Friday, July 19 — Cryptocurrency markets are reporting mixed signals, with most of the top-20 coins by market capitalization are down over the last 24 hours.

Market visualization. Source: Coin360

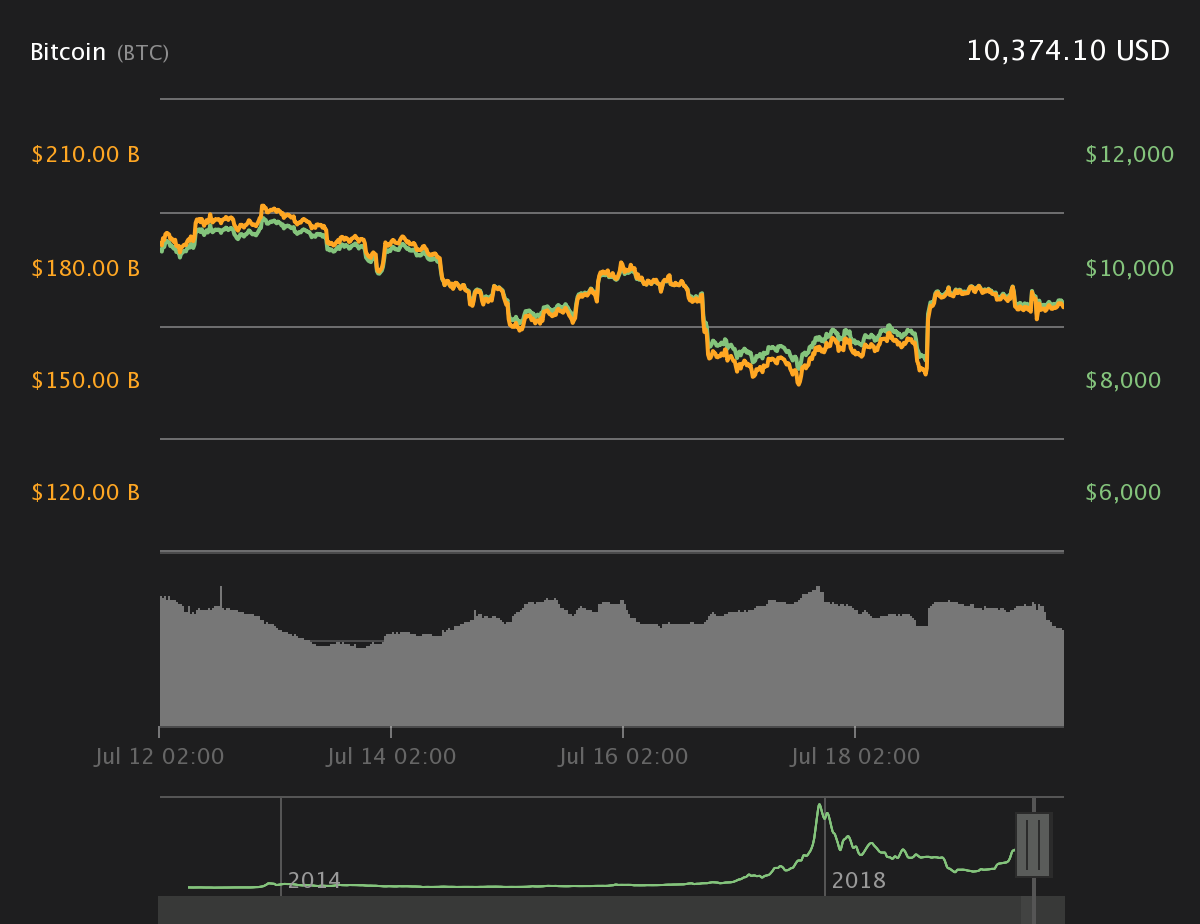

Bitcoin (BTC) has stayed above the $10,000 threshold during the day and is trading at around $10,412 at press time. The leading cryptocurrency has lost 2.14% on the day, while its weekly losses amount to nearly 10%.

As reported earlier today, U.S. Congressman Patrick McHenry, who represents North Carolina’s 10th District, told fellow lawmakers directly that attempts to stop Bitcoin are futile. “The world that Satoshi Nakamoto, author of the Bitcoin whitepaper envisioned, and others are building, is an unstoppable force,” he said.

