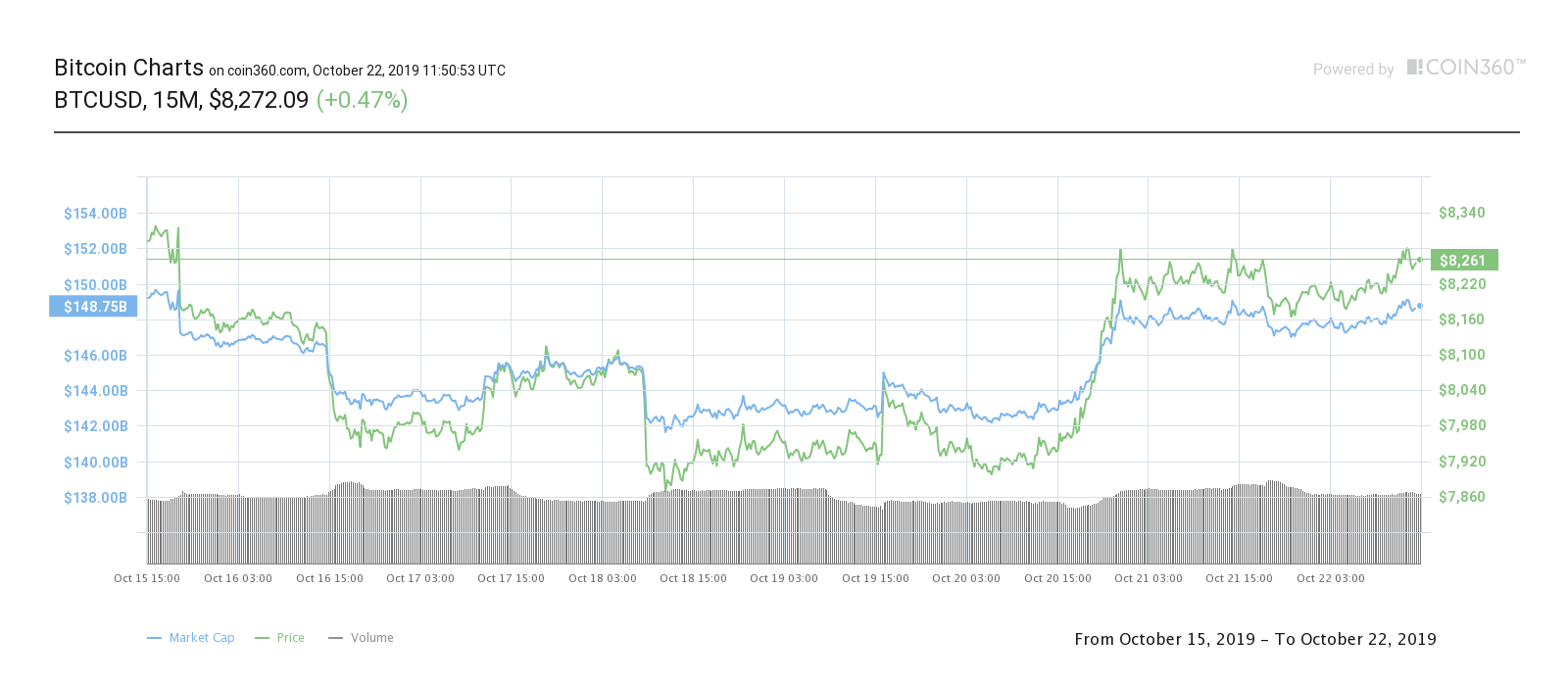

Bitcoin price (BTC) continued its rangebound trading on Oct. 22 after failing to crack resistance at $8,300.

Cryptocurrency market daily overview. Source: Coin360

Bitcoin shows little sign of major shift

Data from Coin360 showed broadly sideways activity for BTC/USD on Tuesday, with 24-hour figures between $8,160 and $8,290.

After two attempts to grind higher, the pair saw rejection at $8,300, in line with projections from analysts who previously identified heavy resistance close to $8,500.

Bitcoin seven-day price chart. Source: Coin360

Bitcoin has remained quiet since the start of the weekend, when markets managed to exit the $7,000 range and stay higher since.

The short-term outlook nonetheless contains few surprises, Cointelegraph contributors agreed, with Michaël van der Poppe not expecting significant shifts as the week progresses.

“To me it looks like an inside day in which we’re stuck between two levels (on the upper side; $8,300 and on the downside $8,170) without making a clear decision yet,” he said in private comments.

