The total crypto market cap added $14 billion to its value during the last seven days and now stands at $266.1 billion. The top 10 currencies are all in green for the same time frame with EOS (EOS) and Bitcoin Cash (BCH) being the best performers with 12.3 and 7.1 percent of gains respectively. By the time of writing bitcoin (BTC) is trading at $10,300 while ether (ETH) stands at $178. Ripple’s XRP moved up to $0.259.

BTC/USD

After closing the month of August with a 4.3 percent loss, bitcoin moved up to $9,780 on Sunday, September 1, and ended the previous seven-day period with an increase of 3.4 percent.

The BTC/USD pair opened the new trading week by forming its fourth consecutive green candle on the daily chart on September 2. The coin registered a 6 percent jump and once again broke above the $10,000 level. Just as predicted, the pair successfully climbed to the mid-$10k levels and stopped at $10,400 – the next major resistance.

On Tuesday, September 3, the most popular cryptocurrency extended its gains and confirmed the break of downtrend, which happened during the previous session. It moved North to $10,620 looking at $11,00 as next major resistance.

The trading day on Wednesday, September 4, found bitcoin correcting its price to $10,577, even though it peaked at $10,850. Bulls registered another losing session on September 5 closing at $10,564.

The last day of the workweek was quite volatile in terms of trading range as the BTC/USD pair was moving in the $10,958-$10,190 corridors on September 6. Bears were able to push the price below $10,400 but found some resistance around $10,300.

The first day of the weekend came with the first green candle in three days. The price of bitcoin climbed to $10,485, erasing most of the losses from the previous session.

On Sunday, September 8, it was driven back to the $10,400 mark and closed with a loss. The coin was 5.6 percent up for the week.

Japanese-based mobile applications and messaging company Line received a license to operate a cryptocurrency exchange in the country through its crypto-focused subsidiary LVC Corporation. As per the official announcement, the company has become a registered cryptocurrency exchanger under Japan’s Payment Services Act and will introduce digital assets trading to its 80 million users through the “BITMAX” platform. Supported crypto pairs and services are still to be confirmed.

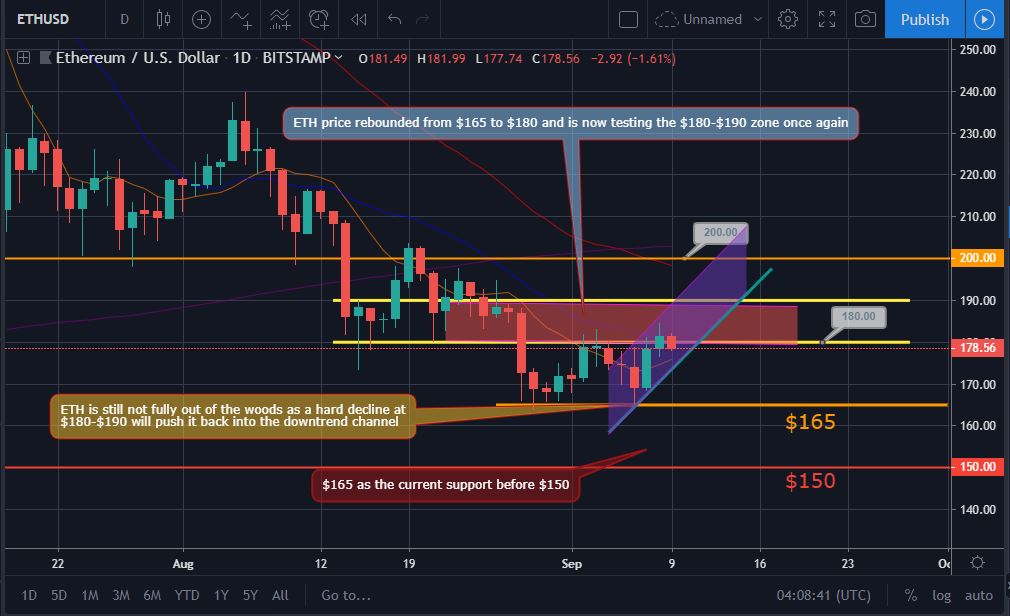

ETH/USD

The Ethereum Project token ETH lost 20 percent value during August and continued its freefall on the first day of the new month. The ETH/USD pair moved down to $171 and closed trading day on Sunday, September 1 with 8.3 percent loss for the seven-day period.

The ether was in a minor uptrend since it found support at $165 on August 29. On Monday, September 2, it finally managed to form a solid green candle on the daily chart. The coin added 4.6 percent to its value and closed at $178. We were once again close to the important trading zone at $180-$190. ETH/USD was stuck in this corridor for exactly two weeks before breaking its lower limit on August 28.

On September 3, the pair continued its good performance and even though it was flat for the day, it peaked at $183 during intraday suggesting increased bull pressure.

The mid-week session proofed to be a lot different as the ether lost 2.2 percent of its value and dropped to $174 after it failed to close above the important level at $180. It remained relatively flat on September 5, trading in the $177-$169 range.

On Friday, September 6, the ETH/USD pair moved South to $169 after touching the major support level at $165 during the day.

The weekend of September 7-8, started with a 5.3 percent increase on Saturday as the popular altcoin climbed back to $178. It continued performing well on Sunday and found itself above the $180 mark, closing at $182, 4 percent up for the week.

XRP/USD

The Ripple company token XRP ended the month of August with a 19 percent loss and dropped even further on September 1, after bulls were again rejected at $0.26. The XRP closed the previous week with a 5.3 percent loss.

The ripple pair against the US dollar opened the new trading period by regaining its position above $0.26. The coin closed at $0.261 and the move was followed by a jump to $0.263 on September 3. The “ripple” once again touched the upper side of the downtrend channel without being able to break it.

On Wednesday, September 4 it dropped down to $0.258 after moving below the short-term uptrend line we drew last week. This suggested increasing bear pressure and lack of momentum from buyers.

The September 5 session was no different as the coin lost more ground and stopped at $0.256.

The XRP/USD pair formed a third consecutive red candle on the daily chart extending its losing streak on September 6. It closed the workweek at $0.251.

On the first day of the weekend, the XRP followed the general crypto market trend and added 3.5 percent to its value by climbing back to $0.26. During the last day of the week, the coin confirmed its presence above the mentioned mark and closed at $0.262 with 1 percent of increase for the week.

Altcoin of the Week

Our Altcoin of the week is Cosmos (ATOM). The decentralized network of blockchains, which allows them to interoperate with each other is 26 percent up for the last seven days. The coin moved up to #23 in the Top 100 list and now has a market capitalization of approximately $624 million.

The so called Internet of Blockchains announced on September 6 a new product called Keystation, which provides end users with an alternative way to access Cosmos wallets, decentralized exchanges and applications. Developed by Cosmostation (staking service and decentralized mobile wallet provider for Tendermint-based chains), Keystation is an “end-to-end encrypted key manager for decentralized applications and networks built with the Cosmos SDK” as per the official blog post.

The ATOM peaked at $2.61 on Sunday, September 8 and is currently trading at $0.000246 against BTC on the Huobi chart.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4