While Bitcoin looks weak, select altcoins are showing resilience and this can shift the focus from Bitcoin to altcoins.

Since the Great Recession, the health of the global financial system has only deteriorated. Corrupt leadership, worsening standards of living and several other problems have sparked unrest in a number of countries. The latest country to see unrest is Iran. Recently protestors set several buildings on fire and one among them was a branch of Iran’s central bank in Behbahan, a city located in the southwestern region of the country.

Such events underline the importance of cryptocurrencies because crypto is the only asset class which cannot be controlled or manipulated by leaders and regulators. Though many suggest that gold can also work as a safe haven during such situations, history shows that governments tend to put capital controls on gold as well. So, that leaves cryptocurrencies as the only alternative.

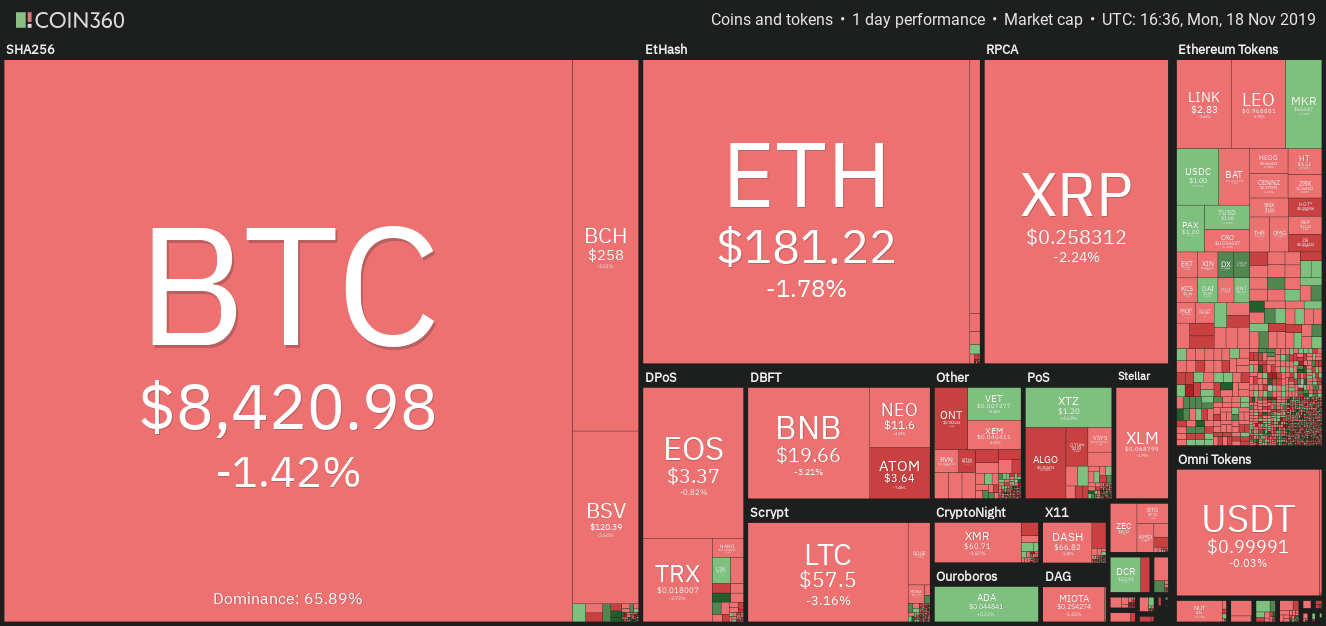

Daily cryptocurrency market performance. Source: Coin360

While many analysts are certain that digital asset valuations will increase over the long-term, the short-term price action paints a different picture. Bitcoin has been gradually declining, which has also pulled altcoins also lower.

However, an interesting development is that a few altcoins are attempting to form a bottom. Let’s have a look at the charts to determine which are moving higher and what are the critical levels to watch out for?

BTC/USD

Bitcoin (BTC) has been trading below the 50-day SMA for the past two days. This is a negative sign and it shows that there is no urgency among the bulls to buy even at these levels. The 20-day EMA has started to turn down and the relative strength index (RSI) has dipped into negative territory, which suggests that bears have the upper hand.

A decisive breakdown below the 61.8% Fibonacci retracement level of $8,467.54 is likely to attract further selling that can drag the price to $7,952.84.

Conversely, if the BTC/USD pair bounces off the current levels and breaks out of the downtrend line, it will signal that the current fall was a bear trap. We anticipate the pair to start a new uptrend above the downtrend line. Therefore, we will wait for the price to breakout and close (UTC time) above the downtrend line before turning positive.

ETH/USD

While several cryptocurrencies are breaking below their support levels, Ether (ETH) remains stable. This is a positive sign as it shows that the bulls are not hurrying to close their positions. Both moving averages are flat and the RSI is close to the center, which indicates that the range-bound action might continue for a few more days.

Longer the consolidation, stronger will be the eventual breakout or breakdown from it. We anticipate the next move to be a strong one.

