Bitcoin (BTC) could be on the verge of a retail major sell-off as exchange inflows spike to almost three-and-a-half-year highs.

Data from on-chain analytics platform CryptoQuant shows users of 21 major exchanges sending coins to their wallets en masse June 14.

Major exchanges finish up 83,000 BTC in a single day

As BTC/USD fell to lows of $20,800, panic appeared to set in among traders, and despite a reversal that at one point topped $23,000, few seemed willing to trust that the worst was over.

Since then, spot price action has returned to near $21,000, while 24-hour exchange inflows reached 59,376 BTC.

According to CryptoQuant data, this is the largest daily inflow since November 30, 2018. On that day, exchanges recorded 83,481 BTC of net inflows.

May 9, 2022 ended with 29,082 BTC in net inflows for the platforms monitored by CryptoQuant.

Concerns may thus now turn to whether even more sell-side pressure will emerge in Bitcoin markets over the coming days and weeks. Around a month after the 2018 influx, BTC/USD hit its cycle bottom of $3,100, 84% below its prior all-time high of $20,000.

As Cointelegraph reported, analysts are of mixed opinion when it comes to whether Bitcoin will repeat the trend this cycle. An 84% drawdown would mean a bottom of just $11,000.

In a separate analysis of the price situation, statistician Willy Woo concluded that macro market movements would dictate Bitcoin’s bottom.

“I think it’s simpler than this, IMO we’ll find a bottom when macro markets stabilise,” part of a Twitter thread contemplating various price support theories read.

FTX, Binance see particularly heavy selling

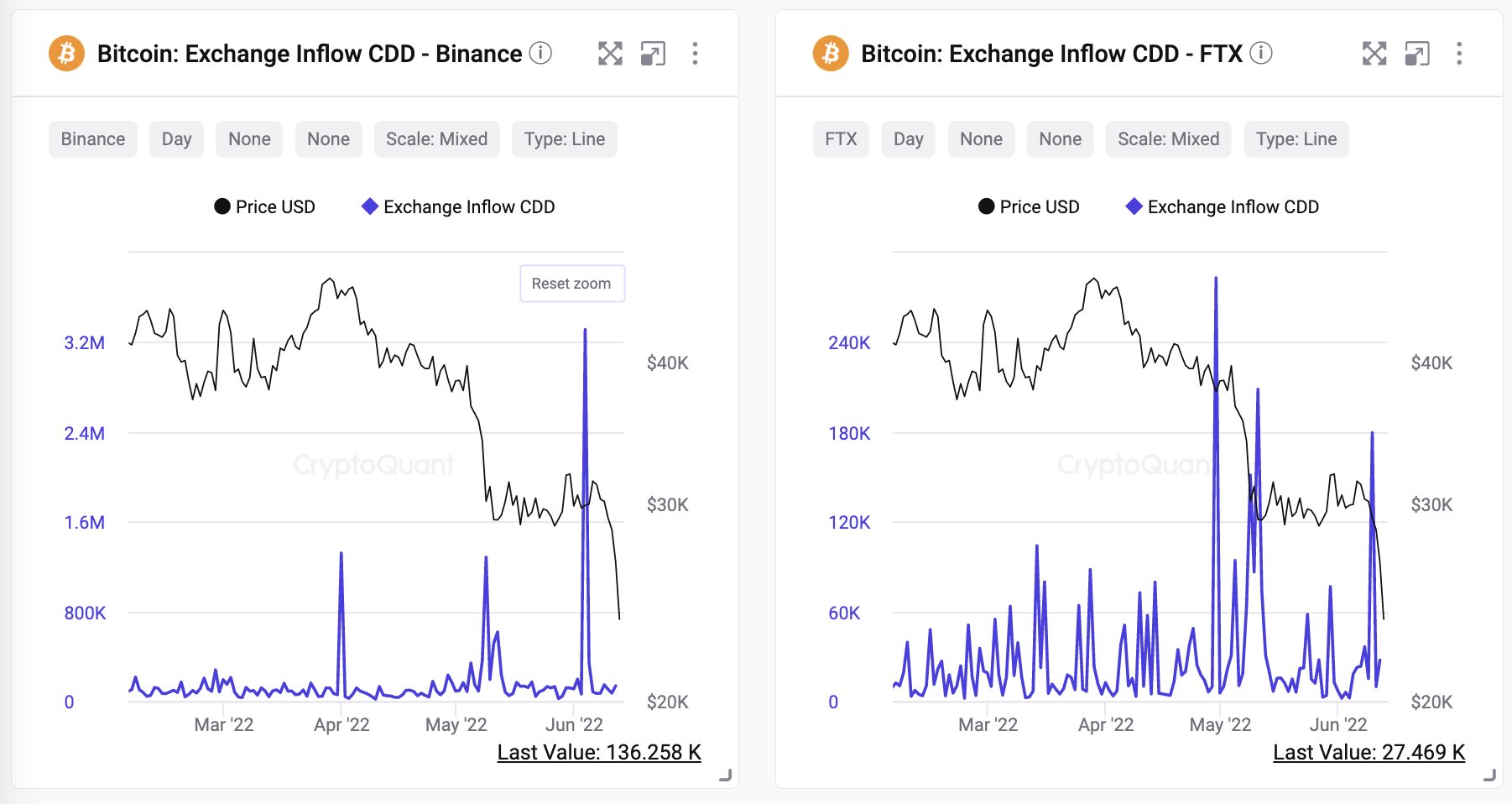

Analyzing who has been selling so far, meanwhile, CryptoQuant CEO, Ki Young Ju, pointed the finger at derivatives traders and largest global exchange Binance.

Related: ‘Too early’ to say Bitcoin price has reclaimed key bear market support — Analysis

Ki noted that the largest number of coin days destroyed — unmoved coins becoming active after a dormant period — came from those specific venues.

“This selling pressure came from Binance and FTX,” he wrote in a Twitter thread June 13.

“$BTC Exchange Inflow CDD(Coins Days Destroyed) indicates old whale deposits. Binance’s Inflow CDD reached a year-high before the drop.”

Ki added that this was in contrast to other whales, who have been comparatively quiet throughout the price upheaval, which began with May’s Terra LUNA implosion.

Data from on-chain analytics resource Coinglass meanwhile shows the extent of downside bias on FTX especially in recent days.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.