There was little change in global market cap value since Wednesday, January 23 as bitcoin, ether, and XRP are all trading sideways.

BTC/USD

Bitcoin lost $40 of its value to $3,600 on the CBOE ETF withdrawal news on January 23. It quickly recovered and stabilized around 3,620 by the end of the trading session possibly due to the fact the exchange traded fund was not directly rejected by the U.S. SEC. The proposed product was temporarily delayed by the company to avoid automatic rejection on the scheduled deadline of February 27 and “build appropriate market structure frameworks for a Bitcoin ETF and digital assets in general,” as confirmed by VanEck’s Gabor Gurbacts.

The BTC/USD pair moved up on January 24 to reach $3,650 still not able to escape from the $3,600 to $3,700 corridor.

On January 23, the Financial Conduct Authority (FCA), UK’s financial regulator, issued a consultation paper titled “Guidance on Cryptoassets.” The goal is to help companies involved in the crypto industry understand whether their cryptoasset activities fall under FCA regulation and also to achieve greater clarity of what is regulated and what isn’t.

The final version of the guidance document will set out the crypto-related activities FCA regulates and will be released on April 5, 2019. According to the UK financial authorities, the cryptocurrency market could bring a host of benefits, but still remains a big risk for retail consumers and companies due to its unregulated nature and lack of transparency.

The Hong Kong-based Atom Group will use the London Stock Exchange Group trading technology on its platform. The official announcement came out on January 22 and was confirmed by Bloomberg. The AAX exchange is set to debut in June this year and will be built on the LSE’s Millennium Exchange matching engine. According to Lorne Chambers, global head of sales and marketing for LSEG Technology, the exchange will benefit from the use of an already existing trading technology and will also comply with any upcoming rules on digital exchange operations. Hong Kong’s securities and futures commission (SFC) is in discussion to introduce crypto regulation since October 2018.

In the meantime, the United Arab Emirates and Saudi Arabia announced that they would collaborate on a new cross-border digital currency. The decision was made on January 19 during the first ever meeting of The Executive Committee of the Saudi-Emirati Coordination Council in Abu Dhabi where the two countries agreed to combine efforts in seven initiatives in the fields of services and financial markets, tourism, aviation, entrepreneurship, customs, and security.

The Saudi-Emirati Pilot cryptocurrency will be used by local banks during its experimental phase and will help authorities evaluate the benefits of blockchain technology and the way cross-border payments work.

ETH/USD

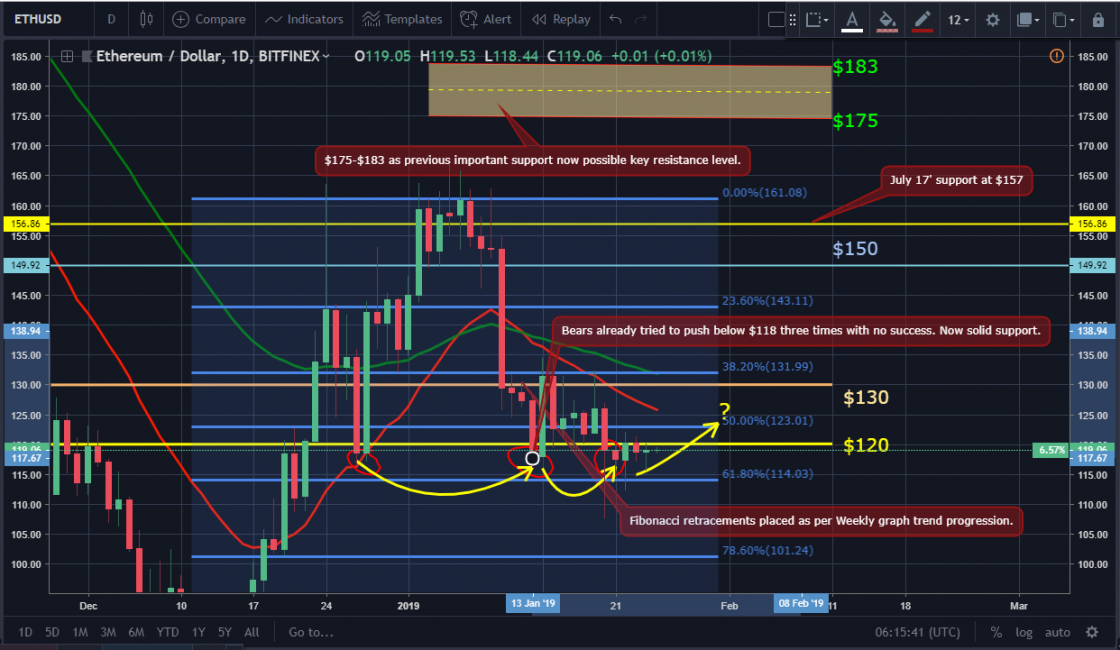

Ethereum found its short to mid-term bottom at $118 since it peaked at $160 on January 6 and has been trading in the $131 to $118 corridor for more than two weeks with no breakout possibilities in sight.

The ETH/USD pair reached a point where many analysts agreed it is oversold and the expectations point, and still are, to a temporary reversal in trend. On the other hand, the CBOE ETF withdrawal, although not as negative as expected, brought back the negative mood to the markets.

One of the most popular altcoins closed the trading session on January 23 at $118 with a $2 loss as it continued to hold above that strong support line. It stabilized around $119 on January 24 after dropping to $115 during the day-trading session.

The next target for bulls will be to reach $120 and hold it in order to consolidate for an attack towards $130. Downwards we see $118 and then $100 as critical resistance points.