Prior to 2021, bitcoin’s three-month implied volatility (IV) – investors’ expectation of how turbulent prices will be over the ensuing three months – spiked during both bull and bear runs, according to data from crypto data firm Skew. But this year, a similar spike only occurred when the market crashed in May.

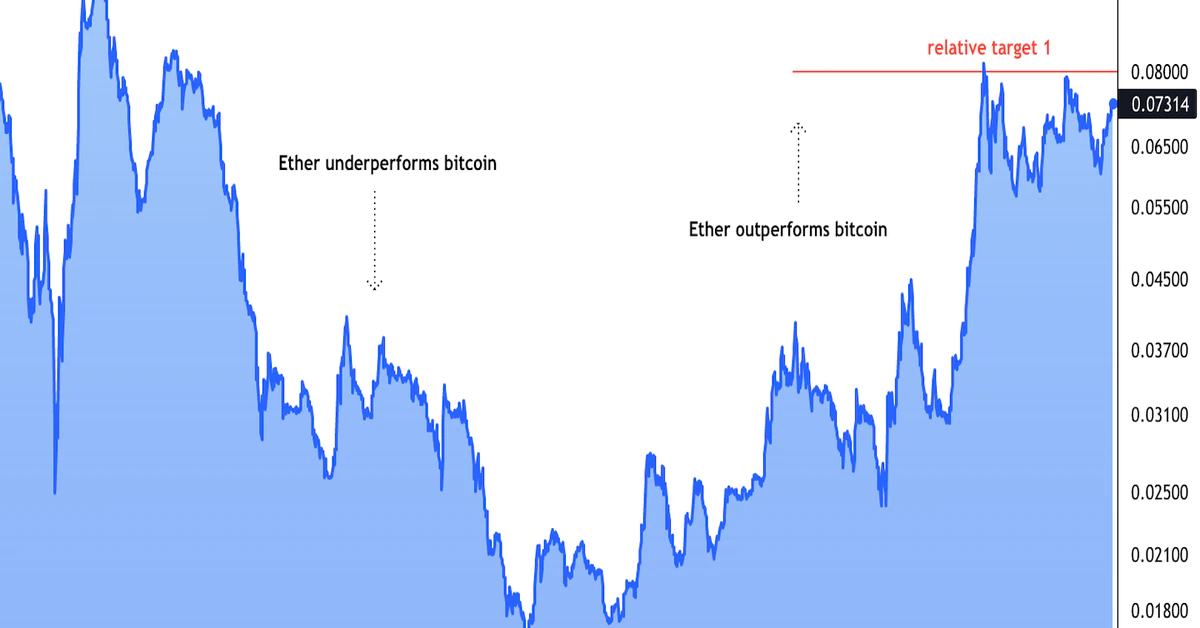

Analysts See Further Upside in Ether as Bitcoin Stalls