The world’s largest crypto exchange Binance has launched Binance Decentralized Exchange (DEX) on April 23 following the official release of the Binance Chain mainnet.

Binance DEX, a non-custodial and decentralized exchange that operates on top of the Binance Chain blockchain protocol, enables users to trade crypto assets while maintaining full control over their funds at all times, processing trades on the blockchain.

Changpeng Zhao, the CEO of Binance better known to the community as CZ, told CCN in an exclusive interview that Binance DEX developers have worked to implement ideas suggested by developers in the crypto community to maximize the speed, scalability, and efficiency of the platform.

CZ told CCN:

“During the testnet period, many developers from the community contributed new features and ideas to Binance Chain that are reflected now in the mainnet. The Binance DEX developers have been working hard over the past several months to get the DEX up and running as quickly as possible. We are excited to introduce the platform to the community, and we encourage more projects to explore Binance Chain for the speed and benefits it offers.”

A New Era in Crypto Trading: Can DEXes Appeal to Casual Traders?

Throughout the past several years, many decentralized exchanges emerged on various blockchain networks including Ethereum in an attempt to provide a platform in which users are able to control their funds and trade cryptocurrencies simultaneously.

The main issue, however, was noticeable boundaries in user experience (UX) and user interface (UI).

Although the allure of complete control over private keys may be sufficient to drive traders from centralized platforms to decentralized exchanges, if UX and UI are subpar to the point in which it is extremely difficult for users to switch seamlessly, the appeal of DEXes declines.

Inevitably, the poor UI and UX of decentralized exchanges led to a drop in user activity, ultimately causing liquidity issues in many cases.

Fred Ehrsam, a former Goldman Sachs executive and a Coinbase co-founder, previously said:

There are some drawbacks. Decentralized exchange requires users to manage the security of their own funds and tools for that are immature. They currently have low throughput and face the same scalability challenges as their underlying blockchains, so those wanting low latency and high throughput will prefer centralised exchanges for quite a while.

The key to the success of decentralized exchanges would be to at least maintain the same standard of centralized exchanges in areas including UI, UX, scalability, and efficiency, which is difficult to execute in a decentralized environment.

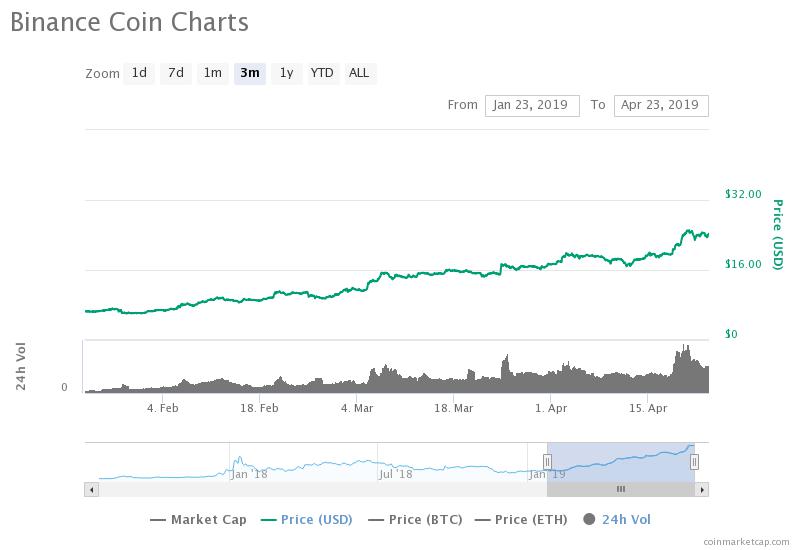

Binance coin (BNB) has increased by more than 3-fold in the past 3 months (source: coinmarketcap.com)

In an official public statement, the Binance team confirmed that during the testnet phase of the Binance Chain blockchain protocol, around 8.5 million transactions were processed in a simulation, a capacity that may be sufficient to handle large demand from traders.

CZ also added that the Binance DEX team will continue to work closely with projects and teams to grow the DEX ecosystem and to provide users with significantly more control over their own funds and asests.

He said:

We believe decentralized exchanges bring new hope and new possibilities, offering a trustless and transparent financial system. With no central custody of funds, Binance DEX offers far more control over your own assets. We hope this brings a new level of freedom to our community. We will work closely with projects and teams to grow the entire ecosystem.

Scalability is Crucial

Efficiency, especially when it comes to trading, is crucial because a server downtime on an exchange or a technical issue could cause short-term or day traders losses if the exchange is clogged and trade orders cannot be executed.

Such a problem could always occur on a decentralized exchange or any blockchain-based application for that matter because data is processed through a peer-to-peer protocol.