There’s a good chance you’ve talked to a friend about Bitcoin. Or maybe heard about this “crazy digital currency” in the news, but haven’t tried to obtain any because you think it might be difficult. These days, acquiring cryptocurrency is actually very easy, with various avenues you can take to purchase your first coins.

Also read: A Look at Some of the ‘Next Generation’ Mining Rigs Available Today

The Most Straightforward Methods to Buy Cryptocurrencies

In the early days, acquiring bitcoins wasn’t so easy and people jumped through all kinds of hoops in order to get some. Nowadays, the crypto ecosystem is vast, with multiple exchanges and various digital assets sold for fiat currencies. People can purchase cryptocurrency using methods like credit and debit cards, cash, Paypal, money orders, and even basic barter arrangements. If you’ve been looking for ways to buy a cryptocurrency like bitcoin cash (BCH) – or any other digital asset – then this article is for you.

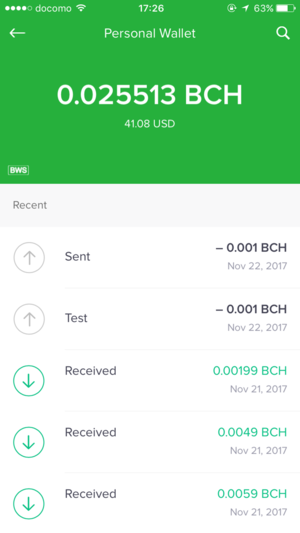

The Non-Custodial Wallet

The first thing you should do is study the digital currency you want to buy so you can understand what you are purchasing. After choosing a cryptocurrency to invest in, like BCH or ETH, you should get a noncustodial wallet so you can store the assets in a safe place. An ethereum (ETH) wallet will not work with BCH and vice versa. The reason for getting a noncustodial wallet prior to buying coins is because you probably don’t want to leave your assets with a central exchange. Storing cryptocurrencies on an exchange, unless you are trading them, leaves your coins vulnerable to the risk of theft.

Bitcoin.com has a dedicated list of wallets that you can review. There’s also the noncustodial Bitcoin.com Wallet, which allows users to store, send, and receive both bitcoin cash and bitcoin core (BTC). After obtaining a wallet on your mobile phone or desktop, you can choose how to purchase some digital currency. There are three primary ways of doing so — via an exchange, a cryptocurrency ATM, or a peer-to-peer service.

