Total crypto market cap added $100 billion to its value for the period since Monday and now stands at $1,558 billion. The top ten coins are showing mixed results for the last 24 hours with Binance Coin (BNB) growing by 29 percent while Ripple’s XRP (XRP) erased 2.4 percent. At the time of writing bitcoin (BTC) is trading at $51,243 on the Bitstamp daily chart, ether (ETH) climbed up to $1,895.

BTC/USD

Bitcoin closed the previous trading week with a 25 percent of a price increase. During the intraday session on Sunday, February 14, the coin hit the $49,667 mark, which was then sitting at the diagonal uptrend line.

It was the fourth time in the last five days for BTC to reach this mid-term resistance and traders were referring to it as the next big uptrend trigger point.

The new seven-day period started with a short pullback to $47,881 on Monday. The BTC/USD pair was consolidating for its next leg up as the psychological level at $50,000 was closed than ever.

The second day of the trading week came with another attempt to break the mentioned diagonal resistance. This time, buyers pushed the price up to $50,558 before closing the session at $49,178. Still, bitcoin finally broke the $50k mark while most of the altcoins were trying to find their bottom after a three-day-long correction. The main factor behind the double-digit pullbacks in the major alts was the fact market participants were cashing out their positions to chase the biggest cryptocurrency while it was making its new all-time highs.

The mid-week session on Wednesday was when BTC finally surpassed the upper limit of the corridor. It skyrocketed all the way up to $52,190, adding 6 percent to its market capitalization.

As of the time of writing this, bitcoin is hovering around $51,253.

24-hour trading volumes increased from $56 billion on Sunday to $68 billion on Thursday morning.

4-hour chart:

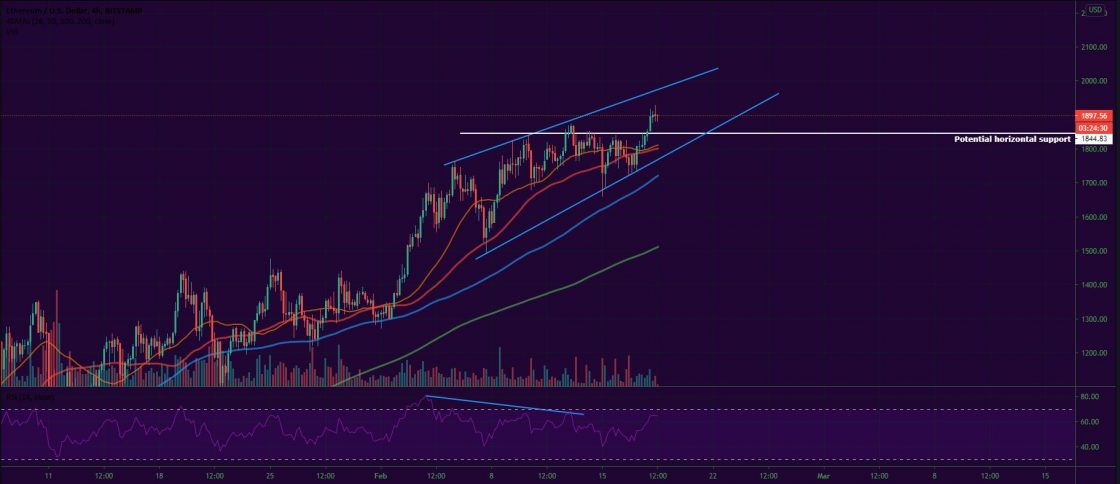

ETH/USD

The Ethereum Project token ETH reached an all-time high of $1,875 on Saturday, February 13. The coin started correcting its price in the evening part of the session as profit-taking activities were kicking in. The coin was taking a breath before preparing the long-expected attempt to break the psychological level of $2,000. It ended the seven-day period at $1,802 or 11.5 percent up compared to where it was the same time a week ago.

On Monday, the ETH/USD pair continued to slide. It dropped as low as $1,660 as the entire altcoin market was severely bleeding. Still, the coin managed to recover during the second part of the trading day and used the $1,775 level as support to close the daily candle at $1,780.

The ether remained flat on Tuesday and even though it was moving up and down in the $1,720 – $1,820 zone, it avoided further losses and stabilized in the support area.

The third day of the workweek came with another run to $1,850. The level was now acting as horizontal resistance. This move resulted in 3.6 percent being added to ETH’s valuation.

As of the time of writing, the ether is trading at $1,895

4-hour chart:

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4