The cryptocurrency industry has just experienced the most anticipated event, Bitcoin’s (BTC) third halving. The last 12.5 Bitcoin block was mined by F2Pool and encoded the message: “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue,” paying tribute to Satoshi Nakamoto, the token’s creator. Antpool was in luck, mining the first 6.25 Bitcoin block. The first Bitcoin halving happened in Nov. 2012 and was mined by Slushpool, while the second having happened in July 2016 and was mined by F2Pool.

The post-halving will still see a positive adjustment

The market experienced some volatility during the last 60 blocks leading up to the halving, however, the Bitcoin price stayed within the $8,500–$9,000 range for a 24-hour window during the event.

The average block production time was roughly 7.5–8.5 minutes per block 24 hours prior to the halving, and we see an increase in block time post-halving, with an average of 11 minutes per block in the 12 hours following the halving. With the available sample, we can safely conclude that the network has experienced a hash rate decline post-halving, as indicated by longer block production times than the pre-halving average.

According to the Bitcoin difficulty estimator, the current network pace is roughly 53 blocks ahead of schedule. This may be due to miners pushing block production faster in the 24 hours leading up to the halving. With the current estimate, the next difficulty change will happen in roughly six days, with an upward adjustment of 4%–5%. However, the block production time could shift significantly within six days as miners try to adjust their operations.

Slight uptick of transaction fees to subsidize miners’ revenue around the 2020 halving

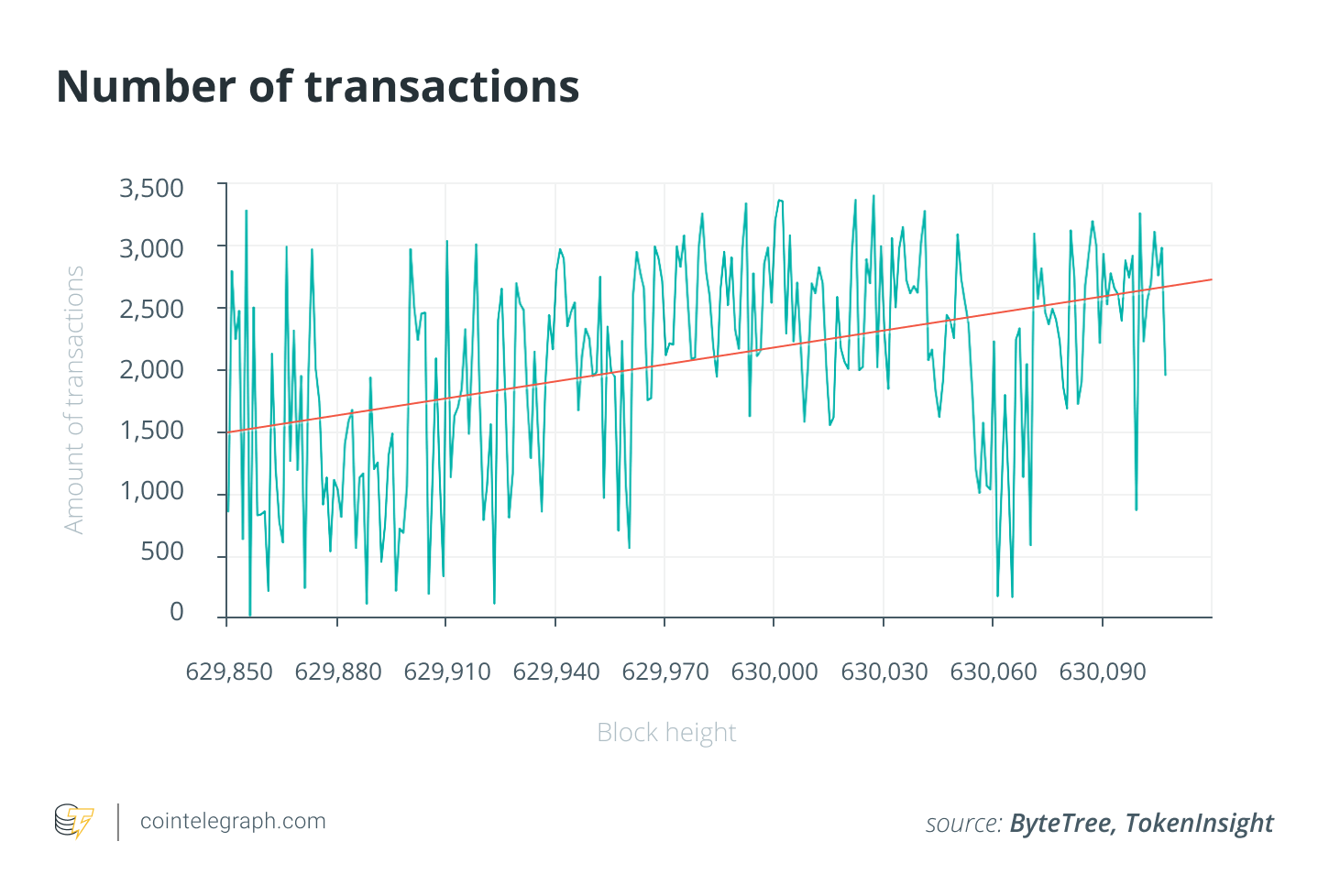

A number of transactions were consistently showing an upward trend in the 24 hours leading up to the halving, with an average of 1,959 transactions contained per block.

