Bitcoin (BTC) traded broadly sideways on the first day of the 2020s as consensus swirled ever stronger around a Q1 breakout.

Cryptocurrency market daily overview. Source: Coin360

BTC in line for uninspiring January

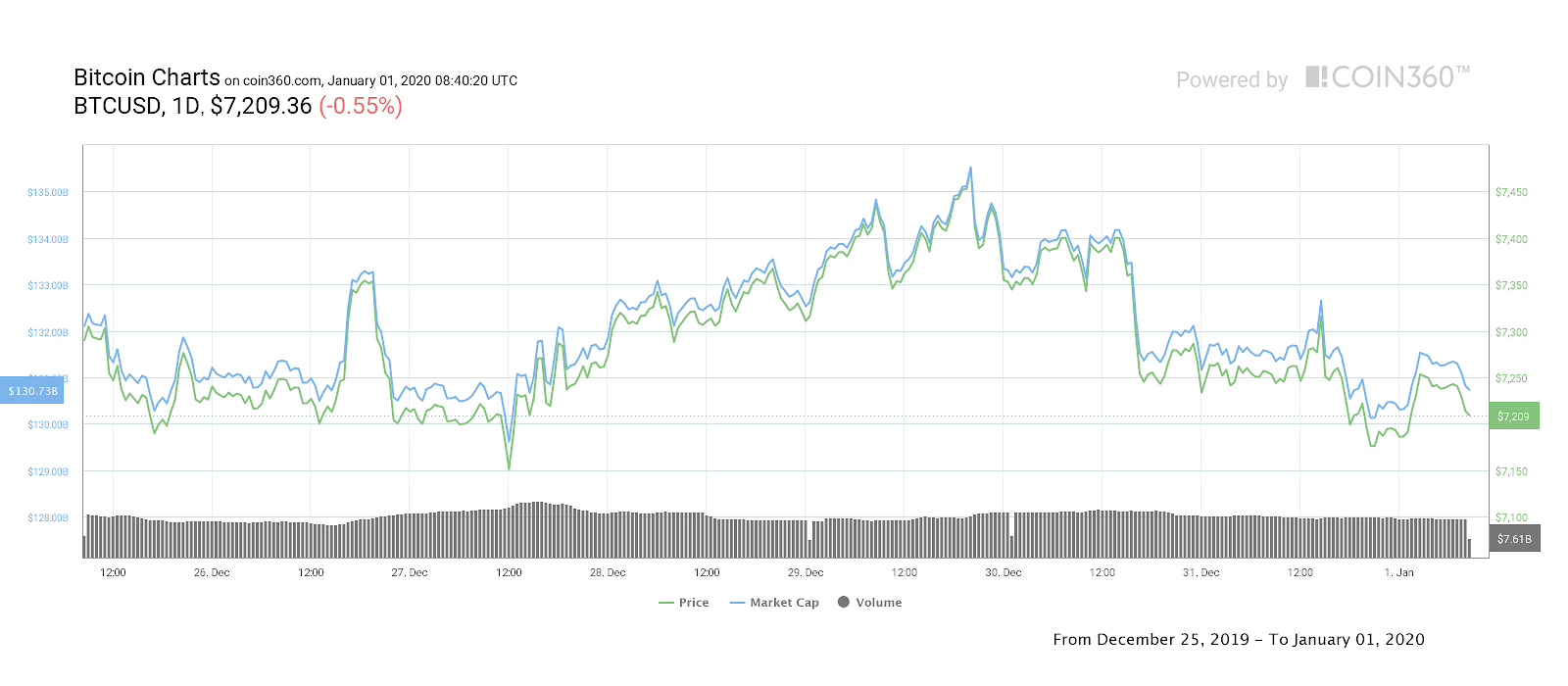

Data from Coin360 and Cointelegraph Markets showed Bitcoin making a decisively calm start to its third decade, with volatility staying away from markets into Wednesday.

At press time, BTC/USD traded at just under $7,200, cementing a week in a narrow corridor between $7,090 and $7,495.

Bitcoin 7-day price chart. Source: Coin360

The slow yet choppy conditions follow a sudden breakdown in the third week of December, which saw the pair dip to its lowest levels in over seven months — around $6,460.

Since then, Bitcoin has broadly coalesced around the $7,200 mark, with brief trips higher quickly reversing.

The status quo is likely to continue, analysts say, with the short-term prognosis for BTC/USD showing little signs of starting a new trend.

For regular Cointelegraph contributor Michaël van de Poppe, a turning point could come in February or slightly later.

“Still stuck within this range and I think we’ll stay here for the next month as well,” he summarized in his last Twitter update for 2019.

Van de Poppe continued:

“Probably see a scenario something like this in which we first make a fake-out to either way to trap the market, before the decisive move occurs.”

