With Bitcoin (BTC) price sentiment continuing to remain bullish following the uncertainty brought on by the United States presidential election, institutional investors seem to be getting more interested in betting on the markets. In the seven-day period ending on Oct. 27, Grayscale Bitcoin Trust, run by Grayscale Investments, saw a record inflow of $215 million (15,907 BTC), which surpassed all of its weekly inflows seen since inception.

At the current rate, it is estimated that Grayscale is on track to hold 500,000 BTC by the end of 2020, which is 2.7% of the circulating supply of Bitcoin. By 2021, it could hold up to 5%. According to Grayscale’s “Digital Asset Investment Report” for the third quarter, the average weekly investment into Grayscale’s Bitcoin Trust was up 40% to $55.3 million from a 12-month average of $39.5 million. Additionally, companies such as MicroStrategy, Square and Stone Ridge have bought into Bitcoin as a treasury reserve, which is driving their revenue growth in 2020.

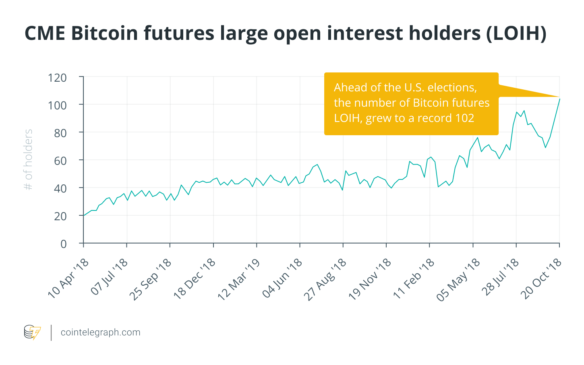

The increase in institutional investing in Bitcoin is seen in the Chicago Mercantile Exchange as well. Cointelegraph discussed this aspect with Tim McCourt, global head of equity index and alternative investment products at CME Group, who told Cointelegraph: “We have seen an increase in large open interest holders (LOIH), which could be suggestive of increased institutional participation in our bitcoin futures markets.”

According to CME, LOIH are entities that hold more than 25 CME Bitcoin futures contracts, with each contract containing 5 Bitcoin. This means that an entity would need to hold at least 125 Bitcoin — i.e., approximately $1.9 million in value. Ahead of the election, the number of LOIH grew to an all-time high of 102.

Setting the trend

Because Bitcoin futures are indicative of the institutional interest in the asset, McCourt further elaborated on how the metrics for Bitcoin futures fared leading up to the U.S. election night: “Overnight trading volume of 6,700 CME Bitcoin futures contracts (33,500 equivalent Bitcoin), 75% more than average in 2020 to date.” He further added that open interest was also up 20%.

Explaining the factors leading to this rise in institutional interest in Bitcoin, Jay Hao, CEO of crypto exchange OKEx, told Cointelegraph that macroeconomic factors such as a second wave of countrywide coronavirus-related lockdowns would have an inflationary impact: “This is leading to massive money printing and there is a growing concern over the eventual harmful effects that inflation will have on fiat currencies especially the dollar.”

In addition to these major recent developments, PayPal announced that it will be launching crypto payment services in early 2021. Even JPMorgan Chase has turned bullish on Bitcoin, saying that the asset has “potential long-term upside” if it competes more closely with gold as an alternative asset, with millennials growing to become a more important aspect of the investor universe.

As Grayscale’s investment funds see investments dominated by hedge funds, it’s indicative of the fact that Bitcoin is also becoming a hedging instrument, like gold, to protect investors from market uncertainty and is increasingly used to capture the arbitrage spread. Hao further pointed out how Bitcoin’s performance has created a demand from clients to investment firms and hedge funds:

“Bitcoin is already up over 115% YTD compared to gold at less than 30% and the S&P at around 8%. Bitcoin is offering investors a real chance to make gains on their money rather than risk-off assets like cash that are bringing back negative yield. This is something that simply cannot be ignored.”

Various other events have also caused this change in perspective from major corporations. Companies like Microstrategy, Square and Stone Ridge buying Bitcoin as a treasury reserve will pave the path for other firms to follow suit, especially considering the significantly positive business impact these investments have yielded, as has been the case with MicroStrategy and Square, becoming the major driving force behind their revenues. Hao believes that “This will start a major trend as we continue this year and move into 2021 that will be very bullish for Bitcoin. We have also seen regulation tilt in bitcoin’s favor as US banks are now able to custody it.”

Bitcoin bull run might be driven by institutional investors

Considering the turbulent times resulting from the COVID-19 pandemic, which has led to growing unemployment rates throughout the world, it’s possible that retail investors are slightly hesitant to invest funds into assets they aren’t familiar with due to the lack of mainstream media coverage of blockchain technology and its products.

However, institutional investors seem to be taking the lead by capitalizing on the high returns that the digital asset class has to offer. John Todaro, director of research at TradeBlock — a cryptocurrency investing platform — is of the opinion that this bull run is indeed led by institutional investors:

“The primary drivers recently have been from institutions. Additionally, spot volumes at institutional platforms have risen considerably—LMAX digital, which is primarily focused on institutional block traders, recorded its highest volume month ever recently. Retail investors have been noticeably absent throughout this bull run. They likely will enter the space at higher levels when mainstream media outlets begin covering the space in earnest.”

