Bitcoin Price Key Highlights

- Bitcoin price broke below its short-term triangle consolidation and rising channel to pave the way for a larger pullback.

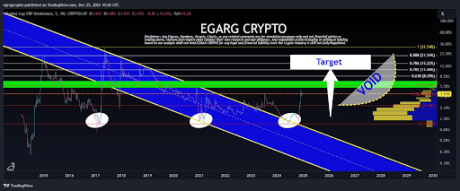

- The Fibonacci retracement tool shows the potential support levels where buyers could be waiting.

- Price might also be forming a larger ascending channel on its 4-hour time frame as indicators still support an uptrend.

Bitcoin price was unable to sustain the climb after previously consolidating, as a larger correction seems necessary.

Technical Indicators Signals

The 100 SMA is safely above the longer-term 200 SMA to indicate that the path of least resistance is to the upside. Although price already broke below the 100 SMA dynamic support to signal a pickup in bullish pressure, the gap between the moving averages is still wide enough to suggest that there’s no imminent threat of a bearish crossover.

Bitcoin price could move on to testing the 200 SMA dynamic inflection point next, and this lines up with the 61.8% Fibonacci retracement level at the $7,000 major psychological mark. A larger pullback could last until the very bottom of the freshly-forming ascending channel at $6,800, which lines up with a former resistance level.

RSI is heading lower to show that sellers are in control, but the oscillator is also dipping into oversold territory to signal exhaustion among sellers. Similarly stochastic is heading south so bitcoin price might follow suit, but it’s also approaching oversold levels to suggest a possible turnaround soon. In that case, the 38.2% Fib at the mid-channel area of interest might be enough to keep losses in check.

BTCUSD Chart from TradingView

The recent slide is being pinned on news from South Korea as officials are looking into ending tax benefits for cryptocurrency exchanges. This has been prompted by rapidly increasing transaction volumes in the country, leading authorities to worry that a lot are being used for money-laundering and financing illegal activity.

Hong Seong-ki, head of the country’s cryptocurrency response team South Services Commission, said:

“While crypto markets have seen rapid growth, such trading platforms don’t seem to be well-enough prepared in terms of security. We’re trying to legislate the most urgent and important things first, aiming for money-laundering prevention and investor protection. The bill should be passed as soon as possible.”