The total crypto market cap dropped another $5 billion to $118 since January 11, 2019, as bitcoin and the top ten currencies continue to struggle to reverse the bear trend.

BTC-USD

Bitcoin stayed flat on January 11 and closed trading session at $3,715 after four consecutive red candles on the daily chart. The BTC-USD pair extended losses on January 12 and dropped to $3,700. Trading volumes also declined from between $4 to 3.5 billion during the week to below $3 billion over the weekend. The low interest from traders’ side resulted in relatively small change in price for the period.

Bitwise, the creator of the world’s first cryptocurrency index fund, filed an initial registration statement on Form S-1 with the U.S. Securities and Exchange Commission (SEC) for an Exchange Traded Fund (ETF). The suggested instrument will track the company’s own Bitcoin Total Return Index, which follows prices from a variety of crypto exchanges making it slightly different from the rest of the ETF proposals so far. Additionally, the company will keep holdings in a cold storage with a regulated third-party custodian.

At the same time, digital assets are once again top priority in the SEC Examination Priorities report. In the 2019 version of the document, prepared by the Office of Compliance Inspections and Examinations (OCIE), the agency reported:

“[It will] take steps to identify market participants offering, selling, trading, and managing these products or considering or actively seeking to offer these products and then assess the extent of their activities. For firms actively engaged in the digital asset market, OCIE will conduct examinations focused on, among other things, portfolio management of digital assets, trading, safety of client funds and assets, pricing of client portfolios, compliance, and internal controls.”

In Europe, the Russian government is also looking to speed up the process of regulating cryptocurrencies as reported by the official website of the Russian Duma (Parliament). According to the report, Vyacheslav Volodin, the chairman of the lower chamber of the Russian parliament, is looking to push the digital economy bills forward making them a top priority during upcoming sessions. Russia is struggling to pass its digital asset bill since the beginning of last year due to the lack of definitions of core cryptocurrency principles and components.

The most popular cryptocurrency moved below the $3,600 line on January 13 for the first time this year and closed the day at $3,590, 13.7 percent down for the seven-day period. At the time of press, the pioneer cryptocurrency is trading at $3,585.

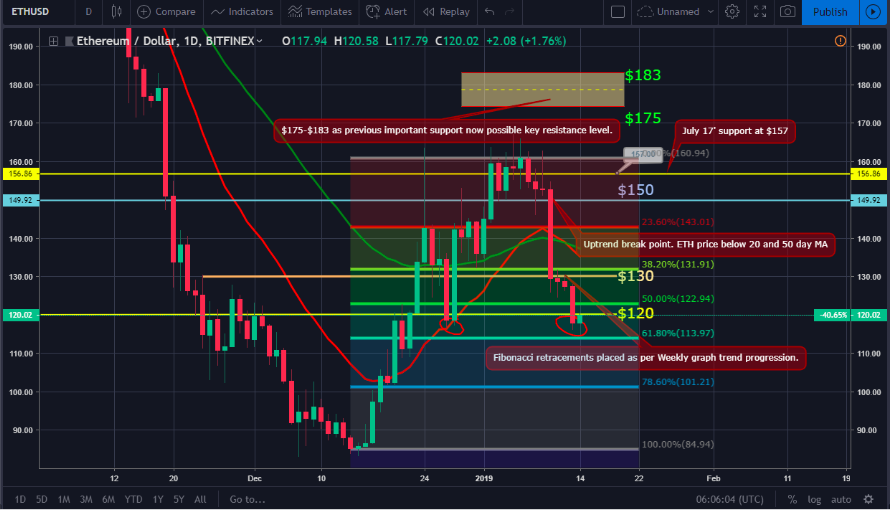

ETH-USD

Ether continued its march south on January 11 as it closed its fifth consecutive day of losses. The ETH-USD pair stopped at $128, 20 percent lower since the beginning of the bear correction on January 8 when it last peaked at $161. It moved even lower, to $127, on January 12 and was once again eyeing the levels below $120.

Observers continue to follow last week’s 51% attack on the Ethereum Classic (ETC) network. Crypto exchange Gate.Io, which was heavily impacted by the issue, reported in a press release that the attackers had returned $100,000 value of ETC back to them without explanation. According to the platform, the hashing power of ETC network is still not strong enough and it’s still possible to rent enough hashing power to launch another attack.

The third biggest cryptocurrency in terms of market cap lost 7.8 percent on January 13 and closed the trading session at $117, below the important $120. Last time ETH dropped this low, on December 27, it managed to rebound immediately up to $142. At the time of press, ether is trading at $118.

Category: Altcoins, Bitcoin, Cryptocurrency Market Outlook, Ethereum, Exchange, Finance, News, Price Analysis

Tags: bitcoin, BTC, ETH, ether, Ethereum, Market Outlook, news, price analysis, trading