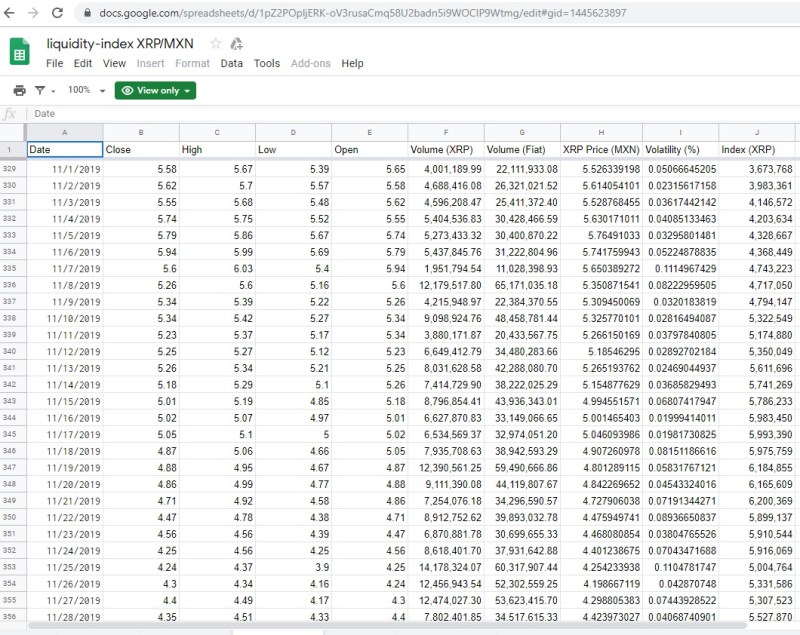

After a record-breaking October, the XRP Ledger continues to grow in real-world usage and utility ending November with $100 million in ODL transactions.

Although XRP price remains unaffected by the growing spike in utility growth, it shows the financial world it works, it is fast, secure and far, far cheaper.

These transactions are over the Moneygram MXN/USD corridor, the perfect testing platform before XRP is adopted by the entire global financial system.

I agree with you, I think there are too many. There are around 3,000 different digital assets that trade on a daily basis now. I think anytime there’s a new market, there are a lot of people who run into that market to show that they can solve a problem and deliver customer needs. I have said publicly before that I think 99 percent of all crypto probably goes to zero, but there is that one percent that I think is focused on solving a real problem for real customers and is able to do that at scale. It’s the reason why Ripple has been focused on a specific customer, a specific problem, and we’ve been fortunate to build a lot of momentum with that customer set

According to AMB Crypto, transactions over the XRPL have tripled during the current quarter with 20 days still remaining of the current fiscal period.

October saw more transactions than the entirety of 2018 according to Brad Garlinghouse with a final figure of over $33 million in ODl transactions.

Expect this utility to grow exponentially over the course of 2020 as mass adoption reaches the event horizon, once this train hits fifth gear it will stop for no one.

RippleNet did more in transactions in October, than in all of 2018. the more customers you have on the network, the more value in joining the network. And we certainly expect to continue to see that momentum build as we bring all of our customers together and they get introduced to each other. We expect more corridors to go live and continue to fuel that volume growth

Quantitative uneasiness grows as fast as the national debt with Secretary Mnuchin in the hot seat over the economy and the coming digitization of banking.

He faced a grilling from Congress on many matters of which Mnuchin responded intelligently and seemingly well informed it has to be said.

On the subject of the world-changing financial events that are just over the chronological horizon, Mnuchin seemed to allude to a system extremely similar to the XRPL.

Mr Foster and I have had a lot of conversations on digital currencies, Jay Powell just answered our letter on the idea of a digital token. I think the concept is a little misunderstood. If we want a digital future in finance and we want to protect the pre-eminence of the dollar as global reserve currency this idea of a digital token is an important concept.

Its not anything but a window for the government to facilitate a block chain transaction process legally in the future, we have Visa, we have Swift… all have private interests and investors. This idea that there is a new level, a blockchain level that both banks and non banks can participate in, to settle transactions with a bridge token, it is coming our way faster than the five year time frame that you outlined

Congressmen Hill 1.33.00 On footage below

Secretary Mnuchin was then grilled rather bluntly by Congressman Heck and quite rightfully so in our opinion with the seemingly limitless FED QE of recent months.

When faced with capital spending graphs showing rampant QE which is not actually QE at all according to the FED, Mnuchin was rather dismissive and evasive.

The problem is that downward arrow, we were promised an upward arror and we haven’t got one. Do you see that downward spiral? Thats not good sir thats business investment, some people use the addage that many use figures like a drunk uses a lampost to lean on not to illuminate. Six consecutive quarters we have seen decline.

If you would let me respond instead of screaming at me – Mnuchin

Oh no sir if I’m screaming at you you, you will know it, this is not screaming… Heck

1.46.30 On video

While not explicitly mentioned, the asset congressman Hill is speaking about fits XRP rather snugly.

Massive thanks to @aydentrading for his coverage of the hearing which showed that a coming recession and digital transformation are on the horizon.

Last but by no means least, we finish off with this little speculatory gem from XRP news legends @xrp_stuart and @LeoHadjiloizou who found the interview below.

Sagar Sarbhai was speaking at the Milken Institute Asia summit about some very high profile banks and their love for XRP, connect the dots…

These 12 banks used XRP for 6 months. Barclays, BMO, CIBC, Intesa Sanpaolo, Macquarie Group, National Australia Bank, Natixis, Nordea, Royal Bank of Canada, Santander, Scotiabank,Westpac They said look “it works beautifully”

These 12 banks used #XRP for 6 months in 2016.

Barclays, BMO, CIBC, Intesa Sanpaolo, Macquarie Group, National Australia Bank, Natixis, Nordea, Royal Bank of Canada, Santander, Scotiabank,Westpac

They said look “it works beautifully” @LeoHadjiloizou –https://t.co/ql0pW6CNdE pic.twitter.com/qiqlFZ3PPg

— ༜༝🅂🅃🅄🄰🅁🅃🅇🅁🄿💧⚡ (@xrp_stuart) December 8, 2019