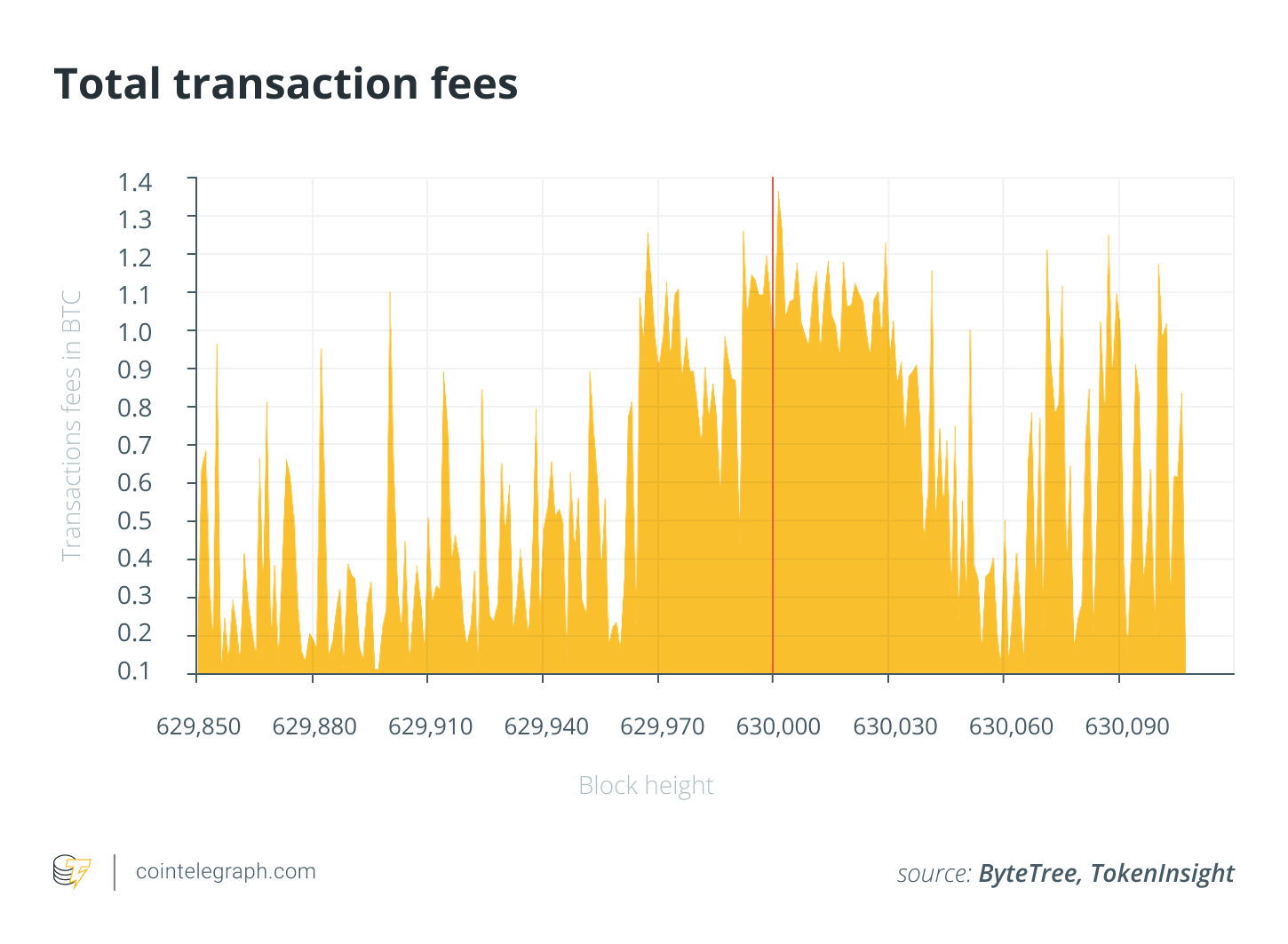

Total transaction fees roughly doubled around the halving from a fraction of a Bitcoin to more than one Bitcoin, and eventually dropped back to the pre-halving level.