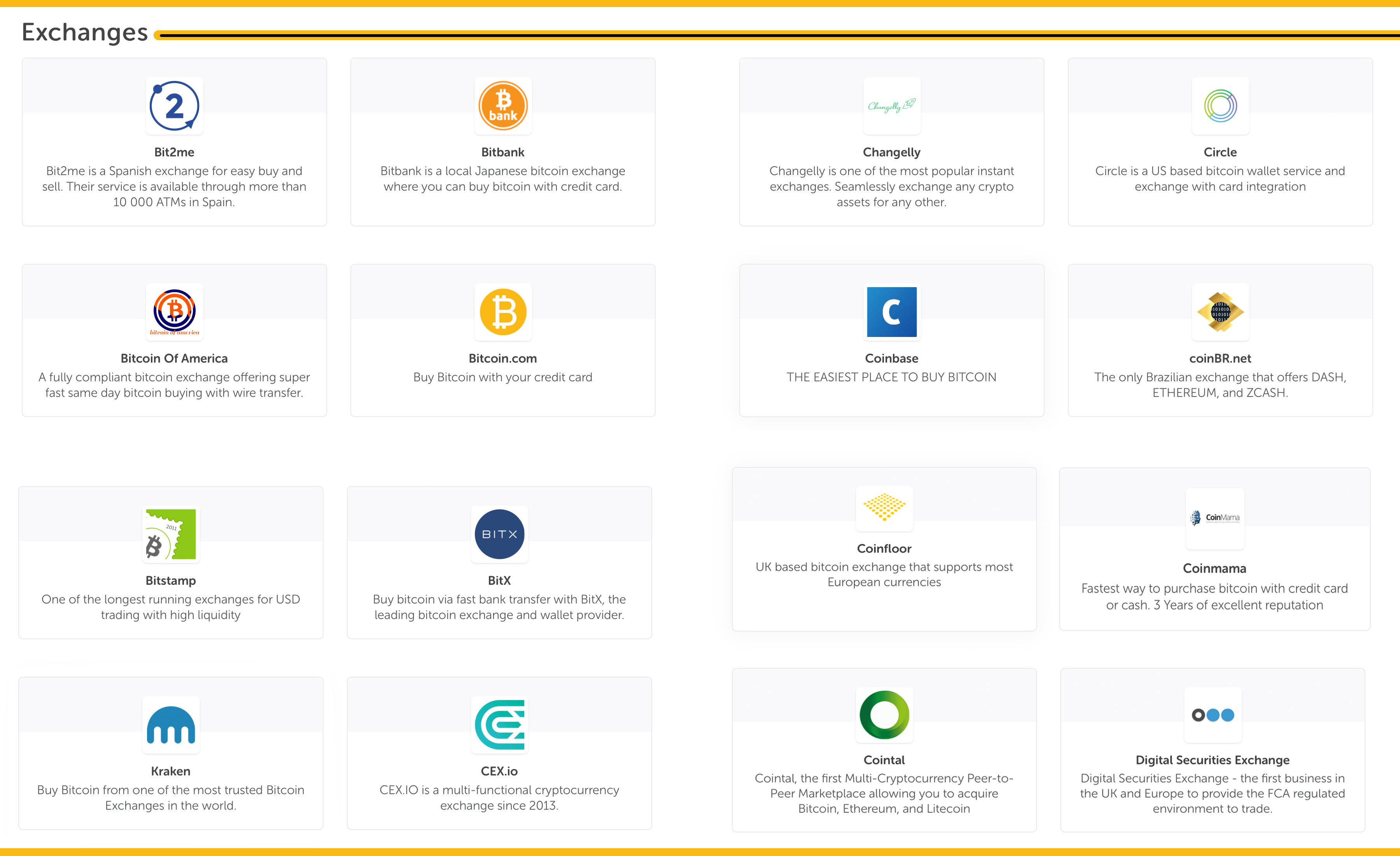

Exchanges

Exchanges are trading platforms that let you buy and sell cryptocurrencies for other digital assets or fiat. An exchange is a pretty quick way to obtain bitcoins as long as you are comfortable with the process. For instance, you will need a means of payment, because you are online and can’t use cash. Trading platforms allow customers to purchase cryptocurrencies in their local currency and you can usually pay using a credit card, Paypal, and bank wire depending on the exchange in question.

Exchanges will also require identification and will want to verify your identity in some fashion. The trading platform may require a picture ID or some proof of residence. Two things you will typically have to wait for before actually purchasing coins on an exchange is a verified identity and a validated payment system. Once those are in order, the platform will let you purchase cryptocurrencies and from there you can send them to your noncustodial wallet. Check out Bitcoin.com’s extensive list of cryptocurrency exchanges.

The Automated Teller Machine (ATM)

Yes, even cryptocurrencies use automated teller machines (ATMs) and you might be able to find one in your local area. At the moment there are more than 4,100 digital asset dispensing devices across the globe and more being installed every day. In order to locate a machine in your local area, Coinatmradar.com is a great resource. There are a ton of bitcoin core (BTC) ATMs (sometimes called BTMs) that sell the coin for a fee of between 6-10 percent per transaction.

There’s also a growing amount of bitcoin cash (BCH), dash (DASH), and ethereum (ETH) teller machines. Crypto ATMs are not like bank ATMs because instead of getting cash, you give the machine some paper bills and the device will send digital assets to your wallet, after you’ve given the ATM a valid public address. Some cryptocurrency ATMs don’t require identification, but there are some providers that do oblige the ATM user to supply picture ID.

Peer-to-Peer Services

After conducting trade with a seller you, can receive coins in relatively little time, but it’s a good idea to research the platform you are using and make sure the vendor has a trustworthy reputation. Typically, these traders have conducted a lot of trades and most platforms, like Localbitcoins, have a reputation system.

Learning the Basic Steps and Getting Comfortable

Buying a digital currency is pretty straightforward, and after doing it once you’ll get an understanding of some of the concepts involved like sending and receiving coins. It’s a good idea to read up on how to send bitcoins from one wallet to another and the basic foundations of the digital currency you decide to buy. Lastly, one last thing to remember is that you don’t have to buy a whole coin when purchasing currencies like ETH, BCH, or BTC. People can buy a fraction of the digital currency they want and can even set up recurring purchases of very small amounts of crypto. After doing it a few times, you’ll quickly get the hang of buying and using digital assets.

Do you think purchasing cryptocurrencies is easy? How would you recommend people buy their first digital coins? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Bitcoin.com, Openbazaar, and Localbitcoincash.org.

Need to calculate your bitcoin holdings? Check our tools section.