The move by Bilibili to file for a secondary listing in Hong Kong is a clear manifestation of the tension between the United States and the Republic of China.

Shares of Bilibili Inc (NASDAQ: BILI) jumped approximately 3.67% in Tuesday’s pre-market to trade around $116.60. Notably, BILI shares closed Monday’s trading session at $112.47, 5.06% down. The spike is attributed to news that the Chinese video-sharing website Bilibili has confidentially filed for a secondary listing in Hong Kong. It is reported that the company aims at raising $2 billion through the listing.

According to news outlet CNBC, the secondary listing in Hong Kong’s stock exchange is in a bid to control adverse volatility on its shares. Bilibili will have followed in similar footsteps by major Chinese tech companies including Alibaba Group Holding Ltd (NYSE: BABA), JD.com, and NetEase.

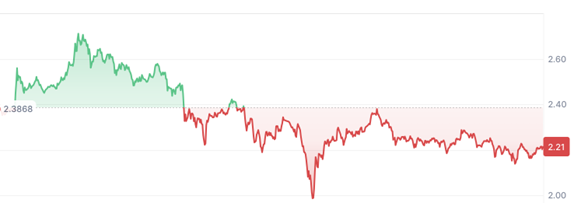

Market data provided by MarketWatch implies BILI stock rallied approximately 391% last year. Besides, BILI stocks are up approximately 135.98% and 46.71% in the past three months and one month respectively. Notably, the company has a reported market valuation of approximately $9.03 billion with 262.07 million outstanding shares.

Having been rated 30 times by credible analysts in the past few months, BILI stocks received an average Buy rating. An indication BILI stocks are poised to rally further in the coming quarters.

Bilibili Performance Ahead of Hong Kong Listing

The move by Bilibili to file for a secondary listing in Hong Kong is a clear manifestation of the tension between the United States and the Republic of China. The two countries began their trade war years back but were intensified during the Trump tenure. However, with his departure from office in less than two weeks, the situation could calm down and businesses operate without much fear of intimidation.

Other than video sharing services, Bilibili also provides users with mobile-based games. Short video streaming services have gained traction during the coronavirus pandemic as observed with TikTok and other emerging global startups.

“We expect short-form video to become a key topic of discussion in the entertainment sector given the huge user base, time spent, and monetization potential,” said Thomas Chong, an analyst at brokerage Jefferies.

Notably, Bilibili will be joined by Kuaishou Technology in filing for a listing on the Hong Kong stock exchange, whereby the latter anticipates raising over $4 billion.

In its recent quarterly earnings results, Bilibili reported a 74% year-on-year increase in net revenue to 3.23 billion yuan ($490 million). Mind you, the average daily video views reported in the 2020 third quarter reached a record high of 1.3 billion.

However, the company is still facing challenges in monetization from its huge customer base. Particularly because most people in China are not used to paying for content.

A financial analyst who sees positive income in both directions of the market (bulls & bears). Bitcoin is my crypto safe haven, free from government conspiracies.

Mythology is my mystery!

“You cannot enslave a mind that knows itself. That values itself. That understands itself.”