When you think about investing in cryptocurrency, there are a few mistakes that will drag your portfolio down. You have to remember some of the important things, like the ones mentioned in this list. Following this list, you will be able to make sure that your crypto investing is a safe experience, and you are on the path to success. I have made a list of 5 key mistakes that you will want to avoid while making an investment in cryptocurrency. If you already know about these things, you can directly go for the Bitcoin Evolution Official Site 2020 – volution.com™. Here you can start with investing and wait for the profits to come in.

The Hype Causes Issues

Social media has a huge impact on cryptocurrency investing and trading. So, without a doubt, the investors and crypto creators do their best for exciting a token. The 2018 crypto market crash saw this in abundance while it still has an impact on investors.

Be careful when you are using social media. Often you come across articles that promise to make you a millionaire. The media hype causes a void in investment that makes a cryptocurrency value jump. During this time, the long-term investors will sell and make a huge profit out of it, while the others will be left with stocks that cannot bring much profit.

Trusting False Exchange

Many investors choose an exchange without reading the amounts or activities of that exchange. Few of the biggest most popular crypto exchanges also have high prices.

The profit margin is lower when the prices are high. Being an investor, you should be looking for low-fee exchanges that are secure and makes your portfolio even more profitable. The higher the fees, the more the investment you make to make a profit while selling it.

Security

Security is important for sustainable cryptocurrency investment. For keeping you invest aloof from hackers and thieves, you should consider purchasing hardware wallets for your invested amount. Make sure that you are always employing best when it comes to security.

An issue that doesn’t go away is investors trusting “Exchange Wallets.” They simply keep their assets within those exchanges. Even though reputable exchanges have a long history of protecting funds of the investor, the online systems can be porous. The hackers are always in a lookout for exploiting your online investment, don’t give them that opportunity.

A secure hardware wallet protects your cryptocurrency funds while you only plugin when you are making a transaction.

Buying and Selling in a Short Time

These above stories are from the investors who held on to coins for over the years and sold it off at even higher values. Cryptocurrency can often go through ups and downs while you will notice prices in short time gaps changing drastically. The reason behind this is investors are buying and selling in short spans while opting for another coin and repeating the process.

Diversification of your trading options will allow you to look through long-term growth plans for making the most of your investment. Short trading is an amazing tool as part of a wider collection; on the contrary, you must explore great trade potential for your benefit.

The cryptocurrency market is filled with amateur investors. This results in selling quickly when they get restless over fluctuation in the price. As a seasoned and knowledgeable investor, you should explore the indications of whether it is the right time for buying or selling, and then get fixated on your experience and education for trading effectively.

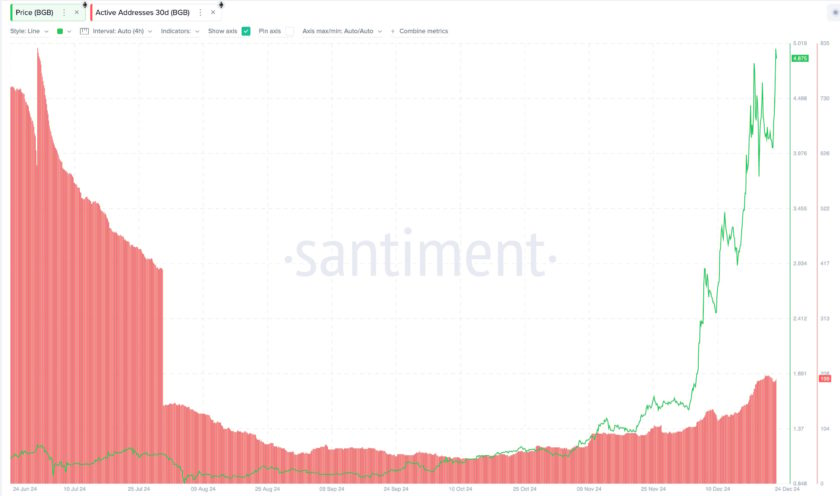

Read Cryptocurrency Charts

The market that you are trading in has to be understood from back to front. You have to learn at the outsets as much as you can and keep building up your knowledge as you move forward. The expression “knowledge is power” is best expressed in the cryptocurrency realm.

The price charts need to be understood, learn where you can invest, and then use your previous experiences alongside you’re minutely sought out projections. Ease of investment will boost good exchanges. For ensuring this, you have to use clear charts and track the trade prices with precision i.e., very close to real-time.