For fellow contributor filbfilb, however, Bitcoin’s failure to crack resistance at $7,600 suggests a dip back into the $6,000 range. That event, he added in analysis for Cointelegraph on Dec. 30, should nonetheless not involve a lower bottom than that seen in December.

A more uplifting statistic meanwhile focuses on Bitcoin’s previous gains. In the ten years from 2010 to 2020, the largest cryptocurrency delivered 9,000,000% returns to investors.

The impressive statistic came to light during an ongoing Twitter debate among commentators as to whether entrepreneur John McAfee will have to honor his pledge to consume his own penis if BTC/USD fails to reach $1 million by 2021.

For reference, the gap between the current price and the seven-digit target is a comparatively doable 13,800%.

A dedicated countdown tool, candidly titled “Dickening,” is keeping track of the odds.

Altcoins follow static sentiment

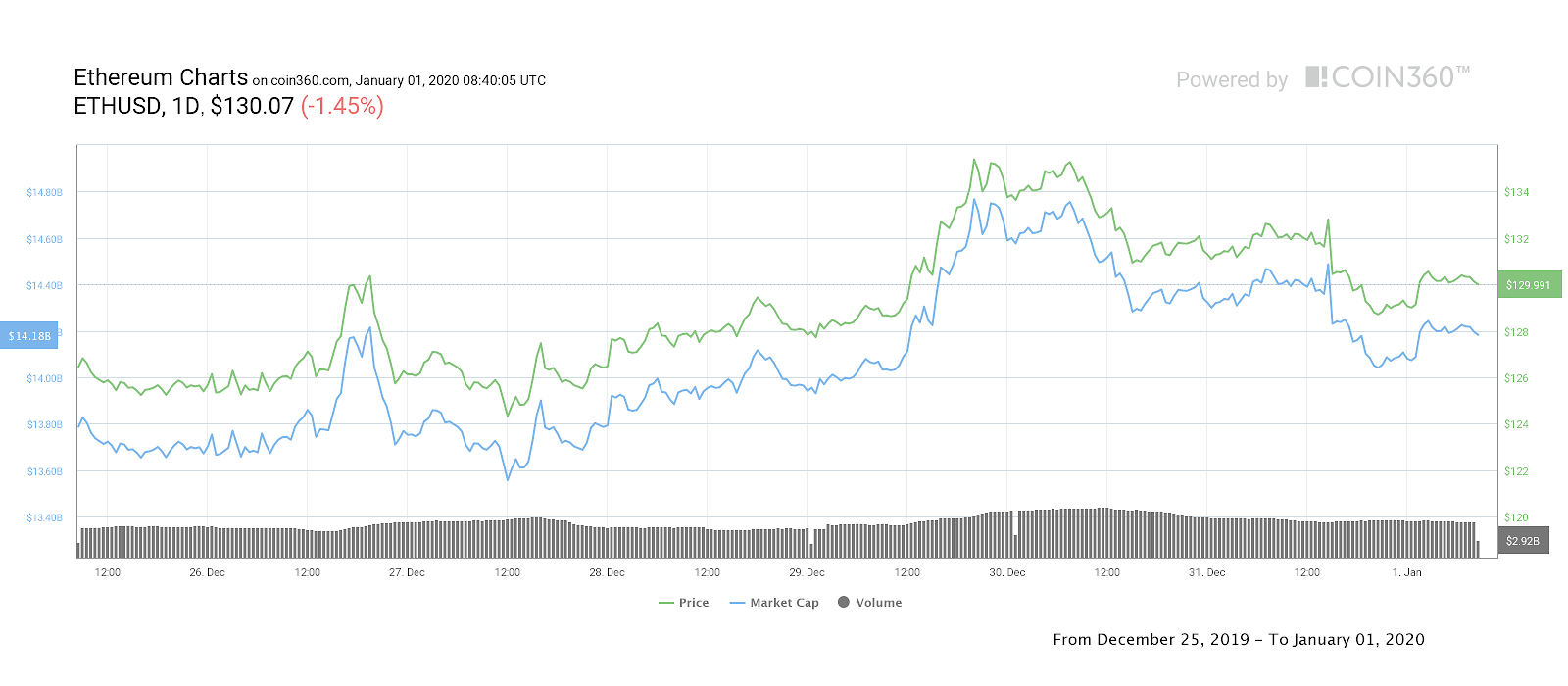

In line with Bitcoin, altcoins saw little change as the new year began, moving up or down by a maximum of around 2%.

Ether (ETH), the largest altcoin by market cap, traded down 1.5% to circle $130.

Ethereum Classic 7-day price chart. Source: Coin360

Others made modest gains — XRP appreciated 1.1% and Bitcoin SV (BSV) 2.5%.

The overall cryptocurrency market cap was $191.2 billion at press time, with Bitcoin’s share at 68.2%.