The president’s team has already passed one crypto tax-related piece of legislation into law; in 2021, the Bipartisan Infrastructure Framework, which later became the Infrastructure Investment and Jobs Act, included a controversial tax provision that would impose certain reporting rules onto brokers facilitating crypto transactions. The definition of “broker” was seen by many in the industry to be overly broad, to the point where miners and other types of entities that don’t directly facilitate transactions or collect personal data from those conducting the transactions could be considered brokers.

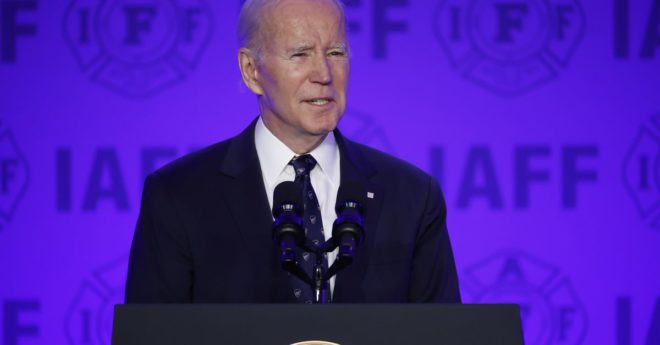

Biden Budget Plan Would Close Crypto Tax Loss Harvesting Loophole