By CCN Markets: Bitcoin plunged below $10,000 on Thursday after a violent three-day selloff. But now is not the time to panic. If history is anything to go by, now might be the best time to accumulate bitcoin.

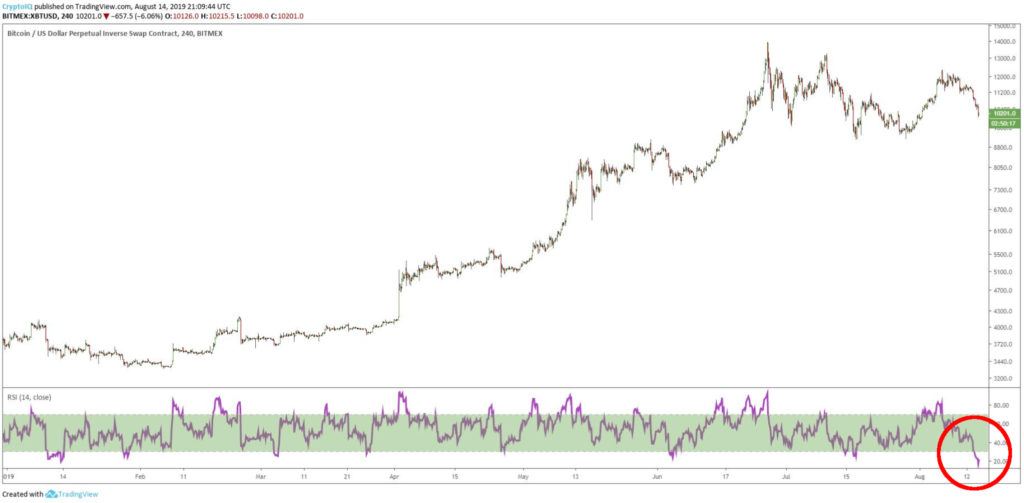

Zoom out to the longer-term charts and BTC is wildly ‘oversold’ according to the RSI indicator, which has accurately pinpointed bitcoin buying opportunities in the past. Last time RSI was this low was in November 2018, right before bitcoin’s huge 200 percent run-up.

Interpreting the bitcoin price charts

RSI, or ‘relative strength index’ is used by traders across financial markets to spot market tops and bottoms.

An ‘overbought’ market triggers above 70 on the RSI scale. In other words, the asset has been hyped up and may be due for a pullback.

For what it is worth, the 4H RSI has never been lower in all of 2019 than it was today.$BTC #Bitcoin pic.twitter.com/z6I8j151Jz

— HornHairs 🌊 (@CryptoHornHairs) August 14, 2019

On the other end of the scale, falling below 30 indicates an ‘oversold’ market. Sellers are running out of steam, providing a good opportunity for buyers to get back into the market.

Historically, when bitcoin breaches 30 on the 4-hour chart, it is shortly followed by a strong price rise.

Right now, bitcoin’s RSI is below 20 on this particular time scale. It’s at the most oversold level of the year so far.

I know a lot of people like to shit on RSI here on Twitter but, c’mon… go ahead, take a peak.

Oversold conditions in a bull market? Typically a good buy. #Bitcoin $BTC pic.twitter.com/HloFCXlWNK

— The Crypto Dog📈 (@TheCryptoDog) August 14, 2019

Smart money buys the dip

A strong pullback in a bull market is often the perfect moment to buy back into the market at lower levels.

Bitcoin went through multiple 30 percent retracements during the last bull run. In a nascent market like bitcoin, large swings come with the territory. As CCN reported, smart money like hedge funds and institutions were carefully buying the dip when BTC collapsed to its 2018 lows.

Of course, there are also bigger factors at play here than technical charts. Cryptocurrencies appear to have been swept up in a global equities sell-off this week. Rather than establishing itself as a safe haven asset, bitcoin still appears to be a risk asset in times of global instability.

This article is protected by copyright laws and is owned by CCN Markets.