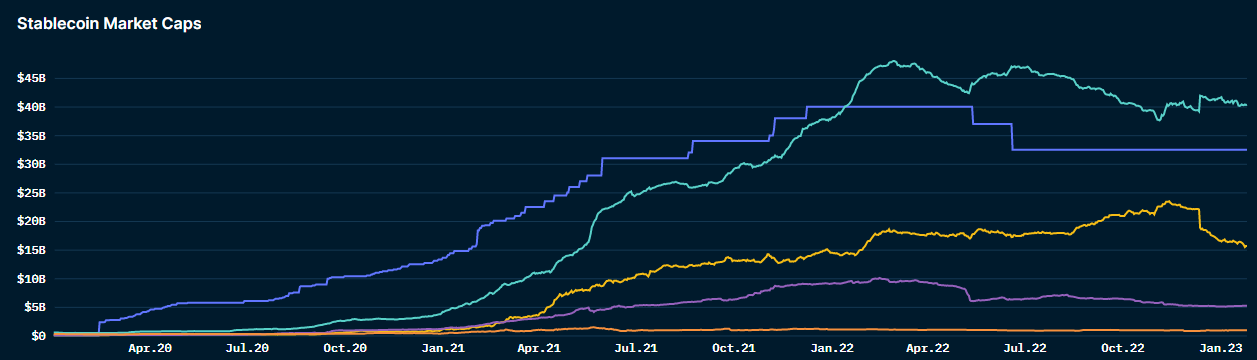

Stablecoins in the cryptocurrency market help provide U.S. dollar-pegged tokens within the volatile industry. In bull markets, the market capitalization of stablecoins tends to decrease as investors flock to more volatile assets; and in bear markets, investors seek shelter in low-volatility stablecoins, thus increasing their market caps.

On Jan. 26, the total market capitalization for stablecoins like Tether (USDT), USD Coin (USDC), Binance USD (BUSD) and Dai (DAI) is over $131 billion.

Stablecoins are so crucial to the future of crypto that Moody’s, a well-respected analytics agency, is planning to develop a scoring system, which may help reduce the speculation and fear that some investors have with stablecoins.

Such fear amid a lack of stablecoin transparency has led one of the top stablecoins, BUSD, to see a major usage decline in recent weeks.

Let’s examine the factors affecting the BUSD stablecoin.

BUSD’s market cap takes a major hit

While the BUSD market cap witnessed a large bump on Sept. 30, 2022, those gains came from Binance’s decision to forcefully swap the exchange’s USDC holders to its own stablecoin. Those gains have since evaporated. At the time, the automatic conversions took $3 billion off of USDC’s market cap.

BUSD’s market cap has continued to fall due to problems with the dollar-pegged tokens’ management that first came to light in January 2023. While Binance pushed back on reports that the stablecoin was not fully backed, investor fears led to a major exodus.

According to blockchain analytics provider Nansen, the circulating supply of BUSD decreased to $15.4 billion on Jan. 25. The drop represents a decrease of $1 billion from the previous week and $2 billion compared with December 2022.

The most recent decline sped up BUSD’s market cap decrease from $22 billion when worried investors rushed to withdraw money from Binance after it misrepresented the amount of digital assets in its collateral reserves by combining corporate holdings on reports.

BUSD inflows struggle

When the price of Bitcoin (BTC) is on the rise, like it has been recently, stablecoins typically see a decrease in inflow as investors sell for other assets. A way to measure demand for stablecoins is to look at exchange inflows.

According to analytics provider CryptoQuant:

“Higher value indicates investors who deposited a lot at once are increasing recently. For stablecoin, value rise indicates buying pressure.”

This means negative numbers show a decrease in buying pressure. While all stablecoins are seeing lower demand or inflows, BUSD has witnessed nearly 3x more inflow.

The massive decrease in demand may continue as the markets continue to rise and questions around BUSD remain.

The majority of BUSD is on Binance

Stablecoins see an uptick in demand when they are utilized in trading pairs with altcoins. The trading use case works on both centralized exchanges (CEX) and decentralized exchanges (DEX).

A concerning statistic surrounding BUSD is the lack of stablecoin use outside of its parent exchange, Binance. While $13.8 billion in BUSD resides on Binance, the next closest tally is $32.6 million in BUSD on Crypto.com. While Crypto.com may be the second-largest exchange for BUSD, USDC is the largest stablecoin on the CEX, with $582 million, dwarfing BUSD’s numbers.

The lack of use cases following the major decrease in demand for BUSD does not bode well for its market cap if the trend sustains over a long period of time. Combining these two negatives with the recent move by SWIFT to ban dollar transfers lower than $100,000 on Binance suggests that the stablecoin could continue to face major headwinds.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.