By CCN: Binance is one of the world’s largest cryptocurrency exchanges and also the scene of a $40 million bitcoin theft. But that has not deterred the firm’s native token, Binance Coin (BNB), from becoming the 2019’s best performing digital asset.

The BNB-to-dollar exchange rate established its year-to-date (YTD) high at $38.646 as on May 26, 2019. That took its profits this year to about 550-percent, including an approx 116-percent rise in May alone. In comparison, Bitcoin, the leading cryptocurrency, recorded a dwarfed 145-percent YTD gain. In truth, every digital asset in the top-10 failed to come closer to Binance Coin, barring Litecoin (LTC), which rose by as much as 310-percent this year.

BINANCE COIN (BNB) POSTS THE MAXIMUM YTD GAINS AMONG TOP TEN COINS | SOURCE: COINMARKETCAP.COM

Scarcity is the Key

One of the main reasons why Binance Coin has been able to brush aside its competition by a large margin is scarcity. Binance every quarter destroys 20-percent of the BNB it accumulates in fees. The exchange aims to continue removing Binance Coins out of circulation until there are only 100 million left. The phenomenon gradually adjusts BNB’s demand against a limited and steadily depleting supply, causing the digital asset’s price to surge.

BNB, in the end, is a discount token for those who access the services offered by Binance exchange. Users purchase the digital asset to pay for everything from transaction to listing fees. And those who use BNB gets an attractive discount, making the coin attractive especially for market makers and active traders.

The pure demand-supply mathematics has been working well so far for BNB in 2019. But that was not entirely the same case in 2018. The digital asset shed more than 85 percent in value ahead of the year’ close despite its number of users increasing. Nevertheless, the drop took place amidst a market-wide bearish sentiment, wherein every top asset suffered huge losses despite their long-term potentials.

🔮Future Prediction: Margin trading on @binance will allow them to capture a majority share of the margin trading market from Bitmex and Bitfinex and make $BNB a top 3 token in the near future.

Congrats to @cz_binance for the new platform upgrade and listening to the community. pic.twitter.com/8pHIWhgkxp

— Jacob Canfield (@JacobCanfield) May 24, 2019

2019 has turned out to be a polar opposite year in comparison. And with Binance now ready with new range services, such as Binance Launchpad to list token projects, and a decentralized exchange to handle customers back the custodianships of their digital assets, the long-term prospects of BNB, in general, have turned bullish.

What do the Technicals Say about Binance Coin

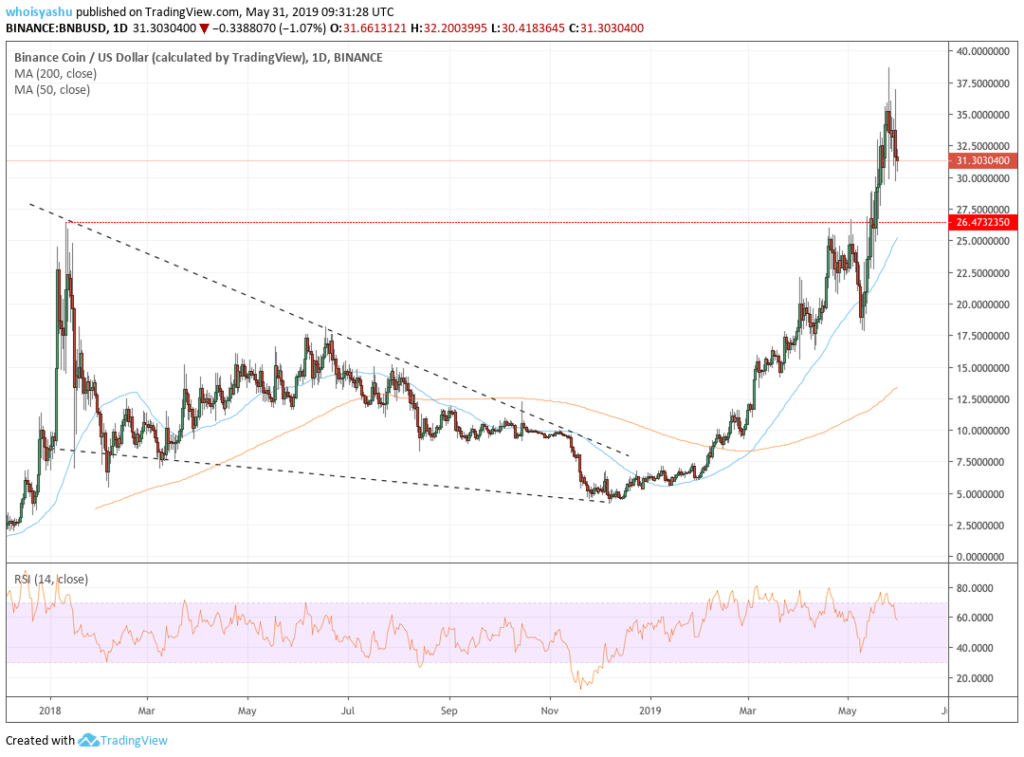

Binance Coin appears to be one of the few digital assets which have more investors than traders. A look at its chart reveals that people have been accumulating BNB tokens all this year. The asset’s first major downside correction of 31-percent this year came in May — owing to the $40 million bitcoin hacking incident — but even the depressive move turned into a buy-BNB-cheap scenario. The BNB-to-dollar exchange rate has surged by more than 50-percent ever since.

Having been established it’s all-time high at $38.646, Binance Coin is now looking at a ceiling-less territory to the upside. The asset has no earlier history in this zone, which means its price can go anywhere based on pure fundamentals.

At the same time, to the downside, BNB is eyeing $26.47 as its interim bear target. The market-wide sentiment is bearish intraday, which could soon reflect in the immediate price action of BNB. Therefore, a drop towards $26.47, followed by a sharp pullback is the best bullish bet one can make.

Conversely, a break below $26.47 would push the same bull scenario towards $17.79, the next potential pullback level.