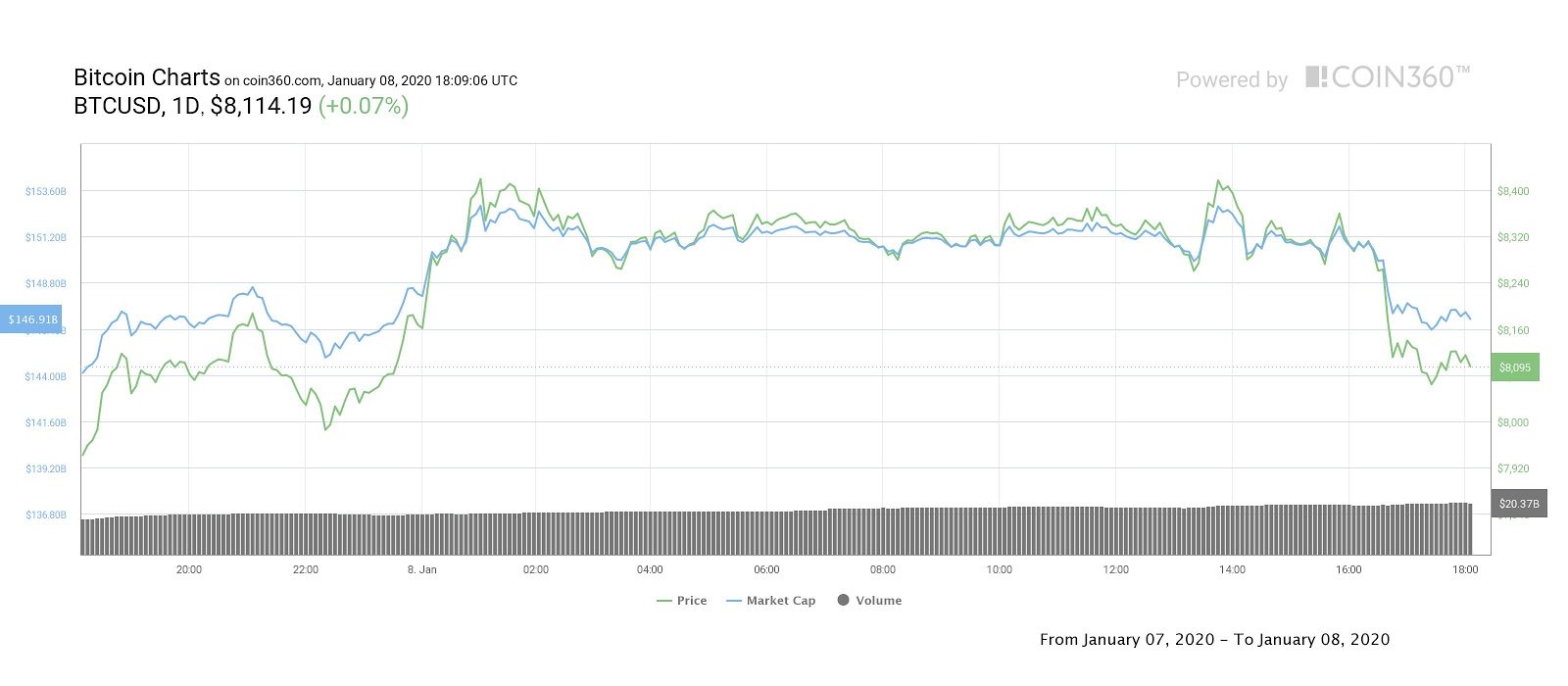

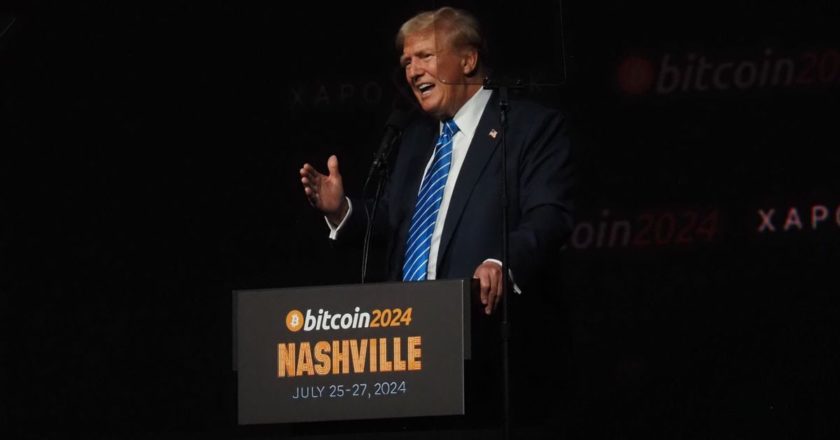

Over the last few hours, the price of Bitcoin (BTC) began to falter at $8,300 and dropped all the way to the support at $8,000 as United States President Donald Trump stated that he would not seek further military action against Iran following Tuesday night’s bombing of two air bases in Iraq.

The 4.82% pullback could show that speculators looking for Bitcoin price to rally higher on what they interpreted an increasing chance of war with Iran decided to either pull their bids or take profit as Bitcoin struggled to hold $8,300.

It should also be noted that since Jan. 6 Bitcoin price has rallied more than 15% for a $1,100 gain so swing and day traders could also be taking profits.

Cryptocurrency market weekly overview. Source: Coin360

BTC USD daily chart. Source: TradingView

Regarding Bitcoin’s immediate price action, there are a few factors to consider. Traders were looking for $8,300 to hold as support after giving was as resistance. It was clear that this would be an area of contention as $8,300 lines up with the main trendline of the long-term descending channel, a point which has been a major zone of resistance for months.

In the event that $8,300 failed to provide support, investors then looked to $8,130 as it is aligned with the 200-day moving average (200 DMA), the 78.6% Fibonacci retracement level and a high volume node on the volume profile visible range (VPVR) indicator.

BTC USD 6-hour chart. Source: TradingView

As this update is being written, Bitcoin’s price continues to pull closer to $8,000 and bulls are attempting to hold the 200-DMA. Aside from President Trump’s relatively tame comments on Iran, the current rally was running out of gas as shown by the overbought position of the relative strength index (RSI) on the 6-hour chart.

