The total crypto market cap lost $8 billion of its value since the morning of Monday, December 9, and now stands at $195.5 billion. The top ten coins are all in red for the last 24 hours with Binance Coin (BNB) and Ethereum (ETH) being the worst performers with 2 and 2.2 percent of loses respectively. At the time of writing bitcoin (BTC) is trading at $7,162 on the Bitstamp daily chart, while ether (ETH) stands at $142 and Ripple’s XRP hovers around $0.218.

BTC/USD

Bitcoin continued to hover around $7530 on Sunday, December 8, while trading volume was steadily decreasing. The coin was mainly seen moving in the $7,580 – $7380 zone.

The Monday session started with a huge drop to $7334 as the BTC/USD pair lost 2.6 percent of its value and once again fell below the current uptrend line.

On Tuesday, December 10, the most popular cryptocurrency continued to slide and formed its second consecutive red candle. It moved down to $7214, right at the previously discussed Fibonacci 61,80% level, which we consider stable horizontal support.

The mid-week session on Wednesday proved to be no different. The coin lost more ground and fell to $7204 after touching $7113 during the early hours of the day.

Bakkt successfully launched its monthly options on a futures contracts for bitcoin officially announced on December 9. The institutional investing platform became the first to offer CFTC regulated options based on cryptocurrencies.

In the meantime, The People’s Bank of China (PBoC), which is the country’s central bank is reportedly aiming to test its digital currency by the end of this year. According to the local financial news media Caijing, the digital currency electronic payment (DCEP) will be first launched in the cities of Shenzhen and Suzhou with the help of seven government-owned companies mainly from the financial and telecommunications sectors. The partners in the projects are still to be officially confirmed.

The Swiss-based fintech company Amun AG received regulatory approval to expand its crypto exchange-traded products (ETP) in more areas in the European Union. On December 10, the Swedish Financial Supervisory Authority (SFSA), or Finansinspektionen gave its green light to the Base Prospectus by Amun, which will allow ETP offering in the country. Amun is currently represented in Switzerland through the country’s primary stock exchange SIX, and also in Germany, on the Boerse Stuttgart.

ETH/USD

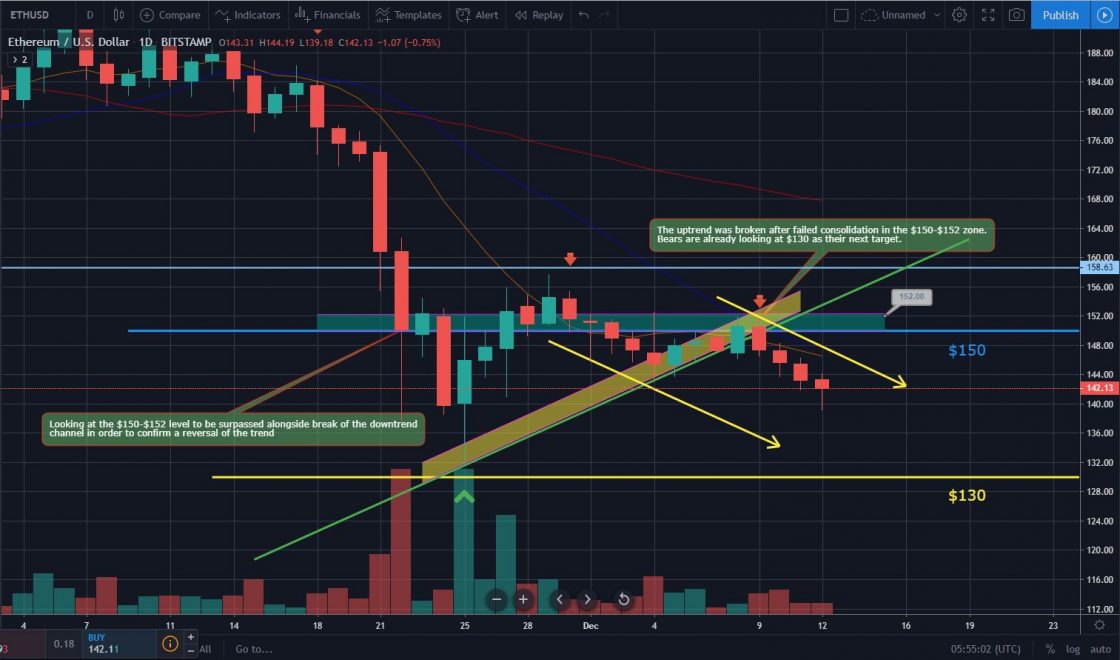

The Ethereum Project token moved North to $151 on Sunday, December 8 and successfully returned to the $150-$152 support zone.

The coin started the new trading period on Monday with a correction to $147. It formed the exact same candle, but in the opposite direction, erasing all gains from the previous day.

The ETH/USD pair continued dropped further to $145 on Tuesday, December 10 after trading as low as $143 during intraday.

On Wednesday, the ether formed its third straight losing session and fell to $143. The current monthly low of $143 was surpassed in the early hours of December 12 as the coin was heading towards $130.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4