Other than ETH which is up 13 percent, Litecoin remains the last 24 hours top performer adding 12 percent. The result is that morning star pattern and rejection of bears at Aug 2018 lows at around $45-$50. Going forward, we suggest small size Litecoin buys for risk off traders with first targets at $70. Afterwards, conservative traders can pick up longs should buyers close above it.

From the News

Aside from the slide in Litecoin’s market cap, there are many developments that are supportive of Crypto—in the long run since the effect isn’t conditioned to be immediate. Spearheading this is Bittrex, the Seattle based cryptocurrency exchange and the 23rd most liquid exchange in the world. In recent days, they have been making headlines for all the right reasons.

Through a tweet, the company said they shall be supporting LTC/USD and TRX/USD pairs beginning Sep 17 and only eligible accounts set up before Sep 4 are free to trade. Accordingly, this should buoy market participants and respective communities more so because this is a US exchange meaning there are options for LTC to benefit from extra liquidity as new investors swarm in from different states where Bittrex allow fiat trading. Remember, in their earlier announcement during the launch of ADA/USD and ZCash trading pairs, their priority was to improve quality of service and create additional channels for crypto investments.

We’re rolling out more USD pairs. On Sep 17 we’re launching US dollar (USD) markets for TRON (TRX) and Litecoin (LTC). Eligible #Bittrex accounts created before Sep 4 are already enabled for USD trading. New user or want to deposit/withdraw USD? Details: https://t.co/KA248OA2Bz pic.twitter.com/21xA8xZ4vm

— Bittrex (@BittrexExchange) September 12, 2018

In complementing news, Litecoin developers are keen on expanding and diversifying the number of secure/convenient wallets. One such idea is the creation of a web wallet that not only is easy to use but safe enough to protect user stash. It’s daring but still, if developers pull through then mass adoption would pick up since merchants and traders alike would have a trusted web wallet with Litecoin developers backing.

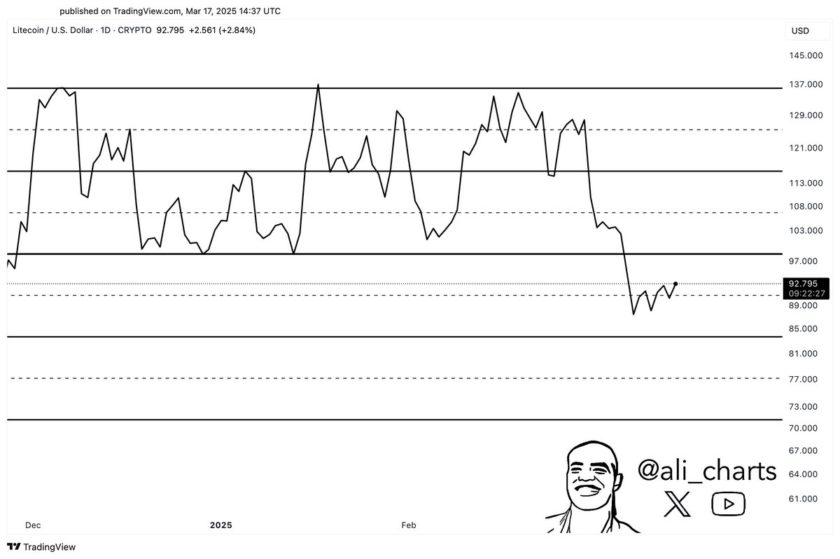

Litecoin (LTC) Technical Analysis

Weekly Chart

As the week comes to an end, Litecoin prices are stabilizing and likely to recover going forward. Notice that on a week to week basis, LTC is stable and up one percent. The end result is a clear rejection of bearish attempts pushing prices above $50.

What we have in the weekly chart is a pin bar with a long lower wick hinting of higher highs in lower time frames. Though this is driving back prices towards a consolidation, we suggest exiting LTC sell trades. Consequently, risk-on traders should adopt a neutral stand. The only time longs would be activated is once there is a conclusive LTC break and close above $70, our immediate resistance line.

Daily Chart

Building on yesterday’s high-volume pin bar is a bullish engulfing candlestick reversing from $50, a support line. What’s significant in this is not the trade range but the level of participation. There is a follow through of Sep 12 bullish attempts. The result is a three-bar bullish reversal pattern, the Morning Star.

If anything, aggressive traders can buy LTC on pull backs in lower time frames with stops at Sep 12 lows at $45 and first targets at $70.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.