From market metrics to ETF aspirations, uncover what drives BTC’s price in October.

Riding the wave of a largely positive October for cryptos, Bitcoin (BTC) breached the $35,000 barrier on Oct. 23, a high it hadn’t seen since May 2022

As of Oct. 24, the price of BTC has been oscillating between $34,000 and $34,500, demonstrating a slight consolidation after the recent high. Moreover, the year has been fruitful for BTC so far, with its year-to-date (YTD) gains exceeding 100%, specifically standing at 103%.

This bullish momentum is largely fueled by the anticipation that a spot BTC ETF might soon receive a green light, escalating mainstream adoption. Several key players like Grayscale and Blackrock have thrown their hats in the ring, applying for ETF approval, adding more fuel to the market’s bullish stance.

Let’s delve deeper into the factors influencing Bitcoin’s performance, the metrics, and market sentiments and try to understand where BTC might be headed next.

Why is Bitcoin price up?

The anticipation of a Bitcoin ETF has stirred a positive storm in the crypto markets, with BlackRock, the world’s largest asset manager, leading the movement with its proposed iShares Bitcoin Trust.

This Trust, now listed on the Depository Trust and Clearing Corporation (DTCC) website under the ticker IBTC, represents a significant stride towards garnering the much-awaited approval for a Bitcoin ETF in the U.S.

Eric Balchunas, a senior analyst at Bloomberg Intelligence, highlighted that IBTC is the maiden proposed spot bitcoin ETF listed on DTCC.

The DTCC, through its subsidiary, National Securities Clearing Corporation (NSCC), has a mechanism for clearing ETFs, ensuring a streamlined review of the ETF’s portfolio constituents – a requisite for automating the creation, redemption, and settlement of ETF shares.

The journey towards a Bitcoin ETF doesn’t stop at BlackRock. Key players like Ark Invest and 21Shares have also amended their ETF proposals, following a constructive dialogue with the Securities and Exchange Commission (SEC), paving the path for clearer regulatory frameworks.

Further progress was seen when Grayscale filed to register its Bitcoin Trust (GBTC) under the Securities Act of 1933, aiming to convert the trust into a spot ETF. This move was further bolstered by the DC Circuit Court of Appeals’ criticism of the SEC’s earlier rejection.

As these financial powerhouses continue to iron out the logistics and comply with regulatory prerequisites, the closer we inch towards mainstream acceptance of Bitcoin, which bodes well for its price trajectory and broader crypto market outlook. However, nothing is certain right now.

Gauging Bitcoin’s market stamina

As Bitcoin continues its upward journey, it’s pivotal to delve into some key metrics that elucidate the strength and potential trajectory of BTC in the current market setting.

Open Interest (OI)

Open Interest refers to the total number of outstanding derivative contracts, like futures and options, in the market.

A rise in OI indicates an increase in the money flowing into the market and, potentially, the level of investor interest and vice versa.

As of Oct. 24, Bitcoin’s open interest soared to $15 billion, marking a nearly 5% increase in the preceding 24-hours.

This surge underscores heightened activity and engagement in the BTC market, which could translate to a sustained price momentum given the increased capital inflow.

