The near-term outlook for bitcoin has dimmed, analysts say, with some now seeing a possible extension of Monday’s major price drop.

“There could be another dump as outflows from the cryptocurrency exchange Coinbase Pro have dried alongside an increased transfer of coins onto exchanges,” David Lifchitz, chief investment officer for Paris-based quantitative trading firm ExoAlpha, told CoinDesk.

Bitcoin fell by over 20% on Monday to $30,305 amid heavy selling in the spot market.

Outflows from Coinbase Pro, which are considered synonymous with institutional purchases, have receded sharply from the three-year high of 55,000 BTC observed on Jan. 2.

The Grayscale Bitcoin Trust (GBTC), the biggest publicly traded crypto investment trust, hasn’t seen inflows since Christmas because it was temporarily closed, as noted by analyst Joseph Young. Grayscale is owned by Digital Currency Group, the parent company of CoinDesk.

That means demand-side pressures, which played a pivotal role in pushing bitcoin higher from $10,000 to $41,000 over the past three months, had weakened. The trust reopened Tuesday.

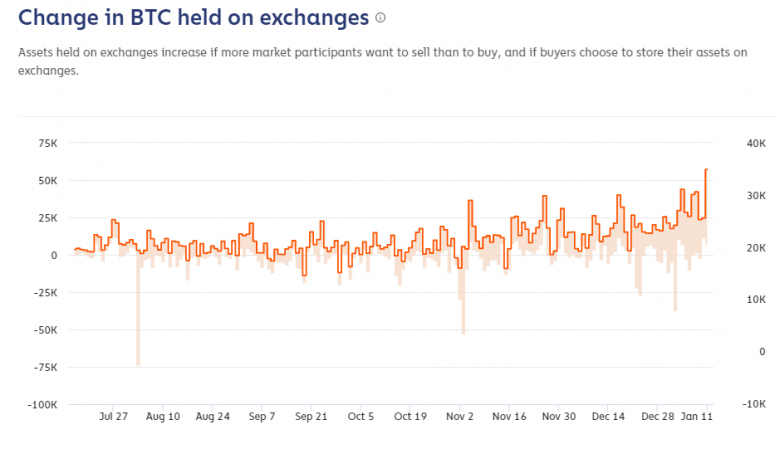

Meanwhile, exchange deposits have picked up the pace, a sign that some investors may be looking to liquidate holdings and take profits.

The number of coins held on exchanges increased by over 57,000 BTC on Tuesday, the biggest-single day change since the markets crash on March 12, 2020, according to data from blockchain analytics firm Chainalysis.

Exchanges have registered an average inflow of 103,000 BTC per day in the past seven days – higher than the 180-day average of 83,700 BTC.

“At a minimum, increased inflows suggest that the type of buyers who self-custody, typically the larger investors, are not buying as much at the moment,” Chainalysis economist Philip Gradwell told CoinDesk. “These coins could be held on exchanges to flip if prices rise rather than to sell immediately, but that will put a lid on gains, if any, or even cause a fresh downturn.”

Technical charts are also calling for an extension of Monday’s drop.

“With bitcoin trading below the Ichimoku cloud, I still see pressure on the downside in the short-term,” Patrick Heusser, head of trading at Swiss firm Crypto Finance AG.

The Ichimoku cloud, a technical tool created by Japanese journalist Goichi Hosoda in the late 1960s, includes multiple lines that help identify support and resistance levels and other essential information such as trend direction and momentum.

When an asset trades below the cloud (red line), the trend is said to be bearish, as is the case with bitcoin at press time.

“$29,000 is the make-or-break level. Things could get ugly if that support is breached,” Heusser said, adding that $36,000 is the level to beat for the bulls.

Chris Thomas, head of digital assets at Swissquote Bank, foresees consolidation in the $33,000–$36,000 range for the rest of the week.

The consolidation could end with a bullish move if institutional demand returns. “We could have a fair amount of fresh buying activity coming over the next few weeks,” Thomas said, highlighting the reopening of Grayscale Investments’ cryptocurrency products to new investors.

While the cryptocurrency may suffer deeper declines in the short term, the broader bias remains bullish.

“Recent institutional investors have long horizons and will absorb near term price shocks,” while retail investors would buy at discounted price levels for fear of missing out, Jehan Chu, managing partner at Hong Kong-based Kenetic Capital, said. “Expect temporary volatility and then a jump back to the $40,000 level, followed by $50,000 as the bitcoin percentage land grab continues.”

Bitcoin is trading near $34,210 at press time, representing a 4% drop on a 24-hour basis.