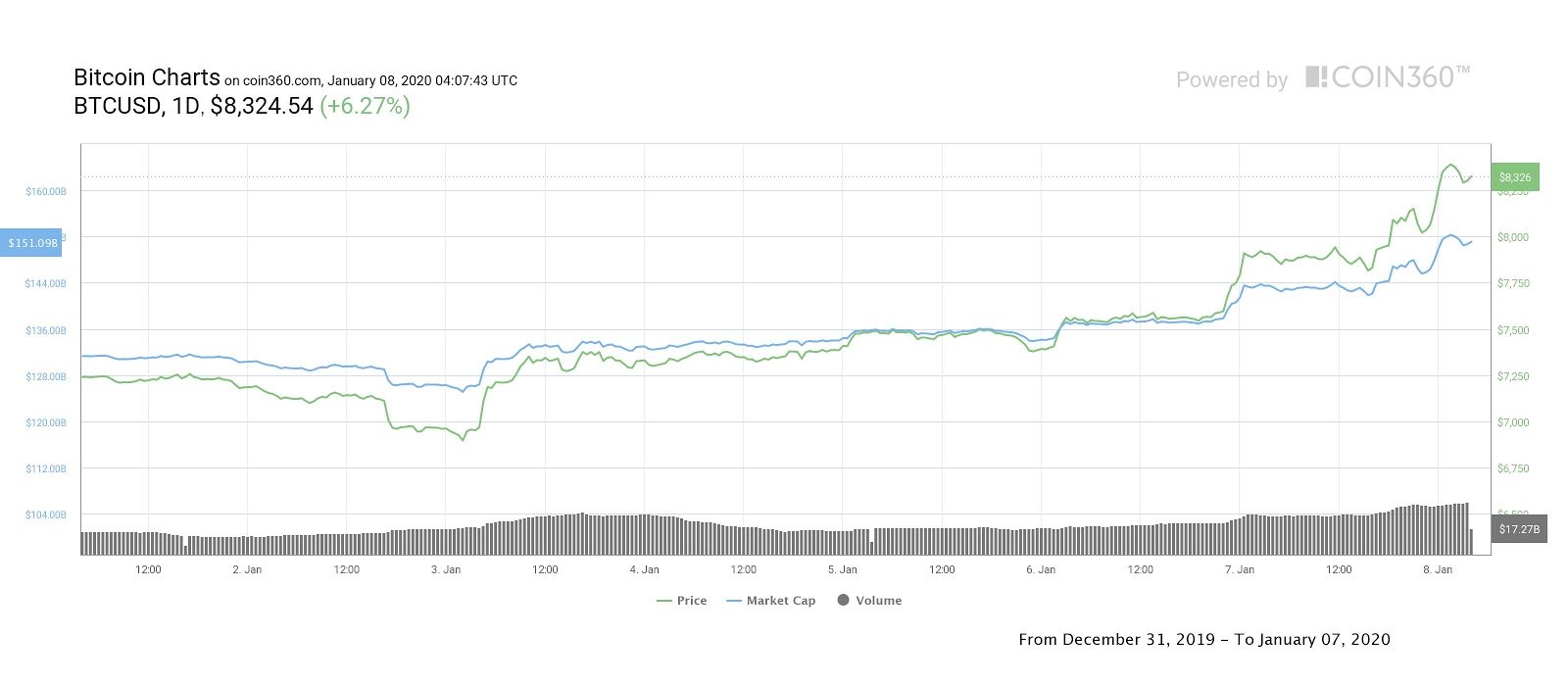

On Tuesday Bitcoin price continued the rally of the previous day by retaking $8,000 then pushing above the 200-day moving average for the first time since November 2019. The strong upside move also brought the digital asset above the long-term descending channel which formed on Jun. 25 and outside of today’s channel breach, Bitcoin had been pinned beneath the trendline since Oct. 26 when Chinese President Xi Jinping called for China to fast track the development and integration of blockchain technology.