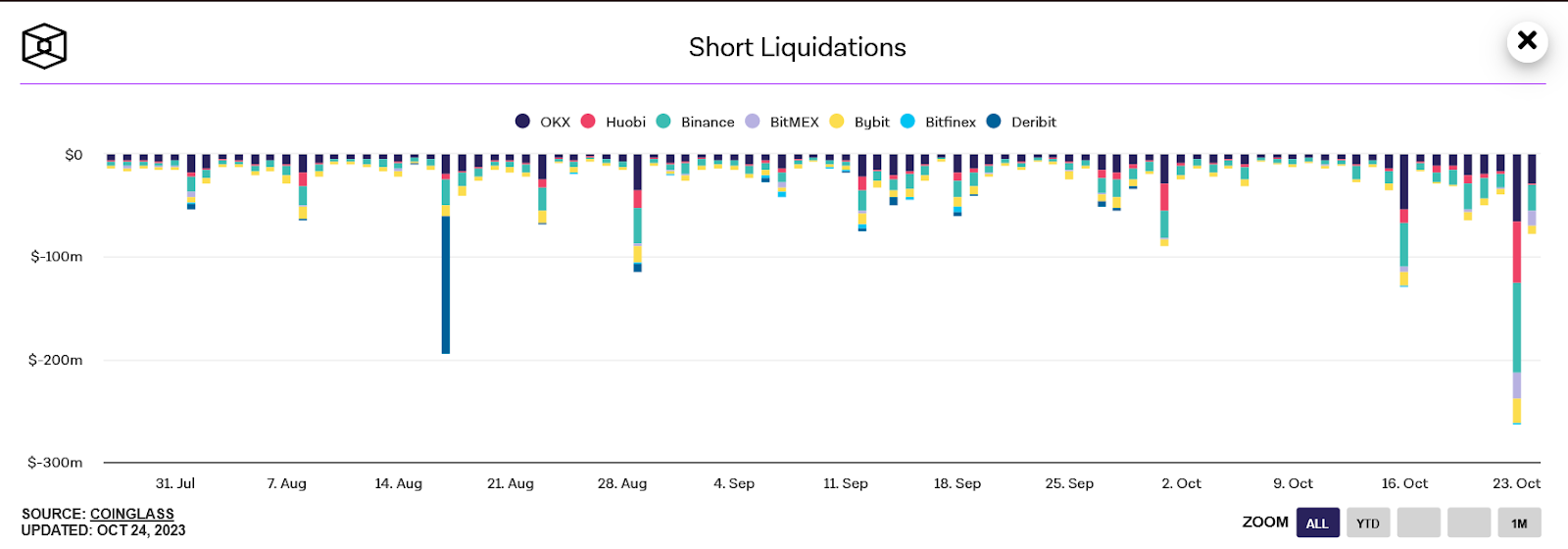

Short liquidations

Liquidation in the cryptocurrency market pertains to the automatic closure of trading positions once certain price levels are hit to prevent further losses. On Oct. 23, BTC witnessed over $263 million in short liquidations, the highest in recent months.

The substantial liquidation volume hints at a strong bullish undercurrent, as traders betting against BTC were compelled to close their positions, further propelling the price upward.

Bitcoin dominance

Bitcoin dominance is a metric that compares BTC’s market capitalization against the aggregate market cap of all other cryptocurrencies. A higher dominance percentage suggests a greater preference or confidence among investors toward Bitcoin over other altcoins.

As of Oct. 24, BTC dominance escalated to over 54%, its highest since the April 2021 dip.

This resurgence in dominance signals a renewed investor confidence in Bitcoin’s market position, potentially at the expense of altcoins. It also hints at Bitcoin’s enduring appeal amid a diverse crypto landscape.

These metrics collectively paint a promising picture for Bitcoin, indicating robust market engagement, bullish sentiment, and a regained investor confidence.

Bitcoin price prediction

As the markets have turned green, various predictions have emanated from crypto traders and observers, each basing their forecasts on differing analyses and market sentiments.

One trader, who accurately foresaw the recent rise of Bitcoin to the $34-35k range, now anticipates a drastic price pullback to the $19-21k levels by the end of 2023.

This prediction is rooted in the belief of a short-term rally driven by a high concentration of venture capital and market maker funds in select altcoins, which, according to him, will be followed by a steep downturn.

Diving deeper, another analysis stemming from a theory crafted earlier this year revolves around Bitcoin’s historical halving cycles. This “Halving Cycles Theory” suggests a structured price movement based on past Bitcoin behavior around its halving dates.

According to a tweet, 2024 (termed as the Blue Year) will see Bitcoin consolidating around the current levels, followed by an ascent towards new all-time highs by the end of the year.

The theory further propels Bitcoin’s price to a range of $90-130k by the end of 2025 (the Red Year), driven by the cycle tops correlating with the halving dates.

On a lighter note, some in the crypto community humorously note the paradox of price predictions, referencing a tweet aimed at Jim Cramer, whose price forecasts are joked to have an inverse effect on Bitcoin’s price movement.

As Bitcoin continues its ascent, its price trajectory is likely to be influenced by a multitude of factors, many of which may be unforeseen. Navigate these speculative waters with caution, armed with thorough research and an understanding of the multifaceted forces at play.

What to expect next?

As Bitcoin basks in its recent rally, the road ahead warrants a cautious stride. The price is expected to remain on a roller-coaster ride over the next few days, making it a tricky terrain for swing trading.

Meanwhile, the much-anticipated spot BTC ETF stands as a wild card, with the potential to either skyrocket the price or send it tumbling down, hinting at heightened volatility in the near term. Trade cautiously and never invest more than you can afford to lose.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.