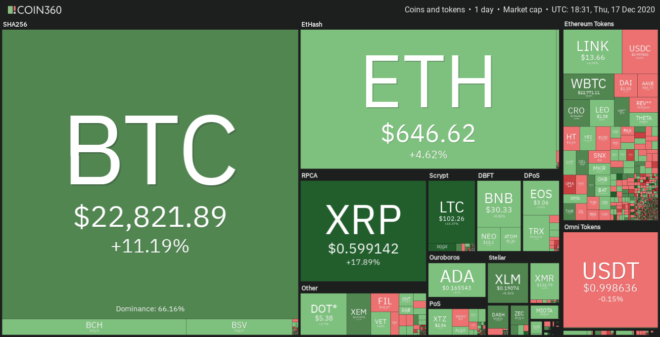

Since breaking through the critical psychological resistance at $20,000, Bitcoin (BTC) price has moved even higher. In the early trading hours, the top-ranked digital asset pushed as high as $23,800 before pulling back to $23,000 but the trend of investors purchasing each dip appears to still be in play.

Although Bitcoin is clearly in a bull phase, many investors are wary to buy at the current levels due to fears of a sharp reversal taking place. Therefore, they are on the lookout for other ‘less expensive’ tokens that are backed by strong fundamentals and also look attractive on the charts.

Let’s take a look at some of the smaller cap altcoins which have been making some strong move over the past week.

KSM/USD

Kusama (KSM) is the parallel network to Polkadot and the team plans to launch initial parachain offerings in the near future. This unique crowdfunding mechanism aims to be a better version of the initial coin offerings which were extremely popular in 2017.

A number of emerging projects are likely to compete with each other to secure a parachain slot on the Polkadot network. However, before this can occur, the projects may want to do some live pre-testing on the Kusama network before deploying them on Polkadot.

Some projects may even keep parachains on both networks, using Kusama to test new technologies and features before rolling them out on the Polkadot network. With limited slots available, there is likely to be a bidding war and Kusama tokens could be in demand.

KSM price has rallied from an intraday low at $43.151 on Dec. 11 to an intraday high at $63 today, a gain of 46% within a week. Currently, the bulls are attempting to push the price above the $65.537 overhead resistance.

The rising moving averages and the relative strength index (RSI) above 62 suggest that the advantage is with the bulls. If traders can propel the price above the overhead resistance, the next leg of the up-move to $80 could begin.

However, the bears are likely to have other plans as seen from the long wick on today’s candlestick. If the price turns down from the current level or the overhead resistance but rebounds off the 20-day exponential moving average ($50.90), it will indicate that bulls continue to buy on dips. This could increase the possibility of a break above $65.537.

This positive view will be invalidated if the price slips below the 20-day EMA. In such a case, the price may remain range-bound between $45 and $65 for a few days.

DCR/USD

In a bull market, trading activity increases across multiple exchanges and this boosts aggregate volume. Decred’s (DCR) recent launch of DCRDEX, a decentralized exchange that puts security, privacy, and zero trading fees at the forefront, could not have come at a better time.

The opportunity to trade without having to go through know-your-customer processes may have attracted several traders who prefer to stay anonymous. In separate news, two candidates in Brazil’s 2020 Municipal elections used Decred’s blockchain to timestamp and record political donations. This type of transparency is desperately needed in many countries and the successful use of Decred’s blockchain could possibly open up opportunities for future elections.

Over the past week, DCR price has risen over 39% from an intraday low at $23.246 on Dec. 11 to an intraday high at $32.40 on Dec. 16. The upsloping moving averages and the RSI in positive territory suggest that the path of least resistance is to the upside.

The bulls are currently facing resistance at the critical overhead level at $32. Previous attempts by the bulls to sustain the price above this resistance failed on Dec. 3 and Dec.10.

However, the long tail on today’s candlestick shows that the bulls are buying on intraday dips. They are likely to again attempt a break above the overhead resistance in the next few days. If the price sustains above $32, a move to $35 and then to $42 is possible.

The selling could intensify if the price turns down from the current levels and slips below the 20-day EMA at $26.50.

QTUM/USD

Decentralized finance (DeFi) has made serious inroads in 2020 and Qtum’s DeFi ambitions received a boost when it launched its own DEX called QiSwap a few days. QiSwap allows users to build DeFi applications and provide liquidity on top of the Qtum blockchain.

Qtum also aims to address the common issue of lagging transactions and high fees on decentralized blockchain platforms. The Qtum Improvement Proposal 26 plans to reduce block spacing to provide faster transactions.

QTUM has been an underperformer in the current bull run but it is trying to make amends. The price has risen from an intraday low at $2.315 on Dec. 11 to an intraday high at $2.844 today, a gain of 22% in the past week.

The 20-day EMA ($2.58) has started to turn up and the RSI has risen above 57, which suggests that the bulls are making a comeback.

If buyers push the price above the $3.066 to $3.283 overhead resistance zone, the QTUM/USD pair could pick up momentum and rally to $3.777 and then to $4.

This bullish view will be invalidated if the price turns down from the overhead resistance zone and dips below the 50-day simple moving average ($2.37).

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.