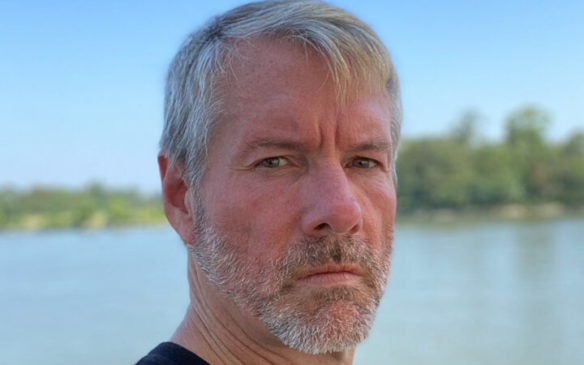

According to Michael Saylor, Bitcoin will pump significantly after the SEC approves a spot ETF and demand for the king coin spikes.

MicroStrategy Inc (NASDAQ: MSTR) Executive Chairman and Co-Founder Michael Saylor recently said he believes that Bitcoin will spike in an unprecedented way. Saylor, a popular Bitcoin bull, reiterated his support for the world’s largest cryptocurrency by market cap.

Saylor’s prediction has it that the king coin will 10x. His argument is a series of Bitcoin events, including the upcoming halving expected in April next year. The halving is a network event that happens roughly every four years or after every 210,000 blocks. At each halving, block rewards for Bitcoin miners crash by 50%. The upcoming halving will see Bitcoin block rewards halve from 6.25 BTC to 3125 BTC. The event is expected to reduce the number of Bitcoins entering the market.

In addition to the expected halving, Saylor’s argument is predicated on the United States Securities and Exchange Commission (SEC) approving the first spot Bitcoin ETF. There are already several predictions that the SEC could approve one of the proposals it’s currently reviewing as early as January. He said:

“You’re going to see $12 billion of natural selling per year converted into $6 billion of natural selling a year – at the same time as things like spot Bitcoin ETFs increase the demand for Bitcoin. So that’s why all of us are fairly bullish over the next 12 months: demand’s going to increase, supply’s going to contract, and this is fairly unprecedented in the history of Wall Street.”

Michael Saylor Says Bitcoin Will 10x

Saylor also said that institutional interest in Bitcoin will pump its price. According to him, major financial giants gradually adopting Bitcoin will stabilize the asset and the entire industry.

“When banks on Wall Street and responsible custodians are managing Bitcoin, and the industry takes its eyes away from all the shiny little tokens that have distracted and demolished shareholder value, I think the industry moves to the next level and we 10x from here,” said Saylor.

Recently, there have been several bullish predictions about Bitcoin. For instance, Bernstein Research said that the SEC’s approval of a spot BTC ETF is a “done deal.” The independent research service based its opinion on several Bitcoin updates, including the SEC court loss against Grayscale Investments. Bernstein Research now believes that an approval by January 10 is “highly likely.” Financial services giant JPMorgan Chase (NYSE: JPM) also believes that an approval by the same date is “most likely.”

Galaxy Digital founder and CEO Michael Novogratz said the SEC will likely approve a spot Bitcoin ETF by December. However, he added that trading wouldn’t start until next year. Galaxy Digital also applied for a spot Bitcoin ETF. In a release, Galaxy Digital noted that an approval will pump the price of Bitcoin by 74%. The firm believes that about $14 billion will enter the Bitcoin ETF market following approval. The prediction further states that the figure would be $27 billion by the second year and $39 billion the year after.

According to CoinMarketCap data, Bitcoin is at $34,702 after climbing 1.54% in the last week but losing nearly 3.5% in 24 hours.

Tolu is a cryptocurrency and blockchain enthusiast based in Lagos. He likes to demystify crypto stories to the bare basics so that anyone anywhere can understand without too much background knowledge.

When he’s not neck-deep in crypto stories, Tolu enjoys music, loves to sing and is an avid movie lover.