The Case For A Crypto Asset Rally

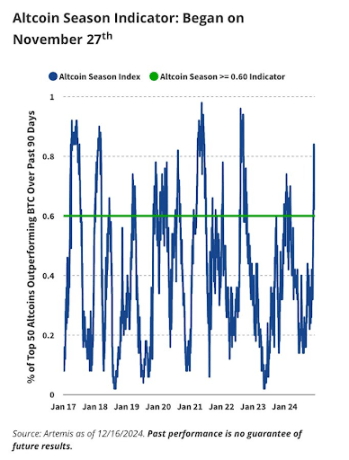

Fundstrat’s prominent head of research, Tom Lee, recently took to Twitter to remark that one of the “pre-conditions” for historical altcoin rallies is coming to life in the current cycle. This precursor, for those unaware, is a drop in the correlation between the crypto asset class at large and Bitcoin (BTC) itself.

Per Lee’s chart (seen above), a strong drop in the rolling 90-day correlation between the two subsets has preceded three altseasons — Mar 2016, early-2017, and late-2017/early-2018. An altseason, as defined by Fundstrat, is when a large percentage of altcoins in the “liquid universe” rally by over 200% in a few months’ time.

With preliminary indicators predicting a further collapse in the correlation between digital assets and BTC, an altseason might already be well underway. If you take a brief gander at CoinMarketCap or other analytics providers, this would seemingly be the case.

Binance Coin (BNB) recently surpassed its all-time high, in a brutal bear market no less, as the launch of the exchange’s in-house chain and decentralized exchange have been a boon for its price. Litecoin, Cardano, and Basic Attention Token are among other prominent cryptocurrencies that have also seen jaw-dropping gains in the past 90 days, as they push higher as a result of fundamental and technical factors. But, this uptick might just be the tip of the iceberg.

2/ past alt-seasons averaged 1,100% gains

Will the next alt-season be as strong as the past? Given there are probably only ~50mm active wallets (vs 5 billion Visa/MasterCard accts), we think crypto still early in the adoption curve. So it should be similar pic.twitter.com/cgTBOHteMT

— Thomas Lee (@fundstrat) April 20, 2019

As Lee explains, historical altseasons averaged gains of 1,100%. He adds that Fundstrat expects for the next rally in cryptocurrencies to “deliver returns similar to the 2017/2018 cycles.” Fundstrat isn’t the only entity claiming that crypto assets other than Bitcoin could outperform BTC in the coming months.

Per previous reports from Ethereum World News, Twitter commentator Galaxy explained that with Bitcoin’s market dominance rally being the weakest so far, he wouldn’t be surprised to see BTC’s share of the cumulative value of cryptocurrencies fall under 30%.

Analyst Begs To Differ, Keeps Portfolio Bitcoin-Heavy

Another prominent analyst, however, claims that altcoins might not be ready to push higher against Bitcoin just yet. In a recent tweet, The Crypto Dog, who sports over 100,000 followers on Twitter, claimed that as altcoins fell faster and further than Bitcoin (-2.5% compared to -1%) in Sunday’s drawdown, he is now less interested in other cryptocurrencies. He explains that he will now be skewing his portfolio heavier to BTC, as he expects for the market leader to begin to outperform altcoins in this time in this indecisive time.

Photo by Mark Finn on Unsplash