He continued:

“If either way we crack one of the levels, a volatile move should occur of a few hundred dollars. On the upside, if we clear $8,300 I wouldn’t be surprised with a push towards $8,500-8,600, however if we break the lower floor, a retest of $8,000 is quite likely to occur.”

As Cointelegraph reported, while price volatility has lessened, investor interest is still evolving. Institutional money continues to pour in, with long positions on Bitcoin futures contracts more than doubling in October.

Altcoins bide their time

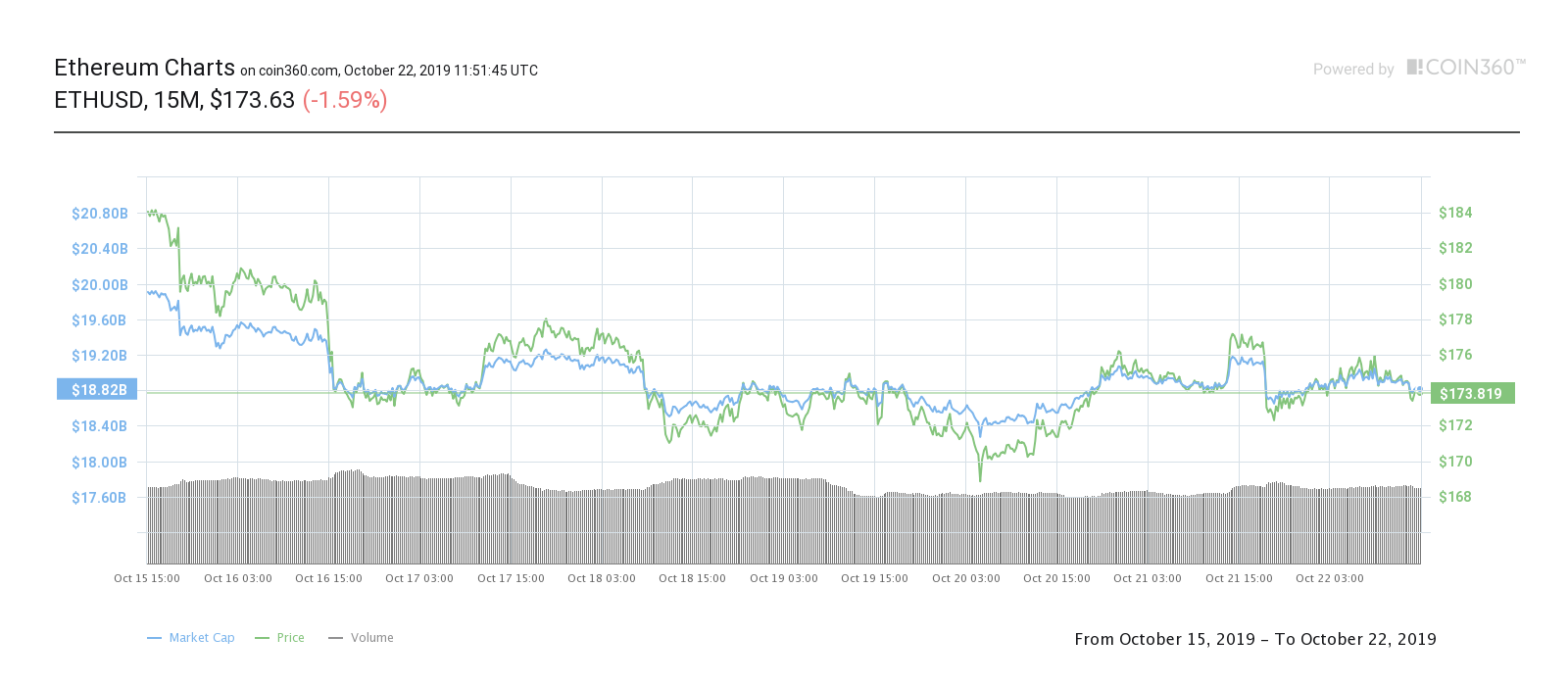

Altcoins meanwhile showed slightly more movement. While no token saw significant shifts, the top ten by market cap typically moved up and down by around 2%.

Ether (ETH), the largest altcoin, traded down 1.5% at $174. By contrast, it was XRP that delivered daily gains, this time of 1.3% to reach just below $0.30.

Ether seven-day price chart. Source: Coin360

The overall cryptocurrency market cap was $224 billion at press time, with Bitcoin’s share at 66.5%.