Gold bug Peter Schiff got dragged on Twitter after spouting false information about bitcoin. Schiff incorrectly claimed that BTC prices have plunged 15% since June 19.

By comparison, Schiff gloated that gold prices have spiked 10% during the same period.

Instead of dropping, Schiff said the bitcoin price should have climbed due to a combination of “favorable press, weakness in global currency and stock markets, and falling interest rates.”

Since June 19th, favorable press, weakness in global currency and stock markets, falling interest rates, and a 10% rise in the gold price, have provided ample reasons for Bitcoin speculators to buy. Yet Bitcoin’s price fell 15%! Hodlers should wonder who’s been selling, and why?

— Peter Schiff (@PeterSchiff) August 8, 2019

Schiff then derisively suggested that BTC holders are probably experiencing some remorse about not selling. “Hodlers should wonder who’s been selling, and why,” he tweeted.

‘You, sir, are lying’

Francis Pouliot, the CEO of Canada-based bitcoin exchange Bull Bitcoin, reacted by drop-kicking Schiff on Twitter.

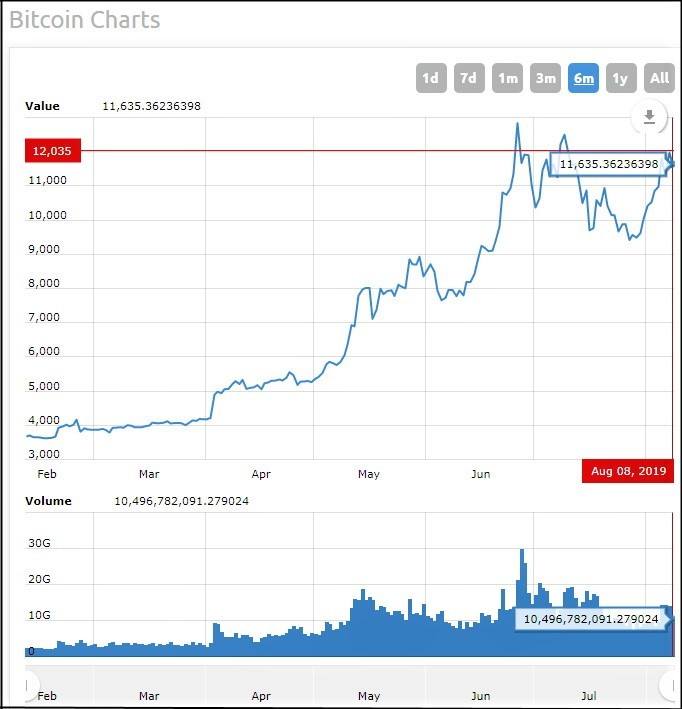

Pouliot attached a chart contradicting Schiff’s claims and showing the gradual crescendo in the bitcoin price over the past seven weeks.

“You, sir, are lying. Bitcoin increased $2,000 per coin since June 19th.”

In a follow-up tweet, Pouliot said Schiff’s mistake probably stemmed from his “trauma from the guilt of leading his followers away from unfathomable wealth since 2013” by repeatedly dissing crypto.

.@PeterSchiff claims Bitcoin price fell by 15% since June 19th.

This is weird, because market data facts are easy to verify and it is very obvious he is wrong.

Trauma from the guilt of leading his followers away from unfathomable wealth since 2013 taking its toll? https://t.co/To6MlKVXPa

— Francis Pouliot ☣️ (@francispouliot_) August 8, 2019

Crypto Twitter: Baby boomers cling to gold

Other crypto bulls chimed in to smack down Schiff, whom they believe was intentionally spewing FUD. In the past, Schiff has repeatedly trashed bitcoin and dismissed its investors as “dumb, inexperienced kids.”

One Twitter user suggested that Peter Schiff is enamored with gold because that’s what people in his age group like. “No one under 50 years old wants gold,” he snipped.

Another joked that Baby Boomers are in for a rude awakening when they’re “forced to sell all their gold to cover medical expenses at the same time when millennials take over a new digital economy.”

Just wait till boomers are forced to sell all their Gold to cover medical expenses and lifestyle at the same time while millenials take over a new digital fast paced economy. #Gold‘s 7 trillion market cap will collapse like a house of cards. We’ll all plate our stuff cheaply 🤣 pic.twitter.com/RhQvTUMHag

— Crypto Millionaire App (@eagletwitt3r) August 8, 2019

Gurbacs: Gold and bitcoin can coexist

Gabor Gurbacs of investment management firm VanEck referred Schiff to a prior tweet, where he said that “gold bugs created a good number of bitcoin fans.”

Gurbacs’ implication is that bitcoin and gold can coexist instead of competing with each other in a zero-sum game where only one asset survives.

Cc: @PeterSchiff

— Gabor Gurbacs (@gaborgurbacs) August 8, 2019

Another member of Crypto Twitter shared a hilarious poem, where he playfully mocked “Peter, Peter gold bug dear.”

Ledger Allan Poe?

— Bueller (@BuellerFund) August 8, 2019

Ninety minutes after his initial tweet, Schiff corrected himself and admitted he made a mistake. Schiff noted that bitcoin is “down 15% from its June 26th high, not June 19th.”

I actually got something wrong on Bitcoin. It’s down 15% from its June 26th high, not June 19th. https://t.co/E8HUtSMv8N

— Peter Schiff (@PeterSchiff) August 8, 2019

In response to Schiff’s continued negative spin, VanEck’s Gurbacs suggested that Schiff compare bitcoin to gold using standardized one-year, three-year, five-year, and 10-year periods.

Gurbacs promised that “as a gold guy, you should like what you’ll find.”

That riposte garnered plenty of Twitter props.

— Senior Jefe Bai (@baijorge) August 8, 2019

— BTCKing USA Distributor #XPOS by Pundi X (@BitcoinKingom) August 8, 2019

The U.S. stock market’s wild fluctuations this week ignited speculation that the bitcoin price spiked because investors were flocking to it as a hedge against market turmoil.

Bitcoin Surge Proves It’s a Haven from Stock Market Turmoil: Circle CEO https://t.co/9nsBMBqCJE

— CCN Markets (@CCNMarkets) August 5, 2019

Many crypto bulls believe that increasing geopolitical conflicts caused investors to seek refuge in safe-haven assets such as gold, U.S. Treasury bills, and bitcoin. However, because of its extreme volatility, bitcoin is not widely considered a “safe-haven” asset.

That said, there’s no denying that bitcoin is experiencing a massive surge since the brutal 2018 bear market. Year-to-date, the bitcoin price is up more than 200%.