If the price breaks out of the overhead resistance at $197.75, a rally to $235.70 will be on the cards. On the other hand, if the bears sink the price below $173.841, a retest of $161.056 to $151.829 support zone is likely. The downtrend will resume on a break below this zone. Therefore, traders can continue to hold their long positions with stops at $150.

XRP/USD

The attempt to pullback on Nov. 15 did not find buyers at higher levels. As a result, XRP has resumed its journey towards the next support at $0.24508. The moving averages have completed a bearish crossover and the RSI continues to trade in the negative zone, which shows that bears are firmly in command.

A break below $0.24508 will be a huge negative that can drag the price to the next support at $0.22. Hence, traders can retain a stop loss on the long positions at $0.24.

Conversely, if the XRP/USD pair bounces off the support at $0.24508, the bulls will try to push it above the moving averages. If successful, it will remain range-bound between $0.24508 and $0.31491 for the next few days.

BCH/USD

Bitcoin Cash (BCH) has been trading below the 20-day EMA and the previous support turned resistance of $269.10 for the past two days. The attempt by the bulls to scale above this resistance failed on Nov. 17. This shows a lack of demand at higher levels.

The next support on the downside is at the 50-day SMA and below it $241.85. We anticipate the bulls to defend this level aggressively. If this support holds, the bulls will again attempt to carry the BCH/USD pair above the overhead resistance at $269.10.

Conversely, if the support at $241.85 breaks down, the pair might slip to the next support at $203.36. We will wait for the price to signal a turn around before recommending a long position once again.

LTC/USD

Litecoin (LTC) has been stuck between its moving averages for the past three days. This tight range trading shows that both bulls and bears are playing it safe and are not taking any directional bets.

Above the 20-day EMA, the LTC/USD pair will again hit a wall in the $62.0764 to $66.1486 resistance zone. The pair will pick up momentum on a breakout of $66.1486

Conversely, if the bears sink the price below the 50-day SMA, a drop to the $50 – $47.1851 support zone is possible. If this zone breaks down, the downtrend will resume. Therefore, traders can retain the stop loss on the long positions at $47.

EOS/USD

EOS has been trading close to the critical support at $3.37 for the past few days. Though the price dipped below the support on Nov. 15, the bears could not capitalize on it. This shows buying at lower levels.

Both the moving averages are flat and the RSI is just above the midpoint, which suggests a balance between both bulls and bears.

The balance will tilt in favor of the bulls if the EOS/USD pair climbs above $3.69 and the downtrend line. Alternatively, the bears will have the upper hand if the price sustains below $3.37. For now, the traders can keep the stop loss on the long positions at $2.95.

BNB/USD

The failure of the bulls to defend the 20-day EMA is a bearish sign. Binance Coin (BNB) can now dip to the 50-day SMA, which is just above the uptrend line and the horizontal support at $18.30.

We expect the bulls to defend this support aggressively. If the altcoin bounces off this support, the bulls will again try to propel the price above the overhead resistance of $21.2378.

Conversely, if the bears sink the BNB/USD pair below the uptrend line, a drop to the next support at $16.50 is possible. If this support also breaks down, a decline to $14.2555 is likely. For now, traders can protect their long positions with stops at $16. We could suggest closing the position if the pair dips below $18.30.

BSV/USD

Bitcoin SV (BSV) has been trading below the 20-day EMA for the past three days but the bears have not been able to break below the descending channel. The bulls are attempting to provide some support close to $120 levels. The 20-day EMA is flat and the RSI is just below the 50 level, which suggests a range-bound action for a few more days.

If the bulls can push the price above the 20-day EMA, a retest of the resistance line of the descending channel is likely. A breakout of the channel will be the first indication that bulls are back in command.

Conversely, if the BSV/USD pair slides below the minor support at $120, a dip to $107 is possible. We will wait for a new buy setup to form before proposing a trade in it.

XLM/USD

Stellar (XLM) has broken below a slew of support levels, which is a bearish sign. It shows that sellers are dominating the proceedings. The next stop is likely to be the 50-day SMA, which is located just below the horizontal support of $0.067457. If this support also fails to hold, a drop to $0.062122 and below it to $0.056 is possible.

However, if the XLM/USD pair finds support close to the 50-day SMA, the bulls will again attempt to climb above the support turned resistance of $0.072545. The flattish 20-day EMA and the RSI just below the 50 suggests further range-bound action for a few days. We will wait for the pair to signal a reversal before recommending a trade in it.

TRX/USD

After trading close to the critical support at $0.018660 for the past two days, Tron (TRX) has resumed its decline. Its next stop is likely to be the 50-day SMA. If the 50-day SMA holds, we might see another attempt by the bulls to make a recovery above $0.018660.

However, if the 50-day SMA breaks, the TRX/USD pair can plummet to the next support at $0.0136655. Such a move will be a huge negative and will weaken sentiment further. Therefore, we will wait for the price to signal a turn around before suggesting a trade in it.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.