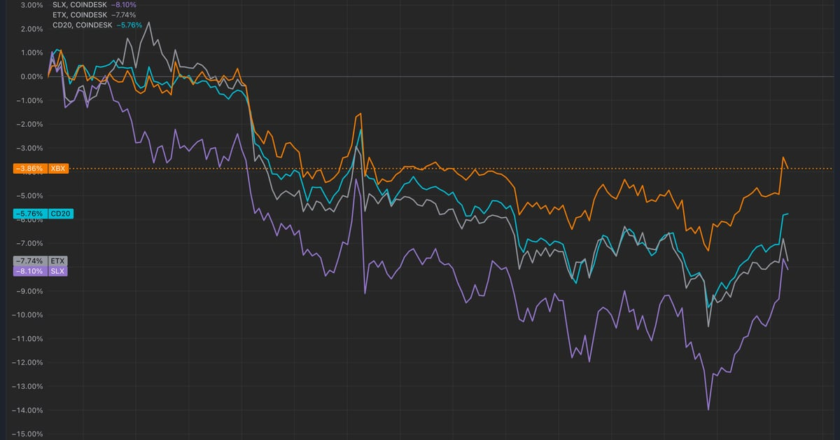

Bitcoin Price Key Highlights

- Bitcoin price appears to be closing above the top of its symmetrical triangle pattern to show that bulls are gaining the upper hand.

- If so, this could lead to a rally that’s roughly the same height as the formation, which spans $6,000 to $10,000.

- Technical indicators are giving mixed signals, although there seem to be signs of slowing bearish pressure.

Bitcoin could be breaking above the top of its symmetrical triangle to signal that a longer-term climb is underway.

Technical Indicators Signals

The 100 SMA is below the longer-term 200 SMA to confirm that the path of least resistance is to the downside. In other words, there might still be a chance that this is a fake out and that the selloff could resume. Price has yet to test and break past the 100 SMA dynamic inflection point but when it does, more bulls could join in and push for a test of the 200 SMA next.

Stochastic is slowly heading lower after recently hitting overbought levels. This signals that sellers still have some energy left in them before oversold conditions are seen. RSI is still cruising sideways to reflect consolidation action and has yet to catch up to the recent upside move.

BTCUSD Chart from TradingView

Bitcoin price drew support from the WTO report highlighting the role of cryptocurrencies in disrupting the global financial industry. It indicated:

“Much of the excitement about blockchain technology has been centred on public permissionless blockchains used for cryptocurrencies. However, the potential use of blockchain technology extends to many other applications, from banking and finance to land registration, online voting, and even supply chain integration…”

In particular, it lauded bitcoin and ethereum for being pioneers in this space that is resilient to cyber-attacks. However, it did note that scalability is still an issue for many of these.