- Mainstream media is out spreading fear, uncertainty, and doubt (FUD) about bitcoin triggered by the recent selloff.

- News outlets miss the fact that bitcoin is an uncorrelated asset.

- The same media companies also ignore bitcoin’s growing use case.

The mainstream financial media is once again feasting on bitcoin’s recent tumble. The number one cryptocurrency dropped to as low as $6,515 on Monday for a 23% dump in one week. The sudden selloff is giving mainstream news outlets ammunition to blast the top cryptocurrency to smithereens.

For instance, Forbes was quick to capitalize on bitcoin’s latest misfortunes. The business publication garnered over 200,000 views with a headline screaming that the cryptocurrency is down because “You Don’t Need It.” The writer argued that for bitcoin to succeed, central banks, equity markets, and gold must fail. This shows the writer’s total lack of understanding of how the cryptocurrency works.

Thus, I thought it would be best for mainstream media (MSM) to learn more about the number one cryptocurrency. Here are three key ideas that the MSM is missing about bitcoin.

First, bitcoin is an asset that is not correlated to any other existing assets such as stocks and gold. There’s literature to support this statement.

A CoinMetrics report revealed bitcoin is largely uncorrelated to the S&P 500. Over a five-year period, there were stretches when the two asset classes seemed correlated but not enough to suggest meaningful correlation. Keep in mind, a value of one indicates perfect correlation while a number below zero reveals negative correlation.

In addition, gold and bitcoin appear to have a positive correlation over the last few years. But the correlation is low and doesn’t appear to be significant.

Overall, bitcoin seems uncorrelated to both the stock market and gold. That means if the stock market crashes or if gold suddenly tanked, bitcoin’s price would be largely unaffected. The same is true if stocks or gold skyrocketed. That’s how uncorrelated assets work.

Bitcoin will dance to its own tune regardless of how other markets perform.

2. Bitcoin Does Not Respond to Central Bank Policies

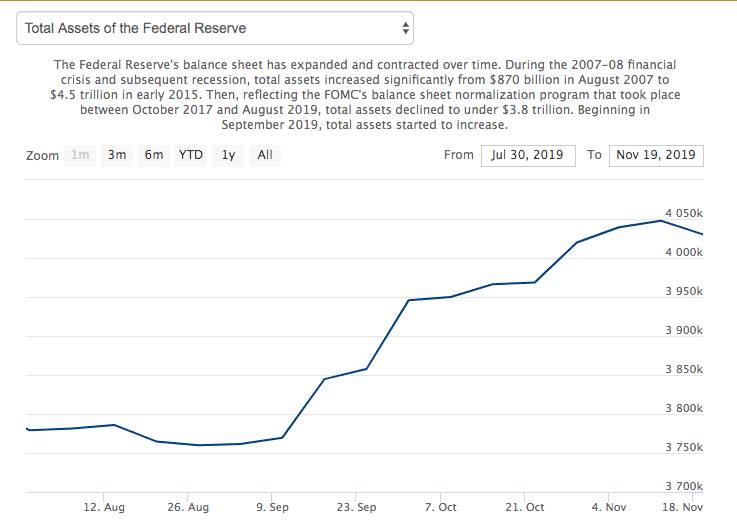

Financial mainstream media also believe that the decisions made by the Federal Reserve have an impact on the top cryptocurrency. For instance, rate cuts and the resumption of large scale buying of Treasury notes (not QE) are seen as bitcoin rocket fuel. The argument is that the cryptocurrency is a hedge against the new paradigm adopted by central banks.

Nothing could be further from the truth.

Over the last few months, the Fed has cut interest rates three times. On top of that, the central bank also began expanding its balance sheet. In the months that the Fed rolled out these new policies, bitcoin dumped by over 33%. The plunge tells us that bitcoin isn’t influenced by the Fed, at least in the way painted by mainstream media.

3. Bitcoin’s Payment Settlement Is Light Years Ahead of Traditional Methods

When the mainstream media covers bitcoin, it is mostly about the cryptocurrency’s price and volatility. In recent days, news articles about the top cryptocurrency’s fall have flooded the internet. Little to no attention was given to the digital asset’s impressive use case.

For instance, on Monday, a whale transferred about 44,000 BTC worth $310 million to another wallet. The transaction fee was an astounding $0.32.

If you use traditional methods such as Western Union to wire $310 million, you’d have to shell out over $6 million. This is the kind of development that can help people save money but mainstream outlets would rather spread FUD about the top cryptocurrency.

Disclaimer: The above should not be considered trading advice from CCN. The writer owns bitcoin and other cryptocurrencies. He holds investment positions in the coins but does not engage in short-term or day-trading.

This article was edited by Sam Bourgi.