On June 23, Monero posted a 2019 high of $121.12. At that point, the privacy token was up by over 194 percent for the year. Unfortunately, the six-month run was met by heavy selling. Those who bought the cryptocurrency early were happy to dump positions at substantial profits.

As a result, Monero plunged to as low as $71.842 on July 17. That’s a brutal drop of over 40 percent in less than a month.

The good news is that the cryptocurrency is still bullish from a macro perspective. Thus, long-term investors shouldn’t lose sleep because of this pullback. On the contrary, they might want to consider buying this dip because Monero’s uptrend remains strong. On top of that, the development team has made massive privacy improvements over the years.

Monero Retracement Healthy for the Long-Term Sustainability of the Uptrend

In an uptrending market, a pullback is healthy. It allows market participants to change hands while providing time for technical indicators to cool off.

In Monero’s case, sellers have been dumping positions since early July with peak selling occurring on July 8. Since then, volume has dramatically plunged. This tells us that sellers are losing ammunition. With supply dwindling close to a demand area, we can see Monero putting together a solid bounce soon.

In addition to the declining supply, the daily RSI is no longer flailing oversold readings. This gives bulls the room to spark a run-up without quickly overheating the market.

Also, the uptrend looks healthy as Monero has posted three consecutive higher highs. On top of that, the diagonal support is being respected as the market quickly bounced after tapping the support.

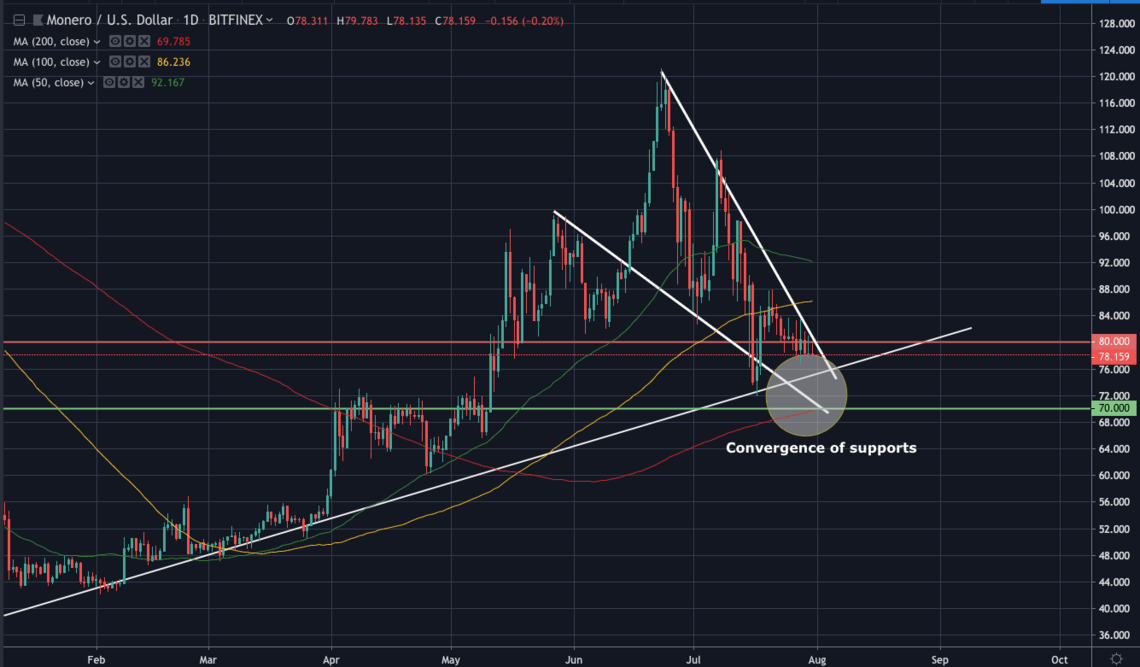

Lastly, the market is printing a falling wedge on the daily chart and it is close to trading at the apex of the structure. We believe it is likely that Monero will breach the diagonal resistance of the wedge because there are three supports converging close to the apex.

We have the horizontal support at $70, the uptrend support, and the 200-day moving average. These supports will likely provide buying pressure that would eventually lead to a breakout.

Numerous Privacy Improvements Over the Years

The coin’s robust fundamentals support our long-term bullish view. As a privacy token, Monero offers four features to make it extremely difficult, if not impossible, for prying eyes to trace your transactions.

The crypto-token uses ring signatures to keep the initiator of the transaction hidden from third-party observers.

Also, the privacy coin uses stealth addresses to obscure the receiver of the transaction.

Now that both the sender and the receiver are concealed, the next piece of the puzzle is to keep the amount of the transaction out of sight as well. For this purpose, Monero relies on confidential transactions.

Lastly, Monero uses Kovri. This is an anonymity functionality that cloaks the user’s IP addresses and geographic details. As a result, Kovri renders passive surveillance impractical.

Bottom Line: Monero Is a Buy-on-Dips Candidate

Monero looks like a solid investment from both the technical and fundamental perspectives. Investors who agree with our assessment might want to buy on strength. Wait for the market to confirm a break out of the wedge, which is around $80. It’s starting to look like it’s breaking out now. The initial target is $100. Above that, $120 is next.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.