Bitcoin price traded to a new monthly low at $9,853 before correcting higher against the US Dollar. BTC is still following a bearish pattern and it is likely to accelerate lower below $10,000.

- Bitcoin is trading in a bearish zone below the $10,800 and $10,500 support levels.

- The price is facing a strong resistance near $10,500 and the 100 hourly simple moving average.

- There is a major declining channel forming resistance near $10,300 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is likely to resume its decline as long as it is below $10,300 and $10,500.

Bitcoin Price Remains At Risk

In the past few days, there was a strong decline in bitcoin price below the $10,800 support against the US Dollar. BTC even settled below the $10,500 support and the 100 hourly simple moving average.

A new monthly low is formed near $9,853 and the price is currently consolidating losses. There was a short-term upside correction above the $10,000 and $10,050 levels. Bitcoin recovered above the 50% Fib retracement level of the recent decline from the $10,640 high to $9,850 swing low.

However, the price is facing hurdles near the $10,400 level. There is also a major declining channel forming resistance near $10,300 on the hourly chart of the BTC/USD pair.

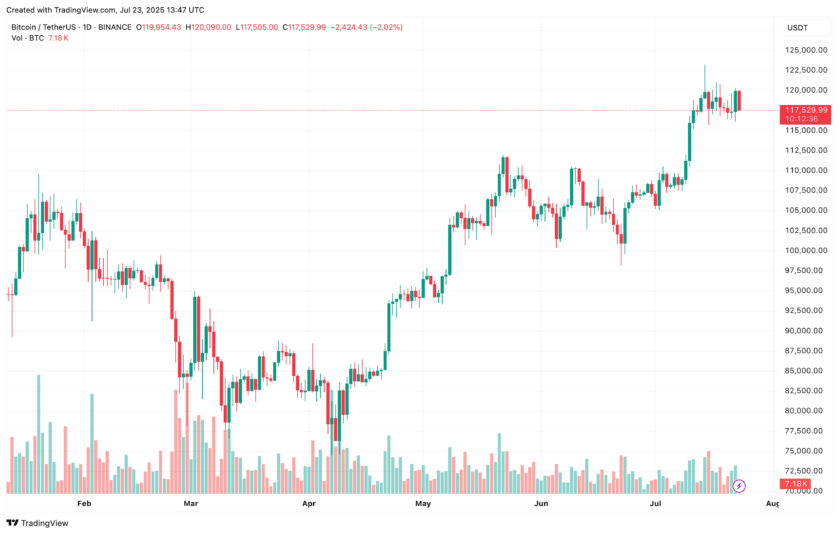

Bitcoin price trades below $10,300. Source: TradingView.com

The channel resistance is close to the 61.8% Fib retracement level of the recent decline from the $10,640 high to $9,850 swing low. A clear break above the channel resistance could send the price above the $10,350 level.

Conversely, the price might continue to move down below $10,100 and $10,050. The main support is near the $10,000 level. A daily close below the $10,000 support may perhaps start a strong decline towards $9,800 and $9,600 in the near term.

Chances of a Recovery in BTC?

The first major hurdle for bitcoin is near the channel resistance and $10,300. The next key resistance is near the 100 hourly SMA and the $10,500 level.

A successful close above the $10,500 is needed for a fresh increase in the coming sessions. In the stated case, the price might recover towards the $11,000 resistance zone.

Technical indicators:

Hourly MACD – The MACD is slowly losing momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently struggling to stay above the 50 level.

Major Support Levels – $10,050, followed by $10,000.

Major Resistance Levels – $10,300, $10,400 and $10,500.