Furthermore, the moving average convergence divergence (MACD) indicator also suggests that bulls were running out of steam and the spinning top candlestick following the local high at $8,478 was also a sign that a pullback was in the works.

As it stands now, if $8,000 gives way, traders may target the $7,850 to $7,550 area, which also happens to fall in the 61.8% to 50% Fibonacci retracement zones.

Meanwhile, those who rely on the Bollinger Bands indicator know that Bitcoin price tends to almost predictably bounce between the lower band, middle moving average, and the top band as rallies and corrections occur.

BTC USD 6-hour chart. Source: TradingView

The recent rally to $8,478 brought the price above the upper Bollinger Band and it is customary for the price to drop back to the moving average and hold there before either dipping below the MA to continue toward touching the lower band, or the price rides along the moving average as Bitcoin consolidates and gains momentum to resume the uptrend.

Currently, the Bollinger Band MA is lined up with $7,660 (the 50% Fibonacci retracement) so if the price drops to $7,854 and fails to bounce at the 61.8% Fibonacci retracement, buyers may look to open positions starting at $7,660.

The 1 and 4-hour timeframe show Bitcoin price holding above the 50-MA and it is important for the digital asset to retake $8,116 over the short-term. A 4-hour close above this point would be an encouraging sign and would strengthen the change of bulls looking to have another go at $8,300.

Bitcoin weekly price chart. Source: Coin360

The overall cryptocurrency market cap pulled back slightly to around $214 billion as Bitcoin’s dominance holds at 69.1%. As President Trump spoke, oil prices also dropped with Brent Crude falling 3.7% from a recent high of $71.75 and the S&P 500 rose by 0.7% to reach an intraday high.