By CCN Markets: Binance, the world’s largest crypto exchange by trading volume, is launching in the U.S. with a partnership with BAM Trading Services Inc. as Binance.US.

Speaking to CCN in an exclusive interview, Binance CEO Changpeng Zhao explained the motive behind the company’s decision to expand into the U.S. and the team’s view of the regulatory landscape in the U.S.

Why binance is finally launching in the u.s.

As seen in the recent fallout between Bittrex and the regulators of New York, the U.S. remains a tough market for both crypto startups and large-scale exchanges to crack due to regulatory uncertainty.

Leading exchanges in the U.S. market in the likes of Coinbase, Kraken, and Gemini have been able to take a compliance-first approach in sustaining their operations despite the high operational costs required in doing so, which many small startups are typically not able to handle.

Binance launched about two years ago in 2017 and since then, the company has expanded to several markets including the U.K. and Uganda, and is expected to launch in Singapore in the near term.

Throughout the past two years, Binance CEO Changpeng Zhao emphasized that the company has been observing the “challenging regulatory landscape” in the U.S., avoiding the major crypto market with plans to expand with full regulatory compliance.

Zhao stated that the company is confident that it can provide services to local users in the U.S. in a compliant and secure manner, interacting with local regulators and partners.

He said:

There has also been confusion as to why Binance has not registered in the U.S. Well, Binance is a very early stage technology start up, and since launching our services less than 2 years ago, we have faced a smorgasbord of ever-changing regulations from around the world. We (Binance.com) have been working tirelessly to improve our regulatory knowledge and capabilities as we aim to provide our services in the utmost compliant and secure manner in whichever new market we plan to enter.

While Binance has specifically prevented from building a presence in the U.S. since its inception, it has established itself as a dominant exchange in the global crypto exchange market.

According to a recent report released by the Blockchain Transparency Institute, Binance remains as the only exchange out of the top 15 exchanges on major market data provider CoinMarketCap with over 85 percent in real and verifiable volume.

Bitwise Asset Management, an investment firm based in the U.S., disclosed in a presentation to the U.S. Securities and Exchange Market (SEC) in March that when 95 percent of the volume in the bitcoin exchange market is removed that represent fake or inflated figures, Binance accounts for 40 percent of global bitcoin volume.

Binance accounted for 40 percent of global bitcoin volume in March (source: Bitwise Asset Management)

If Binance succeeds in penetrating into the U.S. crypto exchange market swiftly following its expansion, it would further solidify the presence of the exchange at a global scale.

Is U.S. a big enough market to co-exist with coinbase?

Binance and Coinbase are considered to be the biggest crypto exchanges in the global market based on various criteria including volume, web traffic, and number of active users.

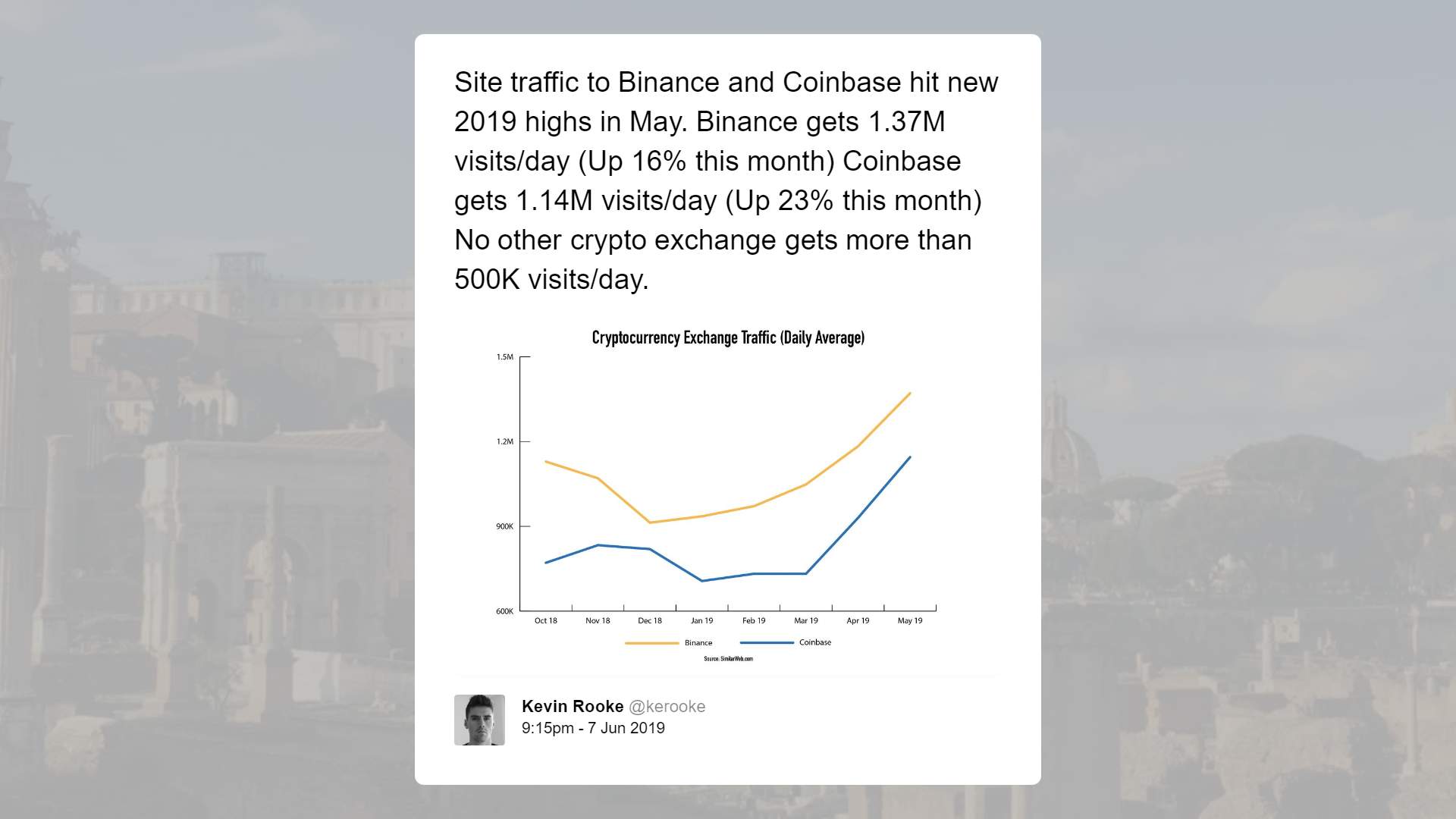

Kevin Rooke, a technology researcher, reported that Binance has recorded 1.73 million visits per day in June, up 16 percent month-over-month, and Coinbase recorded 1.14 million visits per day, up 23 percent month-over-month.

No other exchange comes close to the million mark based on the findings of Rooke, falling below 500,000 visits per day.

Zhao told CCN that he sees the U.S. as a big enough market for both Binance and Coinbase and compared to the size of traditional financial institutions, Binance remains a small organization.

“We believe there is so much room for every organization in this space to grow, and not at the expense of each other, but together. By working together, we can grow the industry faster, which is more beneficial for everyone in the industry,” he said.