Total crypto market cap added $112 billion to its value for the period since Monday and now stands at $1,137 billion. The top ten coins are mostly in green for the last 24 hours with Polkadot (DOT) registering 12.4 percent of price increase while Chainlink (LINK) lost 3.1 percent. At the time of writing bitcoin (BTC) is trading at $37,780 on the Bitstamp daily chart, ether (ETH) climbed up to $1,633.

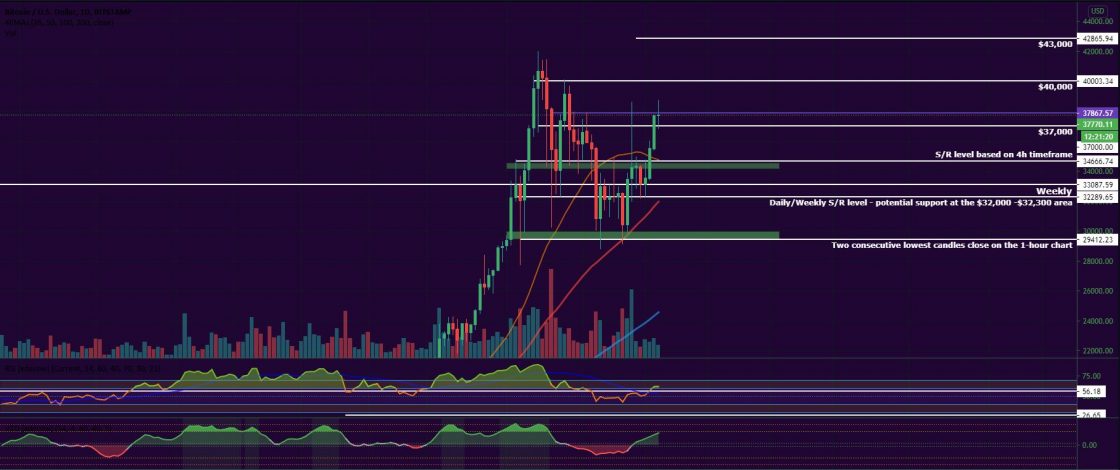

BTC/USD

Bitcoin closed the trading day on Sunday, January 31 at the weekly support level of $33,105. The coin erased 3.3 percent of its value and briefly touched the next strong support on the daily/weekly timeframes during intraday – $32,300. Despite the decline and the recent volatility, BTC managed to grow by 11.7 percent during the first month of 2021.

On Monday, the bull traders launched another attack on the $34,700 level and even though they were rejected, the upside reversal was already in the making. The BTC/USD pair ended the session at $33,560 after moving up and down in the wide range between $34,700 and $32,300.

What we saw on February 2 was an unexpected to many as BTC was not showing the necessary bullish momentum and the required strength to break above both the diagonal and horizontal resistances. That is exactly what happened as the biggest cryptocurrency stormed past the $34,700 level, the mid-term diagonal resistance line, and the 26-day EMA on the daily chart. The coin added 6.2 percent and reached $35,520.

The mid-week session on Wednesday was a continuation of the upward movement. It was the third straight day in green for bitcoin as it surpassed the psychological level of $37,000 for the first time since January 19 (if we exclude the so-called “Musk candle” from January 29).

On Thursday morning, it hit a weekly high of $38,769 before dropping back to sub-$38k as of the time of writing.

The 24-hour trading volumes were stable in the $48-$50 billion area for the first three days of the workweek.

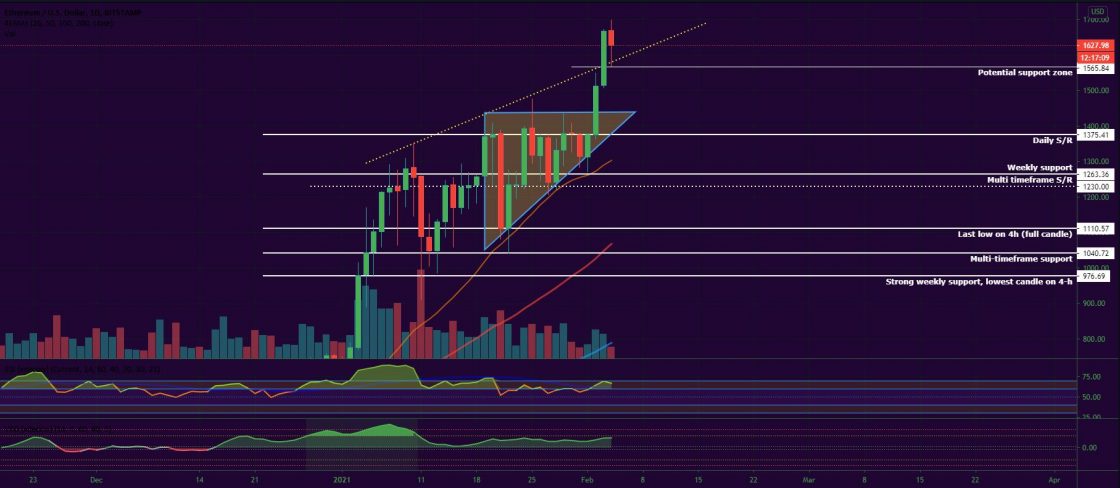

ETH/USD

The Ethereum Project token ETH concluded the month of January with the stunning 78.5 percent of price increase. It was also one of the best performing major altcoins for the period considered by many as severely undervalued. Still, the coin was rejected at the daily resistance level of $1,375 on January 31 and erased 4.6 percent, closing the day at $1,314. The ETH/USD pair maintained its course in the uptrend channel and continued with the formation of the ascending triangle pattern.

On Monday, February 1, the leading altcoin once again hit $1,375 after rebounding from the 26-day EMA on the daily chart.

The move was followed by a solid upside impulse on Tuesday when the ether skyrocketed all the way up to $1,514, or 10 percent higher, also breaking out of the already-mentioned triangle pattern. The coin also registered a new all-time high.

On the third day of the workweek, it continued to climb breaking above the uptrend channel and the $1,600 level, stopping at $1,670.

As of the time of writing, ETH is trading lower – at $1,628.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4