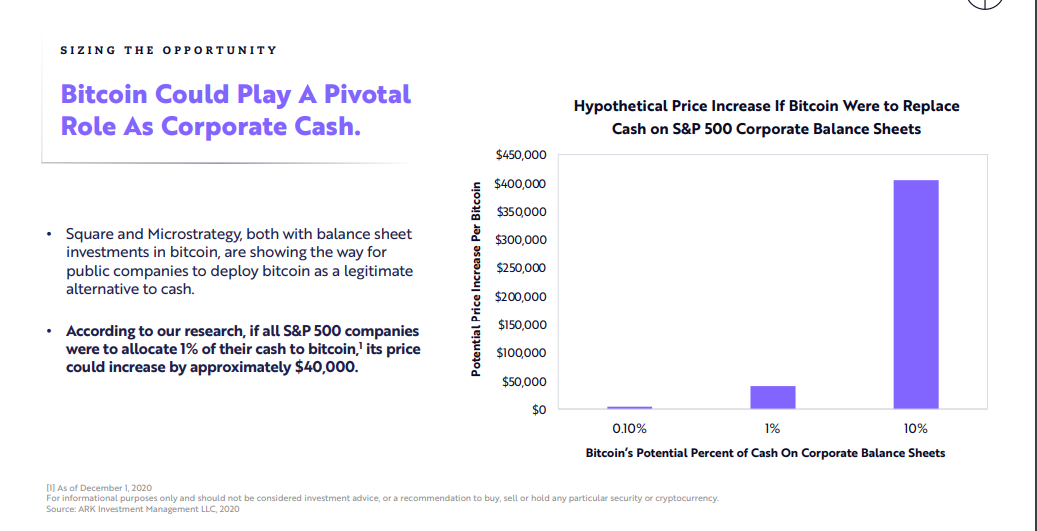

According to the findings of a study by Ark Investment Management (AIM), the value of bitcoin can potentially increase by $40,000 if all S&P 500 companies allocate 1% of their cash holdings to the crypto. Similarly, if all these companies were to convert 10% of cash holdings into bitcoin, the value of the crypto asset will potentially rise to $400,000.

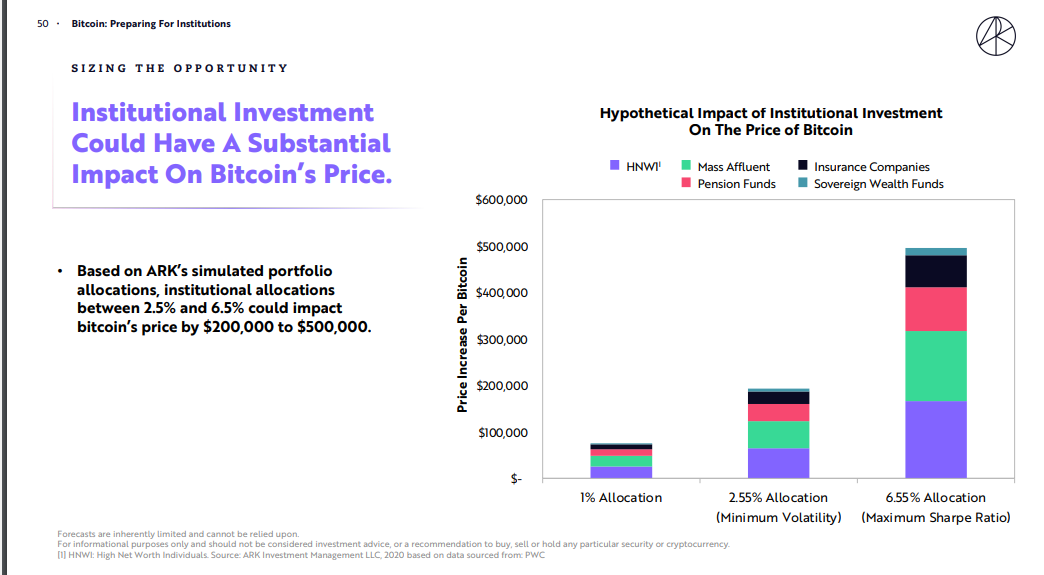

Institutional Adoption

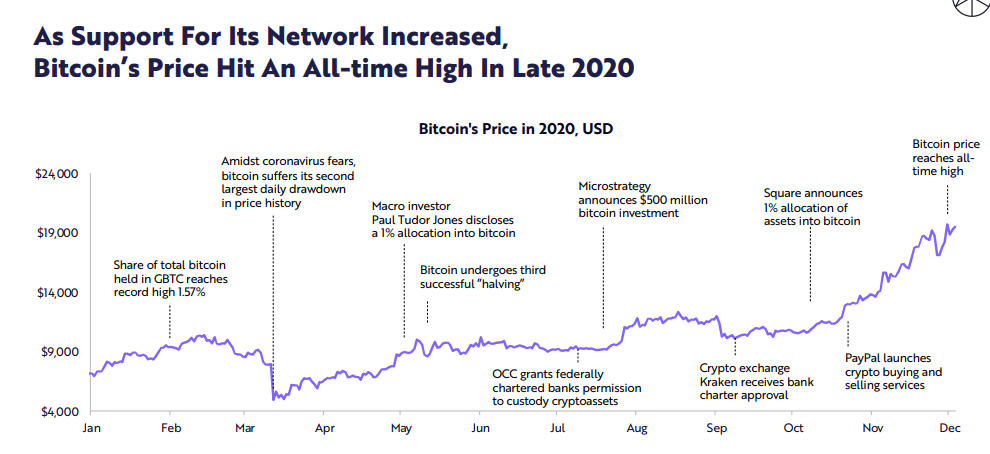

The study findings, which are based on December 1, 2020 data, seem to get validation from BTC’s price movement after Square and Microstrategy acquisitions. As on-chain data shows, the value of the crypto asset went up after the two companies announced their BTC acquisitions.

Still, in making the case for a greater allocation of bitcoin in institutional portfolios, the AIM study says:

Untethered from traditional rules and regulations and generally uncorrelated to the behaviour of other asset classes, bitcoin seems to have earned a strategic allocation in well-diversified portfolios.

Further, the study findings also show that during the past decade, “bitcoin is the only major asset with consistently low correlations to traditional asset classes.”

Less Hype During 2020 Bull Market

Meanwhile, in addition to the price predictions, the study finds that the last bitcoin rally was driven less by hype. According to the study summary, “bitcoin’s search interest is low relative to the increase in its price.” Consequently, as bitcoin price neared all-time highs, the digital asset’s “Google search interest was at 15% of its all-time high.”

Another key takeaway from the study is AIM’s assertion that “bitcoin offers one of the most compelling risk-reward profiles among assets.” In the findings, AIM says:

As our analysis suggests, it could scale from roughly $500 billion to $1-5 trillion in network capitalization during the next five to ten years.”

Consequently, AIM says “capital allocators should consider the opportunity cost of ignoring bitcoin as part of a new asset class.” In the meantime, the study suggests bitcoin’s apparent acceptance could well “set the stage for ethereum and a new wave of financial experimentation.”

Do you agree with Ark Investment’s view that BTC value will skyrocket if all S&P 500 companies buy the crypto? You can tell us what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.