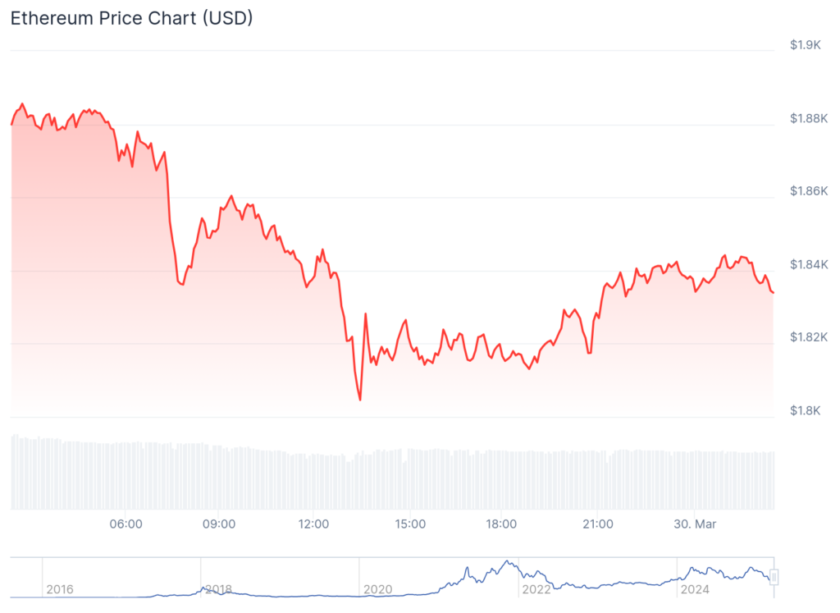

- Ethereum (ETH) is down 8.1 percent

- Istanbul may include the activation of EIP-2025

Code improvement is vital for the survival of any public chain. Even though EIP-2025 is an enhancement that will aid in funding Ethereum development, there is resistance against its activation. At the time of press, ETH is down 8.1 percent in the last week.

Ethereum Price Analysis

Fundamentals

Because of asset tokenization, the future of facilitating platforms as Ethereum is bright. However, their success largely depends on the ingenuity of project’s creators.

In the case of Ethereum, there is a consensus that the network must upgrade for it to be competitive. That’s regardless of their current position as a successful dApp development and launching site. Tron and EOS are already miles ahead on scalability because of their algorithm choices.

On marketing, Tron is pulling ahead of the pack. Despite the postponement of Justin Sun’s lunch with Warren buffet, a Wall Street legend, the expected media coverage will position Tron as a desirable Ethereum alternative given the founder’s efforts.

Meanwhile, the proposal to incorporate EIP-2025 in the next Ethereum hard fork, Istanbul, is already sparking controversy. Well-meaning in that the EIP-2025 creates a developer fund by temporarily increasing ETH inflation for 18 months upon activation, developers are arguing otherwise.

High ranking Ethereum developers as Ameen Soleimani, the CEO of Spankchain are against this implementation. Ameen asserts that the activation of this EIP, even if it will spur development within the Ethereum ecosystem, will at the end of the day dilute ETH as a store of value.

Candlestick Arrangements

At the time of press, ETH is printing lower. Down 8.1 percent and 2.1 percent in the last week and day respectively, bears are no doubt in control. From the chart, ceilings are at $230 and the primary resistance, previous support, trend line.

Even though there is a likelihood that buyers will flow back thanks to on-chain development in the next few quarters, a correction to $190 or lower is highly likely. Evident from the chart, ETH support is at the $170 to $190 zone.

Therefore, because of the candlestick arrangement, every high is a selling opportunity for savvy traders aiming at $190. Ideally, a fitting stop limit will be above $230. Furthermore, for sell trend confirmation, this drawdown ought to be with high trading volumes indicating liquidation.

Technical Indicators

Leading this trade plan is July 16 bear candlestick. Because of undervaluation, the bar is wide-ranging with high trading volumes of 405k.

Therefore, if buyers are indeed in charge, then the spike above $230 must be with high participation exceeding 405k. Such a move will likely reverse losses of July 14 in a retest of the main resistance, previous support, trend line.

On the reverse side, steep losses with volumes exceeding 405k could spur liquidation as bears as aim at $100 or 2018 lows of $70.

Chart courtesy of Trading View. Image Courtesy of Shutterstock