Bitcoin (BTC) continued trading in a narrow corridor on Feb. 22 as markets awaited fresh action after last week’s sudden 8% price drop.

Cryptocurrency market daily overview. Source: Coin360

BTC “correcting in an uptrending market”

Data from Coin360 and Cointelegraph Markets showed BTC/USD spending another day in a stable zone between $9,500 and $9,800, having stayed there since Thursday.

Previously, traders had reacted with bewilderment as the pair dumped almost $1,000 in a matter of minutes, firmly rejecting turning $10,500 resistance into support.

Bitcoin 7-day price chart. Source: Coin360

The motives behind the event remain unclear, but market participants are yet to deliver a bearish verdict on Bitcoin overall.

For Cointelegraph Markets analyst Michaël van de Poppe, even fresh losses would not necessarily be a cause for concern.

“…I’m not seeing anything ultra bearish in particular,” he summarized in a tweet on Friday.

“So far: Just a corrective move in an up-trending market. Even $8,800 wouldn’t be that bad.”

As Cointelegraph reported, technical metrics are also fuelling continued optimism among other analysts.

Historically, 2020 remains a record year for volume-weighted average price. On the back of 35% returns year to date, another indicator suggests that Bitcoin is in the middle of a bull cycle which could last as long as 570 more days.

Several prominent figures have delivered highly bullish short-term price forecasts — these include a $27,000 price tag by August from Fundstrat’s Tom Lee. Earlier this week, Max Keiser said he had quadrupled his longer-term price target.

Altcoins pause but gain market share

Altcoins meanwhile put in broadly copycat moves as Bitcoin’s lack of momentum appeared to stifle progress.

Across the top twenty cryptocurrencies by market cap, moves of around 1% characterized markets, only Litecoin (LTC) breaking the trend with 3% 24-hour gains.

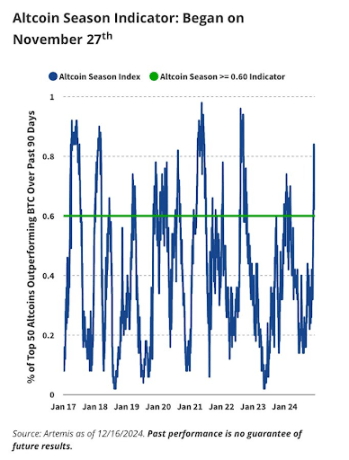

Ether (ETH), the largest altcoin, was stationary compared to Friday and trading at just above $260.

Ether 7-day price chart. Source: Coin360

The overall cryptocurrency market cap was $280 billion at press time, with Bitcoin’s share at 62.7% — its lowest since July 2019.