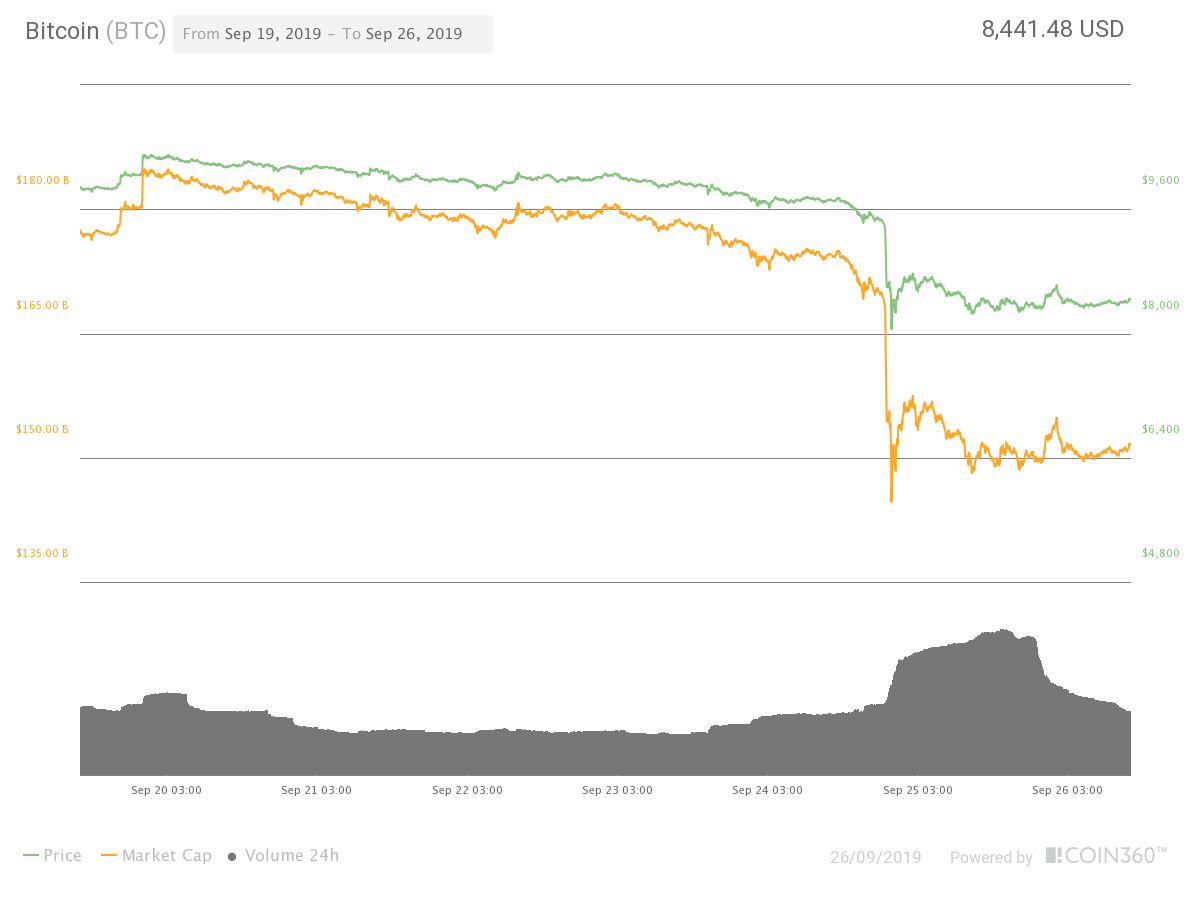

Bitcoin (BTC) lingered around $8,400 on Sept. 26 as relative stability returned to markets after their tumultuous fall earlier in the week.

Cryptocurrency market daily overview. Source: Coin360

Bitcoin price ponders resistance at $8.5K

Data from Coin360 showed sideways behavior for BTC/USD on Thursday, with only a brief move to $8,600 disrupting the trend.

24-hour lows for the pair currently sit around $4,235, while overall, markets remained 15% down versus their levels before the drop on Tuesday.

Bitcoin seven-day price chart. Source: Coin360

As Cointelegraph reported, attitudes about Bitcoin’s health vary. Some argue the largest cryptocurrency is on track beyond the short term, with the stock-to-flow metric in particular remaining bullish.

Others are slightly more nervous. In his latest social media update, regular analyst and Cointelegraph contributor Michaël van de Poppe said that while markets looked sturdy, Bitcoin needed to close above $8,800 to cement more positive sentiment.

“So far, the 200 Moving Average on the daily and this block is holding. That’s a good sign,” he wrote.

