, Maduro announced the launch of a Petro-funded crypto bank that would support project proposals from the country’s youth. During July 2018, The Venezuelan minister of habitat and housing, Ildemaro Villarroel, announced a plan to fund the construction of houses for homeless citizens using the cryptocurrency. The following month, the president also announced that Petro would be used as a general unit of account in Venezuela, stating:

“As of next Monday, Venezuela will have a second accounting unit based on the price, the value of the Petro. It will be a second accounting unit of the Republic and will begin operations as a mandatory accounting unit of our PDVSA oil industry.”

Despite the announcements, during August 2018, Reuters reported that there was little indication of Petro’s presence in the oil-rich Venezuelan town of Atapirire. Despite comprising the sole town located in a region that the Venezuelan government estimates is home to 5 billion barrels of oil, Atapirire resident, Igdalia Diaz, told Reuters, “There is no sign of that Petro here.”

During the same month, the country’s former oil minister, Rafael Ramirez, estimated that Venezuela’s state-owned oil company did not possess the roughly $20 billion that he believed would be required in order to tap the nation’s oil reserves. Ramirez stated, “The Petro is being set at an arbitrary value, which only exists in the government’s imagination.”

Accusations of plagiarism

Ethereum Core developer Joey Zhou published a tweet on Oct. 2, 2018, asserting that the 11th page of Petro’s white paper contained an image plagiarized from the Github repository of Dash. Petro also opted to use the same X11 proof-of-work (PoW) mining algorithm as Dash. Zhou described Petro as comprising a “blatant Dash clone.”

On Oct. 5, 2018, Venezuelan Vice President Delcy Rodriguez announced that the fees for all passport applications would be exclusively payable in the form of Petro from Oct. 8 onward. The announcement was accompanied by a hike in the cost of passport applications, with new applications incurring a fee of 2 PTR and passport extensions priced at 1 PTR.

Venezuela launches Petro offering

Venezuela’s Ministry of Economy announced that Petro had been made available for purchase on Oct. 29, 2018. In an infographic published on Twitter, the token could be purchased from the Venezuelan Treasury from either the coin’s official website or from six government-authorized cryptocurrency exchanges: Bancar, Afx Trae, Cave Blockchain, Amberes Coin, Cryptia and Criptolago. The official Twitter account of the Petro indicated that investors were able to purchase the cryptocurrency using U.S. dollars, euros and Chinese yuan, in addition to Bitcoin, Litecoin, Ether and Dash.

During November 2018, the National Assembly of Venezuela approved a bill containing new cryptocurrency regulation. The bill sought to legitimate Petro as a unit of commercial exchange within the country. The same month saw the National Assembly pass amendments to Anti-Money Laundering (AML) laws to pave the way for Venezuelan cryptocurrency exchanges to conduct foreign exchange operations using Petro.

Venezuelan government official Andres Eloy Mendez described the amendments as being intended to combat the “financial and commercial blockade” being maintained by the U.S. government, adding that the cryptocurrency would allow the evasion of sanctions and facilitate new transnational business relationships.

Venezuela raises bolivar-value of Petro

On Nov. 30, 2018, President Maduro announced that the fiat-value of Petro had been raised from 3,600 bolivars to 9,000 bolivars amid extreme inflation, alongside ordering an increase in the monthly minimum wage by 150% — the sixth wage hike of that year.

During December 2018, the Venezuelan government moved to automatically convert its pensioners’ monthly bonuses into Petro. According to Caracas Chronicles, pensioners’ government payouts were withdrawn and converted into Petro after initially being deposited into fiat accounts hosted by government web portal patria.org.ve on Dec. 7, 2018.

On Dec. 28, 2018, Venezuela filed a consultation request with the World Trade Organization (WTO) making a complaint regarding the economic sanctions imposed by the U.S., describing five examples of “coercive trade-restrictive measures” that were imposed on the Bolivarian Republic of Venezuela.

With regard to “transactions in Venezuelan digital currency,” the complaint alleged that U.S. sanctions violated the WTO’s General Agreement on Trade in Services by subjecting Venezuelan financial service suppliers to conditions “less favourable than that accorded to like services and service suppliers of WTO Member States not subject to the measures,” as well as conditions inferior to the treatment of “like domestic financial services and service suppliers.”

In February 2019, the Venezuelan government published a decree imposing regulations on cryptocurrency remittances within the country. The document revealed that the National Superintendency of Crypto Assets and Related Activities (SUNACRIP) would be responsible for taxation pertaining to cryptocurrency transactions.

The new regulations established a monthly limit on cryptocurrency regulations and imposed a maximum fee of 15% on cryptocurrency transfers alongside a minimum fee of roughly $0.28. Remittances in the form of Petro were capped at 10 PTR per month (equating to approximately $600), however, individuals and entities will be permitted to conduct up to 50 Petros worth of monthly trade with SUNACRIP approval.

Petro-active

During March 2019, the United States Treasury Department added Moscow-based Evrofinance Mosnarbank to its sanctions list, accusing the financial institution of comprising the “primary international financial institution willing to finance” Petro. The department stated:

“This action demonstrates that the United States will take action against foreign financial institutions that sustain the illegitimate Maduro regime and contribute to the economic collapse and humanitarian crisis plaguing the people of Venezuela.”

In May 2019, Venezuelan U.N. delegate Geneva Jorge Valero stated that Russia and Venezuela were discussing utilities for Petro amid agreements to settle trade using the Russian ruble. On July 4, 2019, President Maduro ordered the country’s leading bank, Banco de Venezuela, to open “Petro desks” and accept PTR at all of its branches.