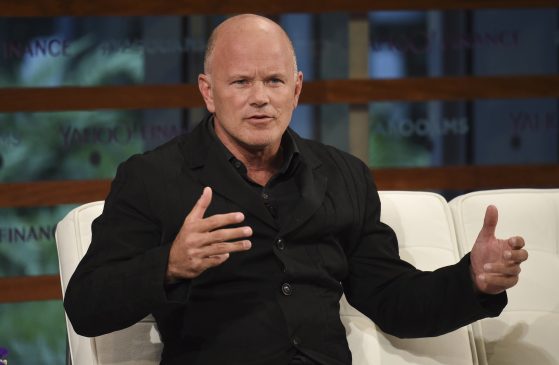

By CCN.com: According to a Bloomberg report, billionaire investor Mike Novogratz’s Galaxy Digital Holding Ltd. lost more than $272 million in 2018 amidst an intense crypto bear market.

From January to December 2018, the valuation of the crypto market dropped from $813 billion to $113 billion by 86 percent as the bitcoin price crashed from its peak at $20,000 to $3,150.

Although the valuation of the crypto market has slightly recovered in Q1, it remains down substantially in the past year (source: coinmarketcap.com)

Since December, within a five-month span, the crypto market has added $55 billion and bitcoin has recovered by 65 percent from $3,150 to $5,200.

Novogratz buys more stake in Galaxy Digital, a bigger bet on bitcoin and crypto

Following a brutal year for Galaxy Digital, Novogratz bought more stake in the publicly traded Canada-based company in January 2019, purchasing 2.7 percent stake in the firm for $5 million.

The acquisition increased the stake of Novogratz in his firm to 79.3 percent, an ambitious bet on bitcoin and the rest of the crypto market after an immense loss in the previous year.

Sam Englebardt, a co-founder of Galaxy Digital, said in an interview with TechCrunch last year that the firm has already invested hundreds of millions of dollars in blockchain, crypto investments, and tokens, so far.

He said:

It’s a merchant bank with a balance sheet to invest. We invest in everything blockchain and crypto-related and in the future of tech broadly. We’re also publicly traded in Toronto [having executed a reverse merger with a shell company on the exchange]. We’ve invested several hundred million dollars already in blockchain and crypto investments and tokens.

The commitment of Galaxy Digital and the acquisition of an additional stake in the company by Novogratz during an intense correction indicates the optimism of Novogratz on the long-term prospect of the crypto industry.

I surveyed notable influencers, analysts and traders for their probability that the bottom is in for this bear market. Here are the results:

95% @woonomic (Adaptive Capital / On-chain Analyst)

90% @jespow (Kraken founder)

90% @arjunblj (Analyst)

85% @novogratz (Galaxy Digital)— Willy Woo (@woonomic) April 22, 2019

Earlier this month, in a survey conducted by cryptocurrency researcher Willy Woo, Novogratz reportedly said that there is an 85 percent chance bitcoin has reached its bottom in December at $3,150.

Why Novogratz went public with Galaxy Digital

Although the investment business remains as the biggest venture of Galaxy Digital, co-founder Englebardt said that the firm would not have gone public in Canada’s stock market if it intended to remain as a venture capital firm.

With several hundred million dollars committed to projects and the firm’s plans to service institutional investors over the long run, Englebardt stated that the firm needed to go public to provide institutions with exposure to blockchain and crypto investments.

“If we’d just wanted to be a venture business, we didn’t need to go public. But we’re in this phase where institutional investors are going to want and need exposure to blockchain [investments] and crypto, while at the same time, it’s going to be a while before they feel comfortable buying these assets directly,” he said.

But, in February, Novogratz firmly noted that the firm expects the crypto market to undergo a difficult recovery process and anticipates institutional investors to take a longer time to get into the cryptocurrency market.

“Realizing having tweeted about crypto in a while. It’s a grind. Don’t think we head north for at least a few more months. Always take longer for institutions to move. Very confident they will. Tons of activity under the hood. Stay the course,” he said.

11/ I’ve been too optimistic about the pace of institutional adoption in the past. It’s coming, but I can’t estimate which quarter (Whether that’s this year or 2022) that we’ll see a big spike. As a humble guess, something like q3 2019.

— Ari Paul ⛓️ (@AriDavidPaul) February 1, 2019

Blocktower Capital’s Ari Paul similarly said that it may take institutional investors several more quarters to commit to the cryptocurrency industry.

In recent months, major financial institutions in the likes of Fidelity and ICE have shown strong efforts to strengthen the institutional infrastructure supporting crypto assets, with Bakkt acquiring DACC on April 29 to better serve institutional investors in the cryptocurrency market.