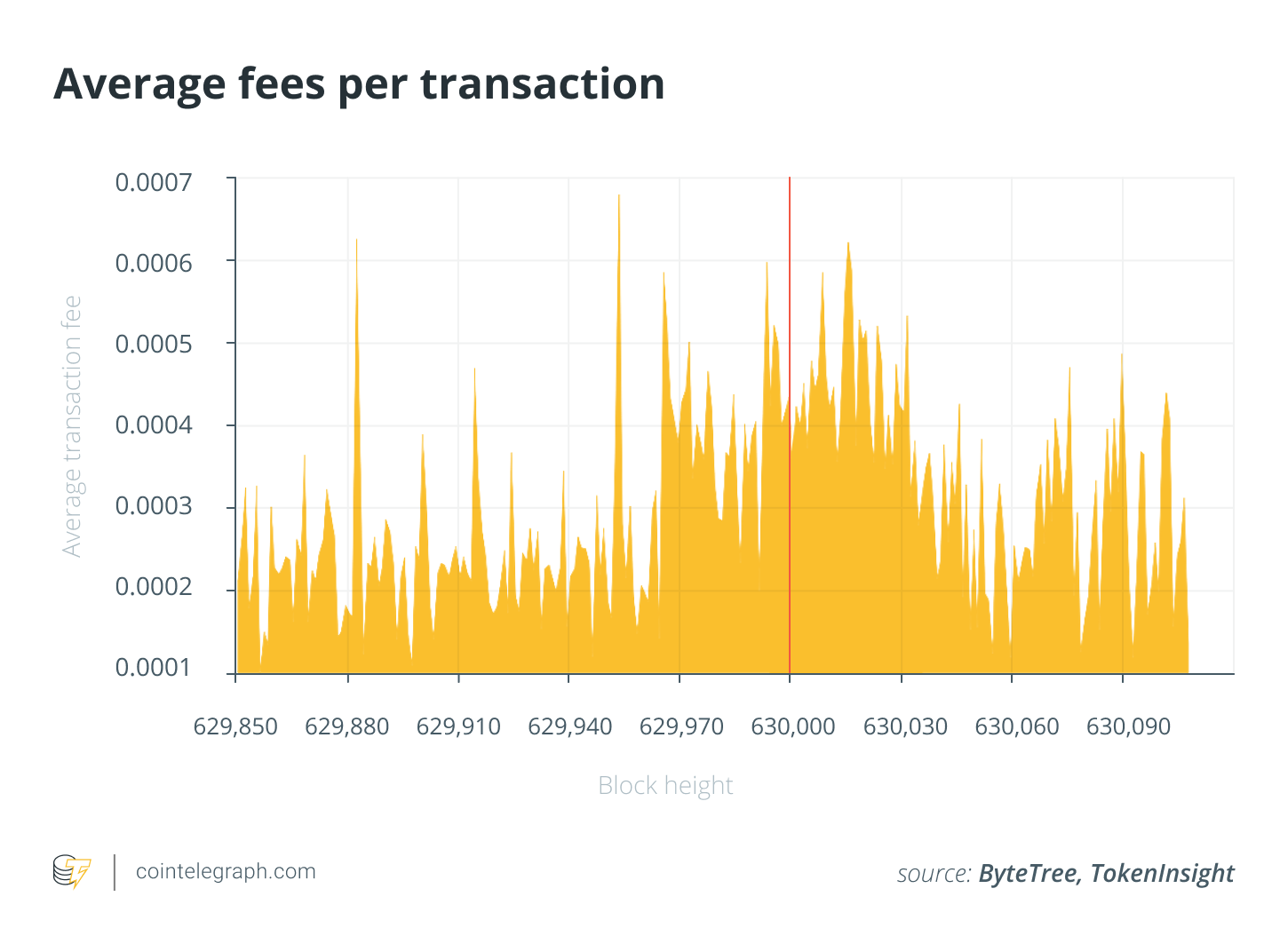

The network has seen a slight uptick of average fees per transaction during the last 50 blocks, and in the first 20 blocks after the halving, the average fees have been decreasing and stayed relatively stable.