He continued:

“Altcoins / BTC pairs are also doing fine. That’s also a good sign. Now we need to break above $8,800.”

Zooming out further also gives cause for relief, the analyst highlighting Bakkt’s launch and Germany’s second-largest exchange launching Bitcoin spot trading as reasons not to be bearish.

As Cointelegraph noted, suspicions remain around the impact of futures settlements on Bitcoin price. New research published just before the dip warned that on average, 75% of futures settlement dates for CME Group alone coincided with market drops.

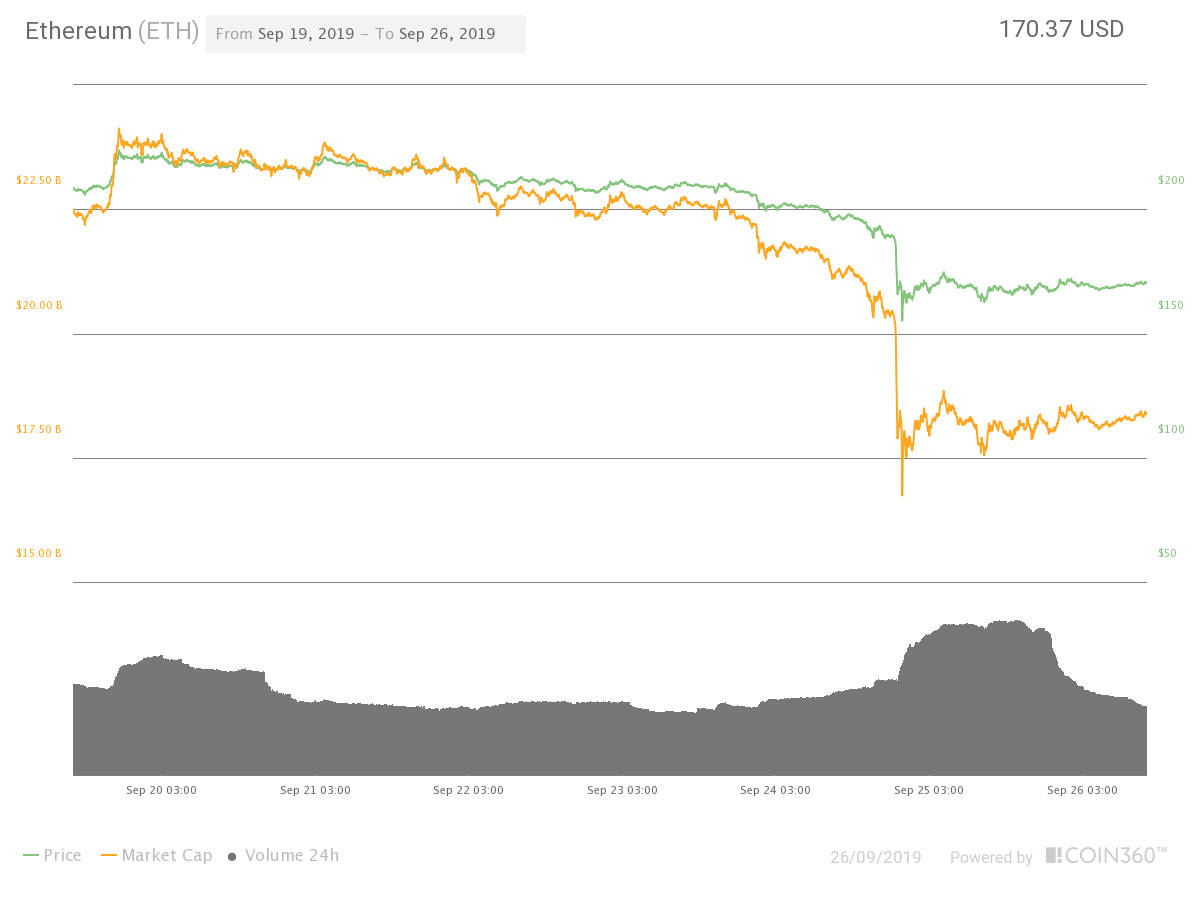

Stellar heads day of relief for altcoins

Altcoins produced unlikely gains on Thursday as Bitcoin stabilized. The market flashed green over the past 24 hours, with major tokens mostly putting in gains of between 1% and 6%.

Ether (ETH), the largest altcoin by market cap, grew 1.7% to hit just over $170. The outright winning bet on the day, however, was Stellar (XLM), which increased by 13.2%.

Ether seven-day price chart. Source: Coin360

The overall cryptocurrency market cap thus also expanded by $2 billion to $223 billion, with Bitcoin’s share at 68.3% of the total.