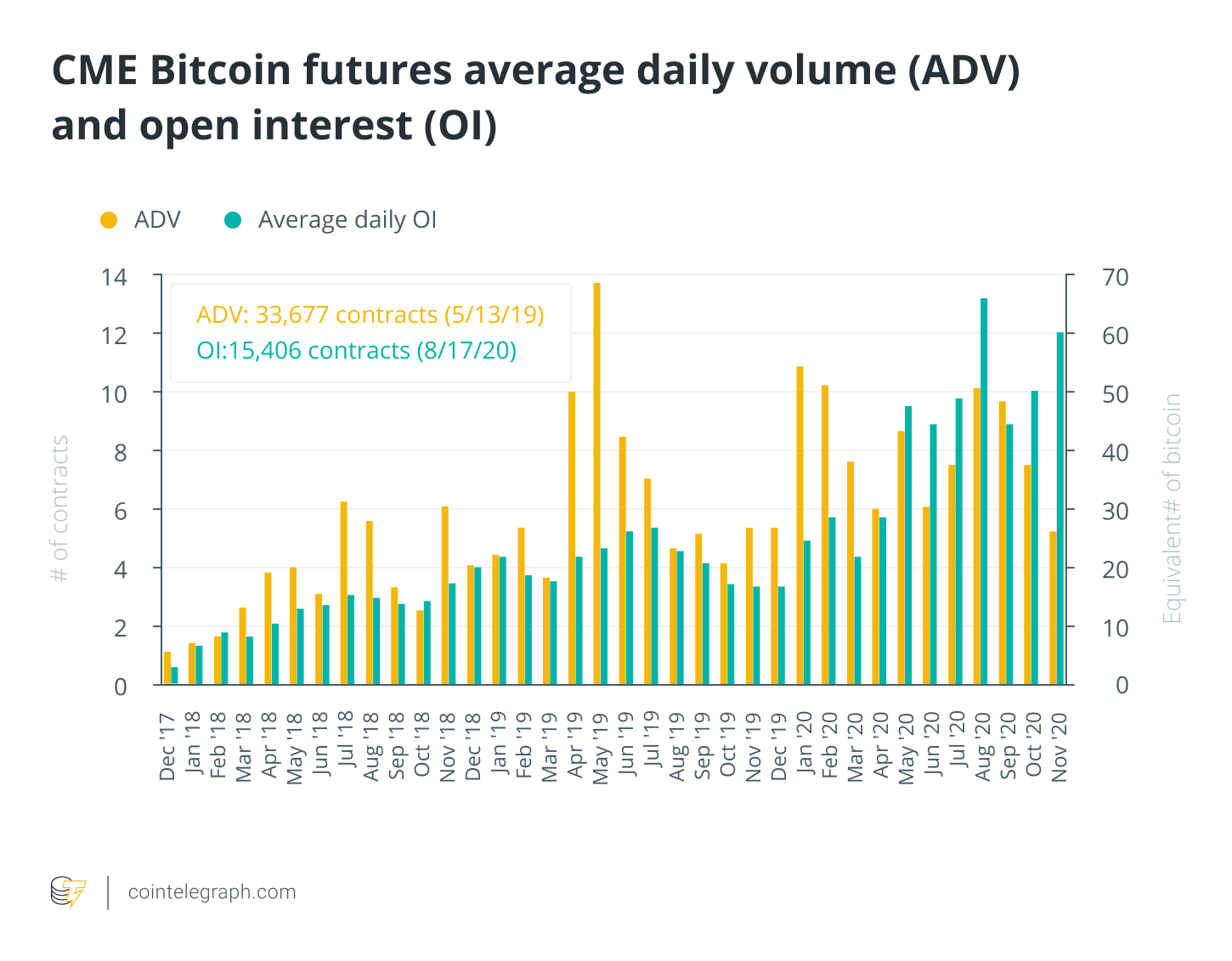

This is also evident in the open interest and the average daily volumes of futures traded on CME, the platform often used by institutional investors to access this market. Open interest is up 20% in November when compared with October, which, in turn, was significantly higher than the average open interest in September. Because institutional investors tend to trade in larger U.S. dollar notionals and in big blocks, it’s presumably them that have caused the rise in the price of the underlying asset, Bitcoin.

Innovations by exchanges and DeFi products spur viability

In addition to supporting the liquidity and price stability of Bitcoin, there are various ways in which an exchange can optimize its offerings to better suit traditional and institutional investors. Because many of these investors have never taken interest in Bitcoin as an asset class in their portfolio before, it seems essential that the crypto market move in the direction of providing products that institutional players may be familiar with. Todaro outlined why this could be a game-changer:

“More and more institutional investors are allocating capital to Bitcoin. Some of these funds may not have mandates in place, or lacking familiarity with custody solutions, to purchase Bitcoin itself.”

Furthermore, even though the hype around decentralized finance seems to have cooled off recently, it’s highly likely that the innovation and products seen in the domain will have a positive impact on the asset class by getting more investors interested through their use cases and applications. Hao further hinted at the possibility for collaboration between centralized finance and DeFi:

“To accelerate the growth of the space CeFi and DeFi can work together to offer more attractive and robust products to users to let them make their money work for them in an alternative financial system that actually brings them high yield, unlike the existing one at the moment.”

Todaro agreed that the DeFi market has an important role to play in the development and growth of the institutional market: “As long as the industry continues innovating through DeFi, launching new products, as well as providing ample liquidity to ensure continued institutional activity, then we should continue to rise.”

Even though the Office of the Comptroller of the Currency has clarified that banks operating in the U.S. are allowed to provide custody services of cryptocurrencies, there so far doesn’t seem to be much interest from the government and regulators to make a clear framework that would enable even more institutional investors and firms to indulge in crypto and blockchain.

Related posts