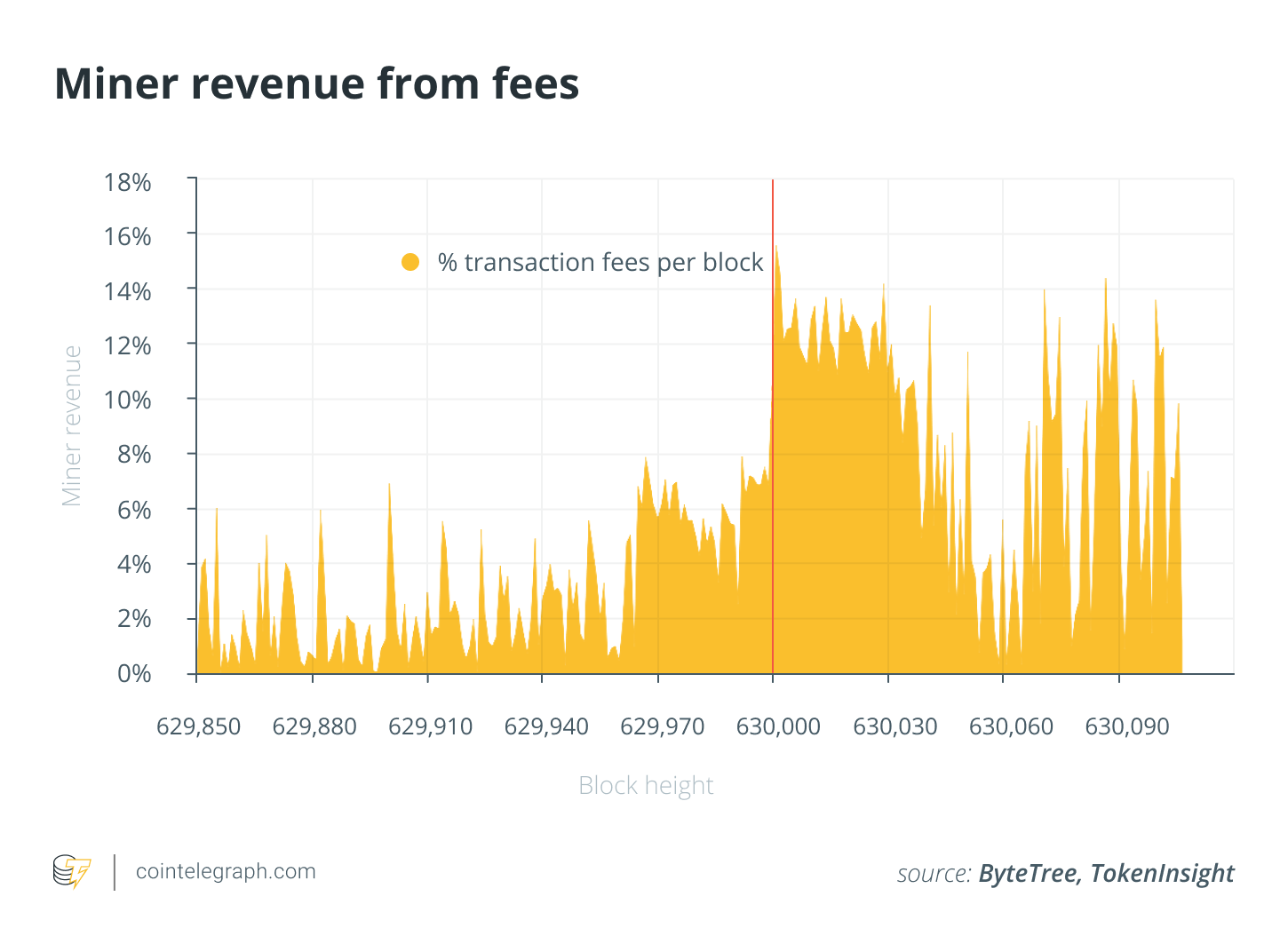

Prior to the halving, miners’ revenue from fees only accounted for a single digit of the total revenue that they will receive. There was an immediate jump in miner revenue from fees post-halving due to the reward being cut in half. Twelve hours into the 6.25 block subsidy era saw miners’ revenue from fees dropping to a lower level, but they stayed about 10% per block on average.

It is also worth noting that Slushpool mined the 630,001st block, which contains almost 18% transactions and cost roughly 1.369 BTC in fees. It is the block with the highest miners’ revenue from fees so far since the halving.

Happy 2020 Bitcoin halving! Now counting down to 2024

Bitcoin was born during a time when banks and the traditional finance industry faced turmoil. Yet, more than 11 years later, the industry is working together to bring the Bitcoin and cryptocurrency industry to the world stage.

The encoded coinbase parameter for block 629,999, “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue” echoes Satoshi Nakamoto’s encoded message for block 0, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This reminds us why Bitcoin was created: To provide a more trustworthy monetary system.

We look forward to witnessing future Bitcoin halvings with the whole world. This is just the beginning.

This article was co-authored by Fanger Chou and Johnson Xu.

The views, thoughts and opinions expressed here are the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Fanger Chou is a blockchain lover with a demonstrated history of working in the blockchain industry. She is currently the senior analyst at TokenInsight, a company that provides investment research, ratings, data analysis, industry insights, investment management services, industry consulting, etc.

Johnson Xu is a devoted fintech professional with a background in finance and computer science and with substantial exposure to the cryptocurrency/blockchain industry. He is currently the chief analyst and leads research initiatives at TokenInsight, a company that provides investment research, ratings, data analysis, industry insights, investment management services, industry consulting, etc. His previous experience includes a global, top-tier cryptocurrency exchange and a Fortune 200 consulting company.