Bitcoin 7-day price chart. Source: Coin360

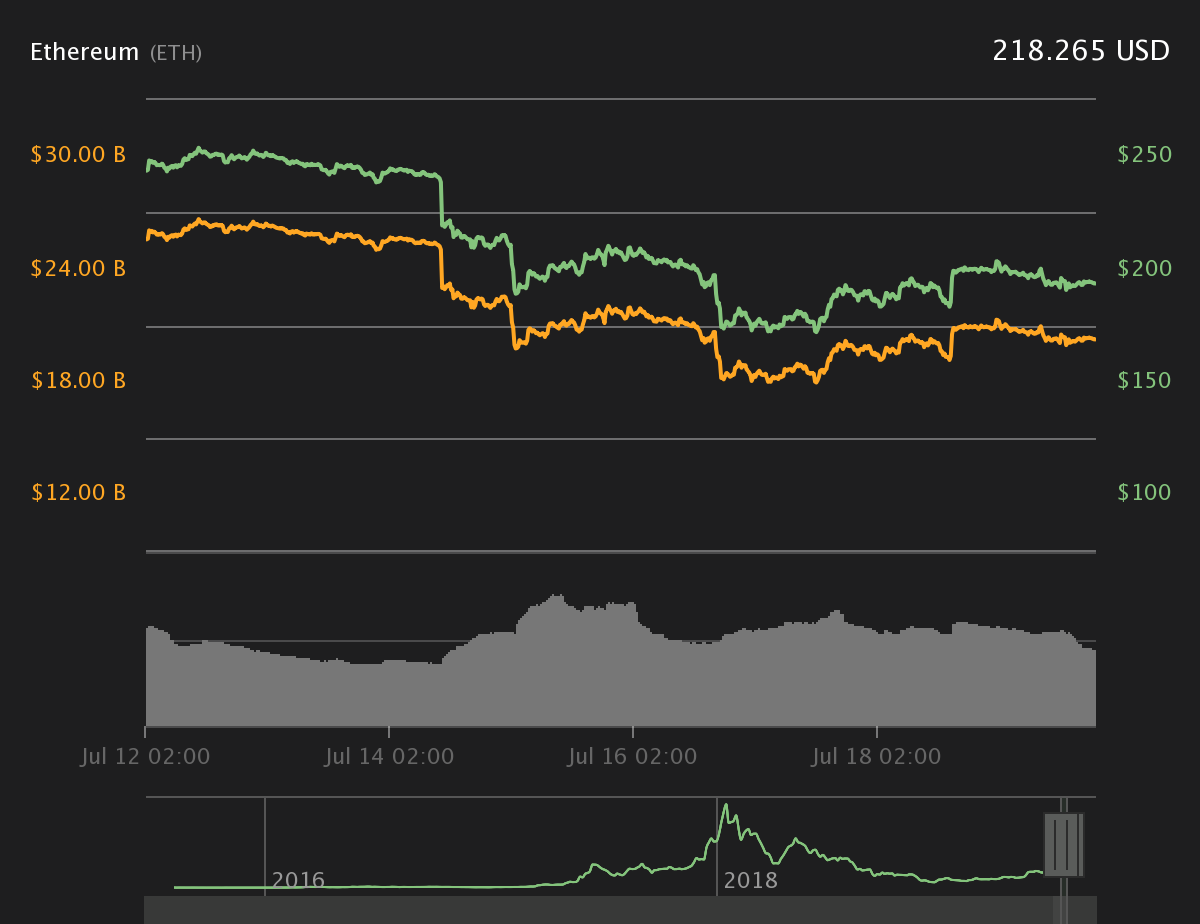

Ether (ETH) started the day around $224.91, subsequently reaching its intraday high of $229.75. At press time, ETH is trading at around $218.29, down 2.71% over the last 24 hours.

Ethereum 24-hour price chart. Source: Coin360

Ripple (XRP) is slightly down as well, currently trading at around $0.317, down by 1.61% over the 24 hour period. The altcoin has not registered significant price fluctuations today, generally staying in the corridor between $0.31 and $0.32.

XRP 7-day price chart. Source: Coin360

On the top-20 list of cryptocurrencies, only Binance Coin (BNB), Bitcoin SV (BSV), TRON (TRX), Stellar (XLM), Dash (DASH), and IOTA (MIOTA) are reporting gains between 0.49% and 3.12%.

Today, privacy-focused digital currency Zcash (ZEC) forked into a new blockchain network dubbed Ycash, whose total supply amounts to 21 million coins. Currently, ZEC is the 24th major coin and is trading at around $73.9.

Zcash 7-day price chart. Source: Coin360

The combined market capitalization of all cryptocurrencies is now at around $282 billion, and the daily trading volume is around $67 billion at press time.

In traditional markets, gold slumped about 1% today, according to CNBC, as the dollar firmed and investors took profits after prices briefly surpassed $1,450 to hit a six-year peak on dovish signals from the U.S. Federal Reserve.