Cryptocurrency market weekly overview. Source: Coin360

Many believe Bitcoin’s strong surge from $7,000 to nearly $8,500 has been heavily influenced by the rising tensions between the United States and Iran. In fact, the most recent push above $8,500 occurred as mainstream media reported that Iran had attacked United States troops stationed at two military bases in Iraq.

More than a dozen missiles were fired at both bases and at the time of writing no casualties have been reported. Gold and oil prices also increased sharply, with spot gold price topping a 6-year high at $1,603.21 and gold futures rising 2% to $1,605.80.

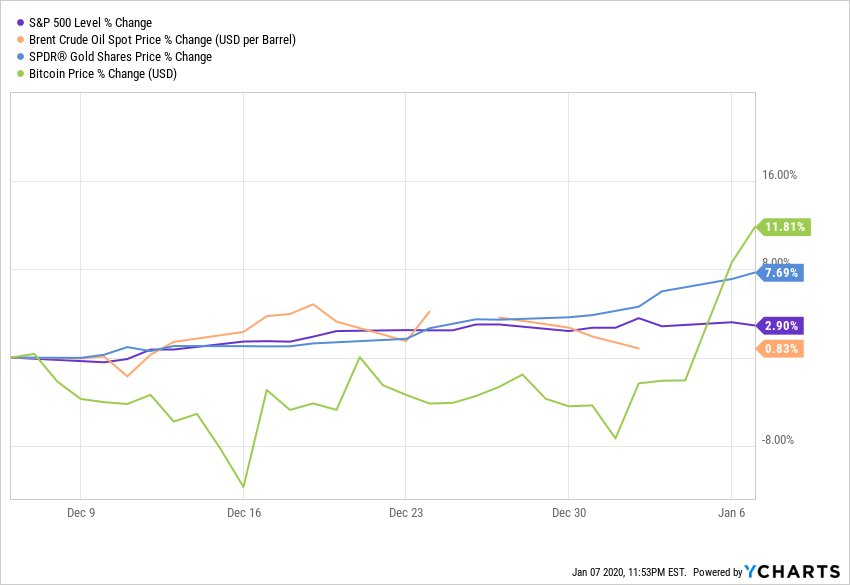

BTC, Gold, Oil and S&P 500 chart. Source: YCharts

Crude oil price also surged 4% with West Texas Intermediate crude futures rallying to $65.65 and Brent crude rising to $71.75 per barrel. As commodities like gold, silver, and oil rallied, the Dow Jones Industrial Average futures dropped by 343 points and the S&P500 and Nasdaq futures also pulled back slightly.

This shows that traders expect that the escalation between the two countries will negatively impact Wednesday’s open in traditional markets.

BTC USD daily chart. Source: TradingView

Bitcoin’s rally alongside assets like oil, gold, and silver is not a surprise to most traders as many believe the digital asset is correlated to the price action of commodities. Since Jan. 6, Bitcoin price has rallied 15% and traders will be closely watching to see if the asset to see if it can hold its recent gains above the 200-DMA and the descending channel.

BTC USD 6-hour chart. Source: TradingView

On the shorter timeframes, the rally is beginning to look a bit over-extended with the 6-hour relative strength index (RSI) punching above overbought territory at 84 and the same could be said for the Stochastic RSI.

One positive is the strong move to $8,470 allowed the price to punch through the $8,100 – $8,300 high volume node of the volume profile visible range (VPVR), so as the price pulls back an encouraging development would be to see $8,300 flip from resistance to a support level.

If the bulls fail to hold $8,300, the price could pullback to $8,150 which is right along the main arm of the descending channel and near the 78.6% Fibonacci retracement level.

Bitcoin weekly price chart. Source: Coin360

The overall cryptocurrency market cap now stands at $217.7 billion and Bitcoin’s dominance rate has risen to 69.1%. Notable gainers amongst altcoins were Litecoin (LTC) with a 4.73% gain and Chainlink (LINK) with 10.04%.